MULTIFAMILY INVESTMENT PROPERTIES GROUP

| SOUTH FLORIDA

YEAR

UNITS ASKING RENT

ASKING RENT

PSF

ASKING RENT

GROWTH

EFFECTIVE

RENT

EFFECTIVE

RENT PSF

EFFECTIVE RENT

GROWTH

VACANCY

NET

ABSORP

DELIEVERED

UNITS

2016 (YTD) 10,194 $1,328

$1.95

2.3% $1,322

$1.94

2.3%

7.4% -130

-

2015

10,239 $1,298

$1.91

3.0% $1,294

$1.90

3.2%

6.4% -84

-

2014

10,259 $1,260

$1.85

4.3% $1,255

$1.84

5.0%

5.8% -175

-

2013

10,339 $1,208

$1.76

3.2% $1,203

$1.75

3.7%

4.7% 124

8

2012

10,352 $1,171

$1.70

4.4% $1,164

$1.69

4.9%

6.1% -290

-

2011

10,687 $1,122

$1.62

1.0% $1,115

$1.61

1.1%

6.4% -89

12

2010

10,683 $1,110

$1.61

1.1% $1,105

$1.60

1.2%

5.6% 15

-

2009

10,729 $1,098

$1.59

-1.7% $1,092

$1.58

-2.0% 6.2% -71

-

2008

10,816 $1,118

$1.62

-2.0% $1,111

$1.61

-2.2% 6.3% -7

-

2007

10,816 $1,140

$1.66

2.2% $1,133

$1.64

2.3%

6.2% -148

-

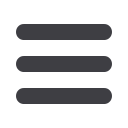

-300

-250

-200

-150

-100

-50

0

50

100

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 YTD

Net Absorption (Units)

Deliveries (Units)

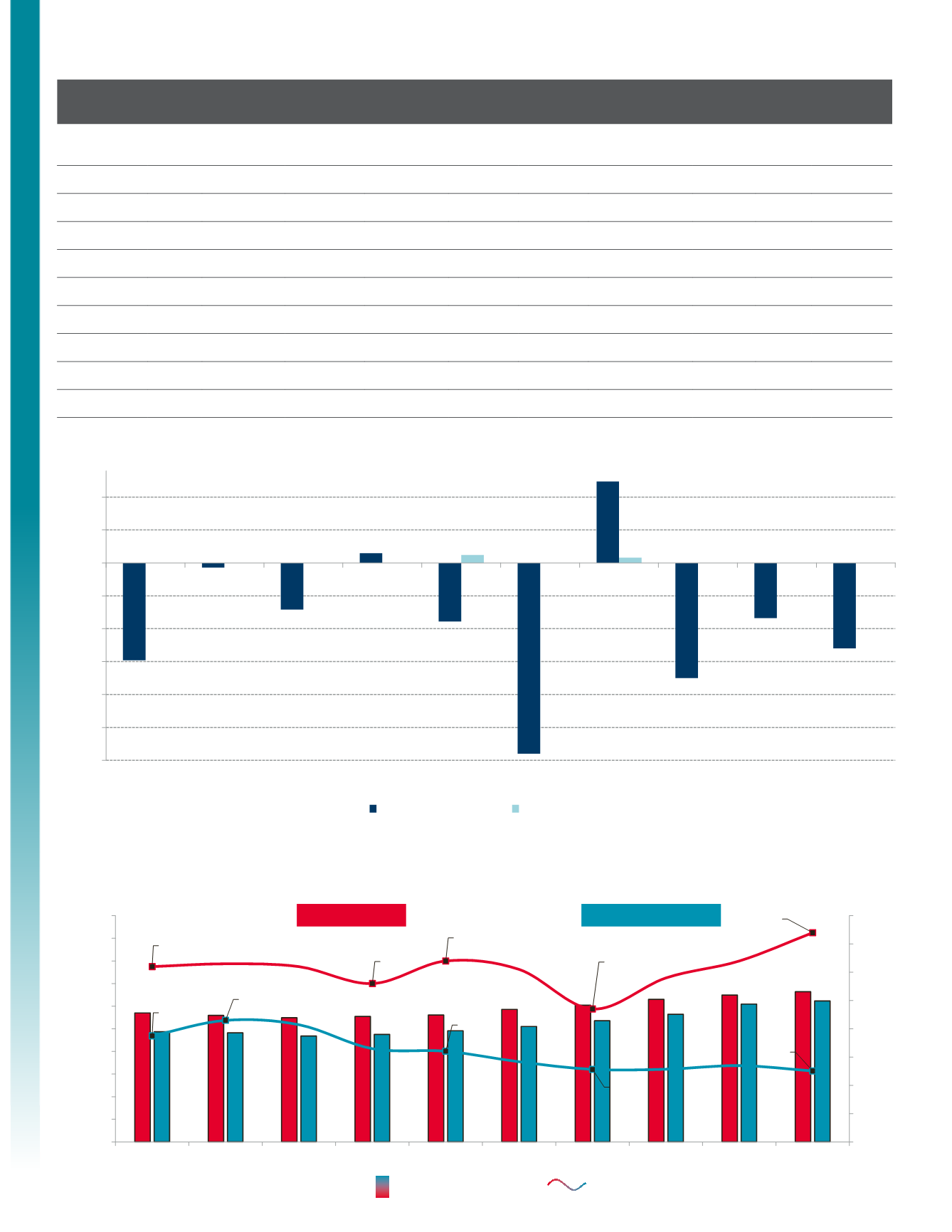

$1,140

$1,118

$1,098

$1,110

$1,122

$1,171

$1,208

$1,260

$1,298

$1,328

$974

$965

$937

$951

$982

$1,020

$1,071

$1,129

$1,218

$1,247

6.2%

5.6%

6.4%

4.7%

7.4%

3.8%

4.3%

3.2%

2.6%

2.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 YTD

Asking Rent $/unit

Vacancy %

Miami Beach

Miami-Dade County

MIAMI BEACH DELIVERIES VERSUS ABSORPTION

MIAMI BEACH RENT VERSUS VACANCY

MIAMI BEACH

MULTIFAMILY MARKET SUMMARY

-300

-250

-200

-150

-100

-50

0

50

100

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 YTD

Net Absorption (Units)

Deliveries (Units)

$1,140

$1,118

$1,098

$1,110

$1,122

$1,171

$1,208

$1,260

$1,298

$1,328

$974

$965

$937

$951

$982

$1,020

$1,071

$1,129

$1,218

$1,247

6.2%

5.6%

6.4%

4.7%

7.4%

3.8%

4.3%

3.2%

2.6%

2.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

$0

$200

$4 0

$600

$800

$1,000

$1,200

$1,400

$1,6 0

$1,800

$2,000

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 YTD

Asking Rent $/unit

Vacancy %

Miami Beach

Miami-Dade County