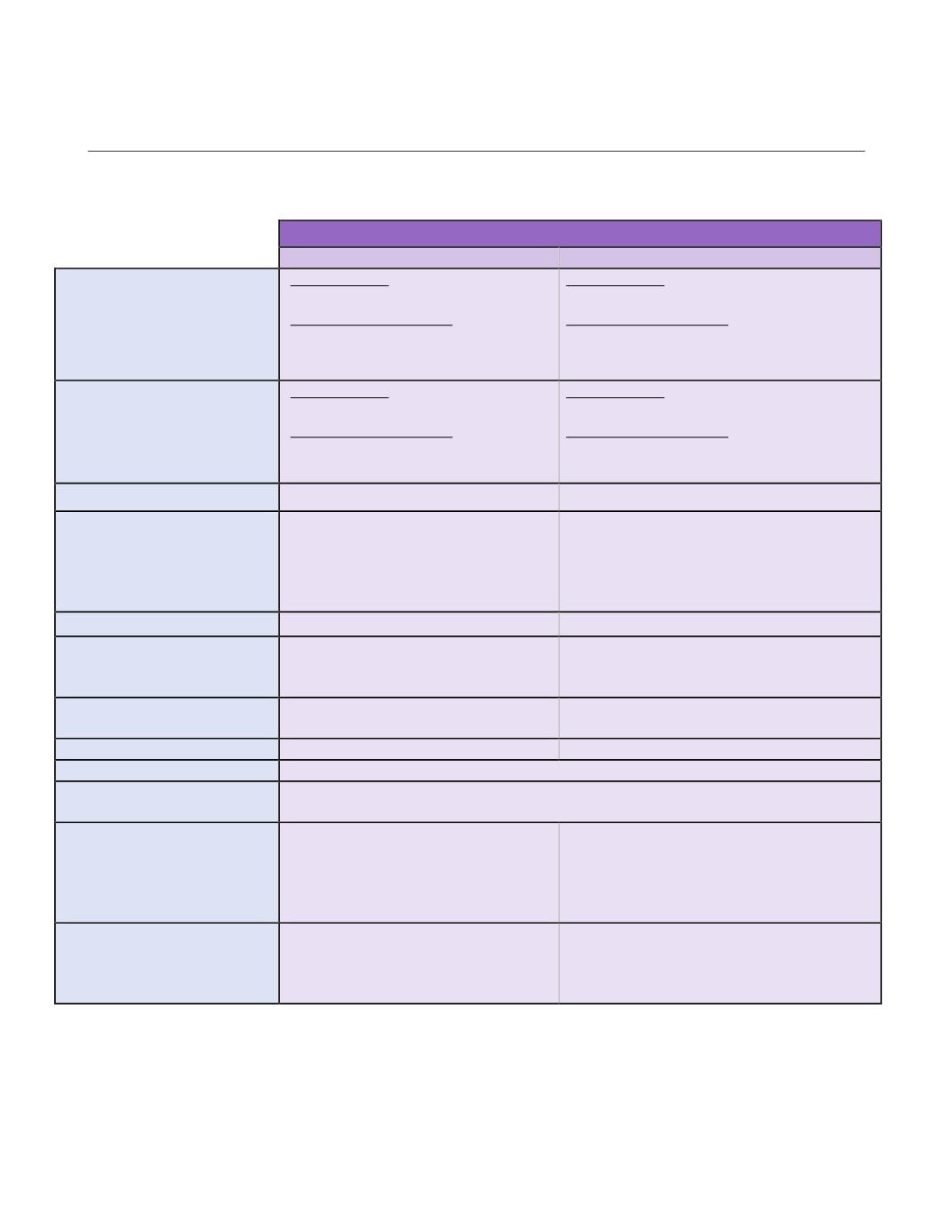

MEDI CAL , CONT I NUED

HDHP Plan

Blue Shield HDHP

In-Network

Out-of-Network

Plan Year Deductible

1

Individual

Family

Employee only:

$2,250

Employee + Dependents:

$2,600 / Individual

$4,500 / Family

Employee only:

$2,250

Employee + Dependents:

$2,600 / Individual

$4,500 / Family

Plan Year Out-of-Pocket Max

2

Individual

Family

Employee only:

$3,000

Employee + Dependents:

$3,000 / Individual

$6,000 / Family

Employee only:

$6,000

Employee + Dependents:

$6,000 / Individual

$12,000 / Family

Preventive Services

No Charge

Not Covered

Office Visits

Primary Care Physician (PCP)

Specialist

Chiropractic Services

(limited to 12 visits per year)

20% after deductible

20% after deductible

20% after deductible

50% after deductible

50% after deductible

50% after deductible

Urgent Care

20% after deductible

50% after deductible

Lab and X-ray

CT, MRI, PET scans

Other labs and x-ray tests

$100 copay + 20% coinsurance

$25 copay + 20% coinsurance

50% after deductible (limited to $350/day)

50% after deductible (limited to $350/day)

Inpatient Hospitalization

$100 copay per admit + 20%

coinsurance

50% after deductible (limited to $600/day)

Outpatient Surgery

20% after deductible

50% after deductible (limited to $350/day)

Emergency Room

$100 copay + 20% coinsurance

Pharmacy Deductible

Incorporated in Plan Deductible

(must meet deductible before prescription copay applies)

Prescription Drugs

Generic

Preferred Brand

Non-Preferred Brand

Specialty Drugs

$10 copay

$25 copay

$40 copay

20% up to $200 per prescription

$10 copay after plan deductible + 25%

$25 copay after plan deductible + 25%

$40 copay after plan deductible + 25%

20% up to $200 per prescription

Mail Order Pharmacy

Generic

Preferred Brand

Non-Preferred Brand

$20 copay

$50 copay

$80 copay

Not Covered

Not Covered

Not Covered

1

There is an individual deductible within the family deductible. Blue Shield will pay benefits for any family member who

meets the individual medical deductible before the family medical deductible is met.

2

There is an individual out-of-pocket maximum within the family and any family member who meets the individual out-of-

pocket maximum will receive 100% benefits for covered services once the respective out-of-pocket maximum is met.

Page | 9