KLÉPIERRE – NOTICE OF MEETING – GENERAL MEETING OF APRIL 19, 2016

3

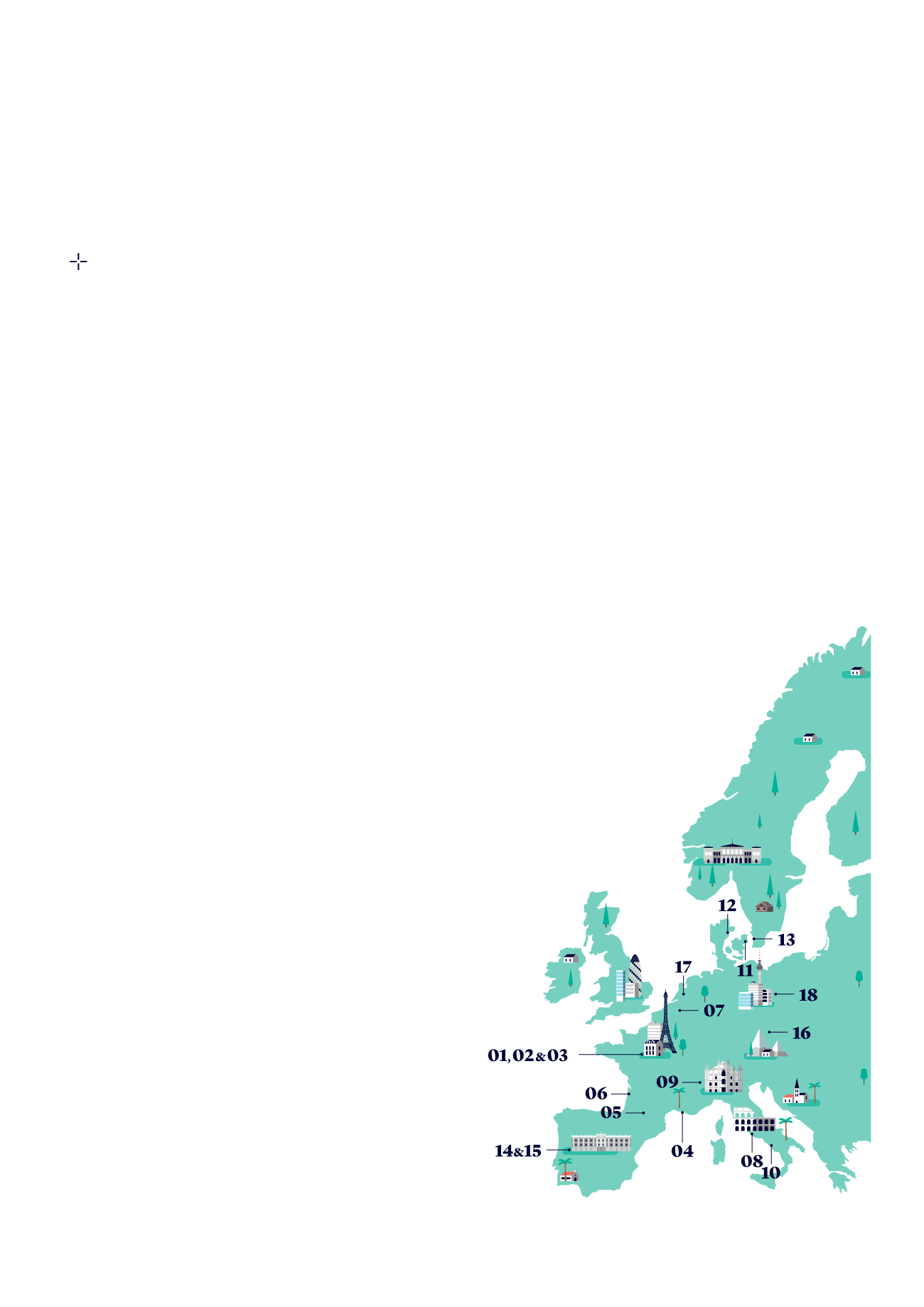

Klépierre in 2015

A year of major strategic moves

Solidoperatingperformances

Successful integration of Corio with cost synergies

exceeding initial target

On January 8, 2015, Corio’s 7 billion euro portfolio was integrated with and

into Klépierre’s, adding a large number of irreplaceable shopping centers to

Klépierre’s property portfolio and enhancing its coverage of Europe’s most

dynamic cities to bring its total value to 22.1 billion euros (excluding duties).

The integration was rapidly carried out and led to the delivery of 34 million

euros in cost synergies in 2015 (19 million euros in financing synergies and

15 million euros in general and administration cost synergies), expected to reach

67 million euros

in 2017.

01 • Créteil Soleil

Parisregion,France

02 • Val d’Europe

Parisregion,France

03 • St.Lazare Paris

Paris,France

04 • Grand Littoral

Marseille,France

05 • Blagnac

Toulouse,France

06 • Rives d’Arcins

Bordeaux,France

13 • Emporia

Malmö,Sweden

14 • La Gavia

Madrid,Spain

15 • Plenilunio

Madrid,Spain

16 • Nový Smìchov

Prague,

CzechRepublic

17 • Hoog

Catharijne

Utrecht,TheNetherlands

18 • Boulevard Berlin

Berlin,Germany

07 • L’esplanade

Brusselsregion,

Belgium

08 • Porta di Roma

Rome,Italy

09 • Le Gru

Turin,Italy

10 • Campania

Naples,Italy

11 • Field’s

Copenhagen,

Denmark

12 • Bruun’s Galleri

Århus,Denmark

Klépierre shopping centers offer access

to circa 150million customers in themost

dynamic retail consumption areas.

Leading centers

in Continental Europe

Retailer sales: +4.4% over full-year 2015

Like-for-like

(1)

retailer saleswere strong inKlépierre shopping centers and rose

by 4.4% in 2015 compared to 2014 (+3.8% like-for-like excluding extensions).

Retailer sales outperformed national indices in most countries.

In

France-Belgium

, retailer sales grew by 2%, mainly driven by sound

performances from retailers that have reformatted and refurbished their

stores, further re-tenanting campaigns, and the introductionof category-killer

brands to each segment of the tenant mix. French malls outperformed the

national sales index (CNCC) by 200 bps over the first 11 months of the year.

(1) Retailersalesperformancehasbeenrestated, i.e.,assumingthattheCorioandthePlenilunioacquisitionsoccurredonJanuary1,2014.Changeexcludesthe impactofassetsales,acquisitionsandnewcentersopenedsinceJanuary1,2014.Retailersales

fromtheDutchportfolioarenot included inthesenumbersasretailersdonotreportsalestoKlépierre.