6

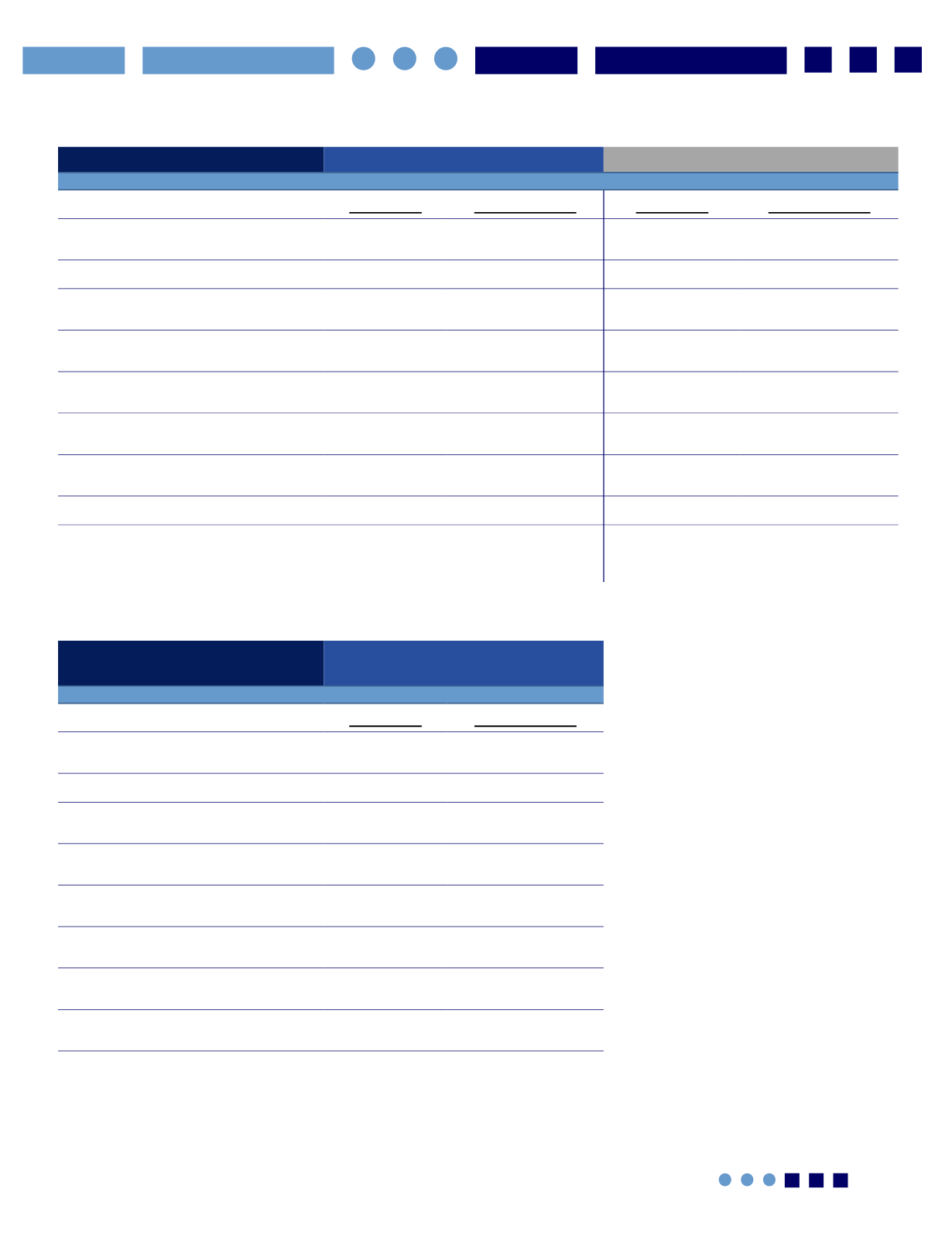

United Healthcare - Plan Designs

Features

PPO Base Plan

PPO Buy-Up Plan

In-Network

Out-of-Network

In-Network

Out-of-Network

Deductible

(Individual / Family)

$2,000 / $4,000

$6,000 / $12,000

$1,500 / $3,000

$3,000 / $6,000

Coinsurance

90%

60%

90%

60%

Out-of-Pocket Maximum

(Individual / Family)

$5,000 / $10,000

$10,000 / $20,000

$3,500 / $7,000

$16,000/ $32,000

Office Visit Co-Pay

(Primary Care physician / Specialist)

$25 / $50

Deductible/

Coinsurance

$20 / $40

Deductible/

Coinsurance

Preventive Care

$0

Deductible/

Coinsurance

$0

Deductible/

Coinsurance

Hospital Services

Deductible/

Coinsurance

Deductible/

Coinsurance

Deductible/

Coinsurance

Deductible/

Coinsurance

Urgent Care

$75

Deductible/

Coinsurance

$100

Deductible/

Coinsurance

Emergency Room

$300

$300

$200

$200

Prescription Drug

Retail

Mail Order (90-Day Supply)

$10/$35/$70

$25/$87.50/$175

In-Network copay plus

any difference in cost

$10/$35/$70

$25/$87.50/$175

In-Network copay plus

any difference in cost

Features

Health Savings Account (HSA)

Qualified Plan

In-Network

Out-of-Network

Deductible

(Individual / Family)

$3,500 / $7,000

$6,000 / $12,000

Coinsurance

100%

70%

Out-of-Pocket Maximum

(Individual / Family)

$3,500 / $7,000

$12,000 / $24,000

Office Visit Co-Pay

(Primary Care physician / Specialist)

Deductible/

Coinsurance

Deductible/

Coinsurance

Preventive Care

$0

Deductible/

Coinsurance

Hospital Services

Deductible/

Coinsurance

Deductible/

Coinsurance

Urgent Care

Deductible/

Coinsurance

Deductible/

Coinsurance

Emergency Room

Deductible/

Coinsurance

Deductible/

Coinsurance

Prescription Drug

Retail

Mail Order (90-Day Supply)

Deductible/

Coinsurance

Deductible/

Coinsurance