ACTIVITY SURVEY

2015

page 12

Gas Markets and National Balancing Point Prices

The wholesale gas market price followed a different but equally dramatic path in 2014. The annual average price

at the National Balancing Point (NBP) fell from 68 pence per therm (p/th) in 2013 to 50 p/th in 2014. However, this

decline had little to do with the slide in the oil price, at least until the last few weeks of 2014. The collapse in oil

prices was not matched by those of gas and, by January 2015, the gap between Brent and NBP prices, expressed

in barrels of oil equivalent (boe), was the narrowest since the 2009 recession.

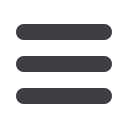

Figure 2: Dated Brent and National Balancing Point Prices

0

20

40

60

80

100

120

140

2008

2009

2010

2011

2012

2013

2014

2015

Price ($/boe)

Dated Brent

NBP Month Ahead

Source: Argus Media, ICIS Heren

The influence of oil prices on NBP gas prices is reflected in forward winter prices because of the inclusion of

oil prices with a lag in some long-term contracts in continental Europe, and the need for the UK to attract gas

from the continent to meet peak winter demand. The slide in Brent prices from $110/bbl to $55/bbl in the

second half of 2014 was accompanied by a decline in forward NBP prices for delivery in winter 2015-16 from

60 p/th to 48 p/th. If oil prices stabilise at $50-60/bbl, NBP month ahead prices are expected to settle in the range

of 40-50 p/th, assuming normal weather and supply patterns.

The main reason behind the fall in NBP prices from 60 p/th to 35 p/th between January and June last year was

the extraordinarily warm weather in the winter of 2013-14. This left the entire European market with excess

stocks at the end of the winter and depressed demand for storage injection in the summer months. The slide in

NBP prices was all the more remarkable because it occurred against a background of persistent fears that there

would be an interruption to Russian gas supplies to Europe arising from the Ukraine-Russia crisis and European

and US sanctions against Russia following its annexation of Crimea in March. Prices then recovered ahead of the

winter but still reflected the effects of warmer than normal temperatures.