INVESTMENT HIGHLIGHTS

There are numerous demand drivers for small bay warehouse space in Miami. Continued population

growth, surging entrepreneurial activity in an improving economy, e-commerce trends towards more

efficient delivery of goods and services over the “last mile,” $1 billion of capital improvements at Port

Miami following the expansion of the Panama Canal, and the recent passage of an amendment to legalize

cannabis for medical use are among the most prominent reasons contributing to growing demand. Given

how tight the market is coming into 2017, there will be continued upward pressure on rental rates.

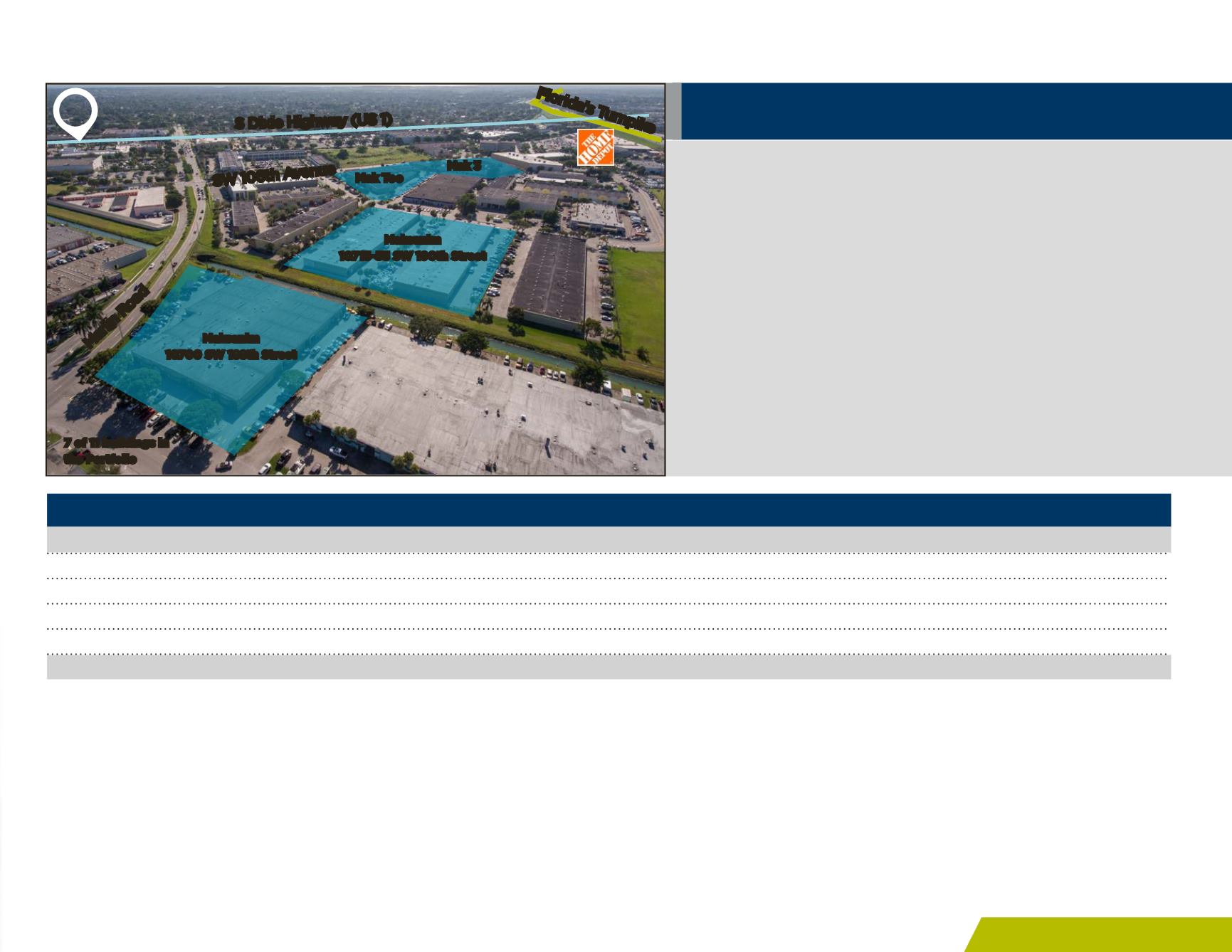

SOUTH MIAMI INDUSTRIAL PORTFOLIO OVERVIEW

Property

Number of Buildings

RBA (SF)

Occupancy

Area (acres)

South Dade Industrial Center

1 (plus development-ready pad)

33,945 (pad for additional 30,972 SF*)

96.3%

3.36

Maksanim

6

218,258

96.2%

8.90

Mak Too

2

57,336

100.0%

3.20

Mak 3

2

56,876

97.9%

3.34

Totals

11 (plus development-ready pad)

366,415 (potential for 397,387 SF)

97.1%

18.80

The South Florida market has two

primary physical barriers to entering

the market: the Atlantic Ocean to the

East and the Everglades to the West.

As a result of these constricting factors

as well as the scarcity of available land,

the replacement cost for warehouse

product comparable to the Properties is

in excess of $120/SF.

7 of 11 buildings in

the Portfolio

N

Mak Too

Mak 3

S Dixie Highway (US 1)

Florida’s Turnpike

Marlin Road

SW 106th Avenue

Maksanim

10700 SW 188th Street

Maksanim

10715-55 SW 190th Street

SOUTH MIAMI INDUSTRIAL PORTFOLIO | INVESTMENT HIGHLIGHTS

* There is a development-ready pad stubbed out for utilities with parking in-place permitted for an additional 30,972 SF small-bay building.

| 7

EXECUTIVE SUMMARY