163

2015 Best Practices Study

Key Benchmarks

Profile

Revenues

Expenses

Profitability

Employee Overview

Producer Info

Service Staff Info

Technology

Insurance Carriers

Appendix

2015 Best

Practices Study

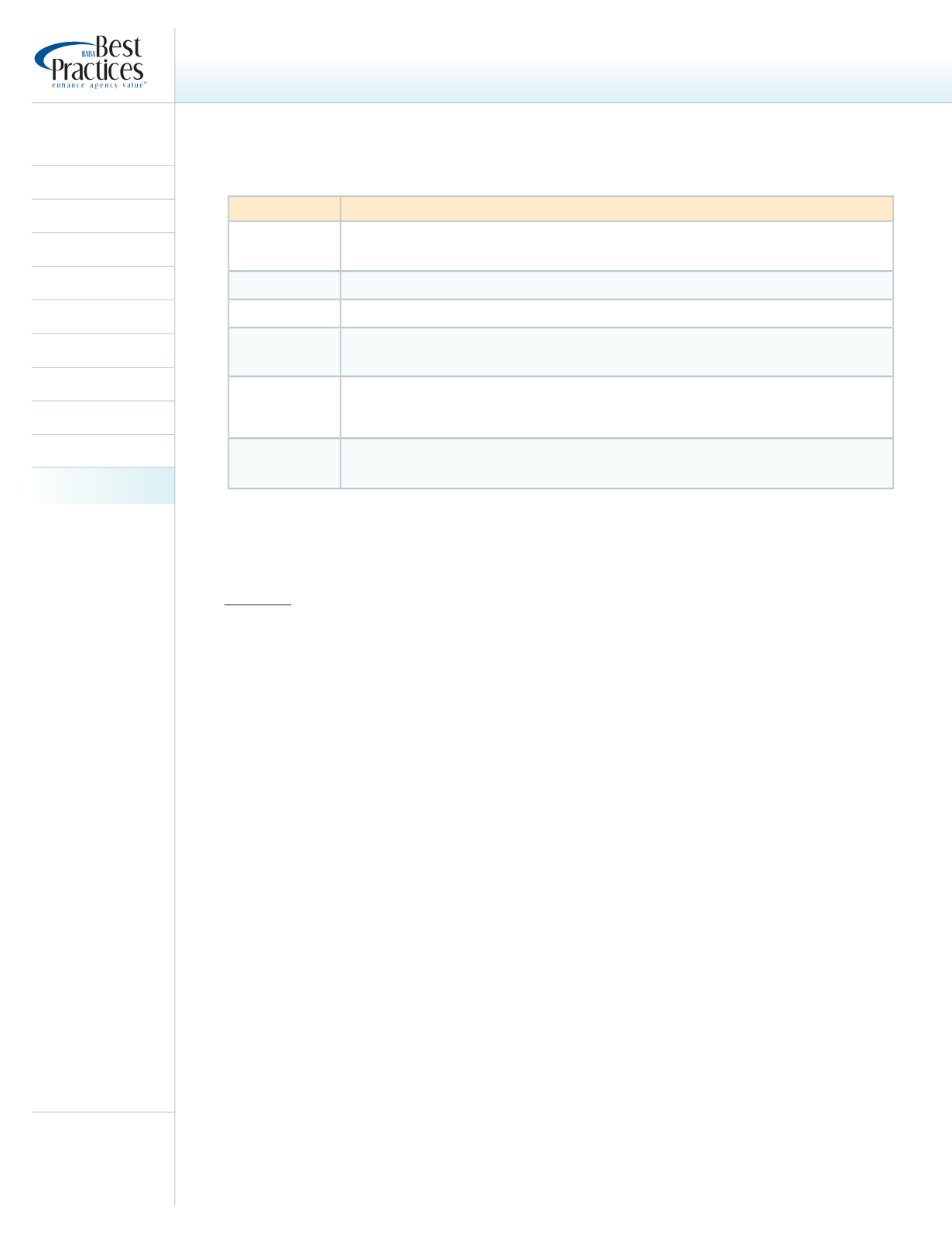

In addition to the average results for each study group, the study provides insights on how the “best of the best”

are operating. This table will help you understand the terms used to report this information.

HEADING

REFERS TO

Average

The average results achieved by all the firms in the study group for a particular factor.

(Extreme high and low results distorting the average have been excluded.)

High

The highest results achieved in the peer group for a particular factor.

Low

The lowest results achieved in the peer group for a particular factor.

Top 25%

The average results achieved by the Top 25% of the firms in the group for that particular

factor or line item.

(The firms comprising this group will be different for each factor or line item.)

Top 25%

Profit

The average results achieved by the 25% of firms in this revenue category having the

greatest pro forma profitability as a percent of net revenues.

(The firms comprising this group

are the same for each factor or line item.)

Top 25%

Growth

The average results achieved by the 25% of firms in this revenue category experiencing the

greatest growth in net revenues.

(The firms comprising this group are the same for each factor

or line item.)

Glossary

REVENUES

(as reported for most recently completed fiscal year-end and stated as a percentage of gross revenues)

Property & Casualty:

1.

Commercial Commissions & Fees

— Commissions (both direct & agency billed) and fees earned in lieu of

commissions for the sale of commercial P&C insurance

2.

Bonds

— Commissions from the sale of all bonds (surety, fidelity, etc.)

3.

Personal Commissions

— Commissions (both direct & agency billed) from the sale of personal P&C insurance

4.

Value Added Services

— Revenues from a Worker’s Comp TPA, loss control , engineering, risk management,

consulting services, self-insurance programs, underwriting and claims services, additional carrier compensation

or reimbursements for services provided on their behalf, etc.

5.

Contingent / Bonus

— Profit sharing, bonus, and supplemental income received from insurance carriers

6.

Total P&C

— The sum of items 1 - 5

Life & Health / Financial

7.

Group Medical Commissions & Fees

— Commissions & fees from the sale of group health/medical insurance

ONLY

8.

All Other Group Commissions & Fees

— Commissions & fees from the sale of all other employee benefits

products and services, including group life, dental, disability, pension, 401(k)s, PEOs, and investment products.

Also includes any revenue from the delivery of value added services (VAS), i.e., revenues from a Benefits TPA,

HR/Wellness/other consulting services, actuarial services, risk management, cost containment, and other VAS

related to employee benefits or L&H/Financial Services.

9.

Individual Commissions & Fees

— Commissions from the sale of individual life, health, dental, disability &

investment products

10.

Bonus / Overrides

— Bonus or incentive payments paid to agency for L&H production, usually for volume,

persistency, growth, etc.

11.

Total L&H / Financial

— The sum of items 7 - 10

12.

Investments

— Income from interest, dividends, premium finance, late charges, gains/losses on sales of

marketable securities (investment type securities)