4

Bitumar Benefit Overview 2017-18

Medical High/Deductible Health Plan/ Health Savings Account

The monthly premiums for the High Deductible Health Plans are significantly lower than other plans. The premium cost for

an HDHP is less because, as its name suggests, there is a higher deductible. You will be responsible for your health care

expenses, other than preventative/wellness, up to the amount of the deductible.

A

Health Savings Account (“HSA”)

is a type of

savings account

that allows you to save for medical expenses on a tax-

free basis. An HSA is like an IRA plan for medical expenses; a tax-favored savings account established by you. The savings

in your HSA are immediately available to you to pay for qualified medical, dental & vision expenses not covered by insurance.

You may also choose to contribute to an HSA and save the funds for medical expenses in the future. Further, HSA funds are

not subject to a

"use it or lose it"

policy. Any money you put into this account belongs to you.

Who is eligible to open a Health Savings Account?

Medical Plan Coverage

You must be enrolled in the HDHP through Bitumar

No Other Coverage

You may not have any other health plan coverage and that would include a medical

spending Account (FSA). Those covered by a spouse’s plan

(that is not a HDHP plan).

Medicare, Medicaid or Tricare are also not eligible to have a health savings account.

Other Benefits

You may not have received any Veterans Administration benefits in the last three months.

Dependent Status

You may not be claimed as a dependent on another person’s tax return.

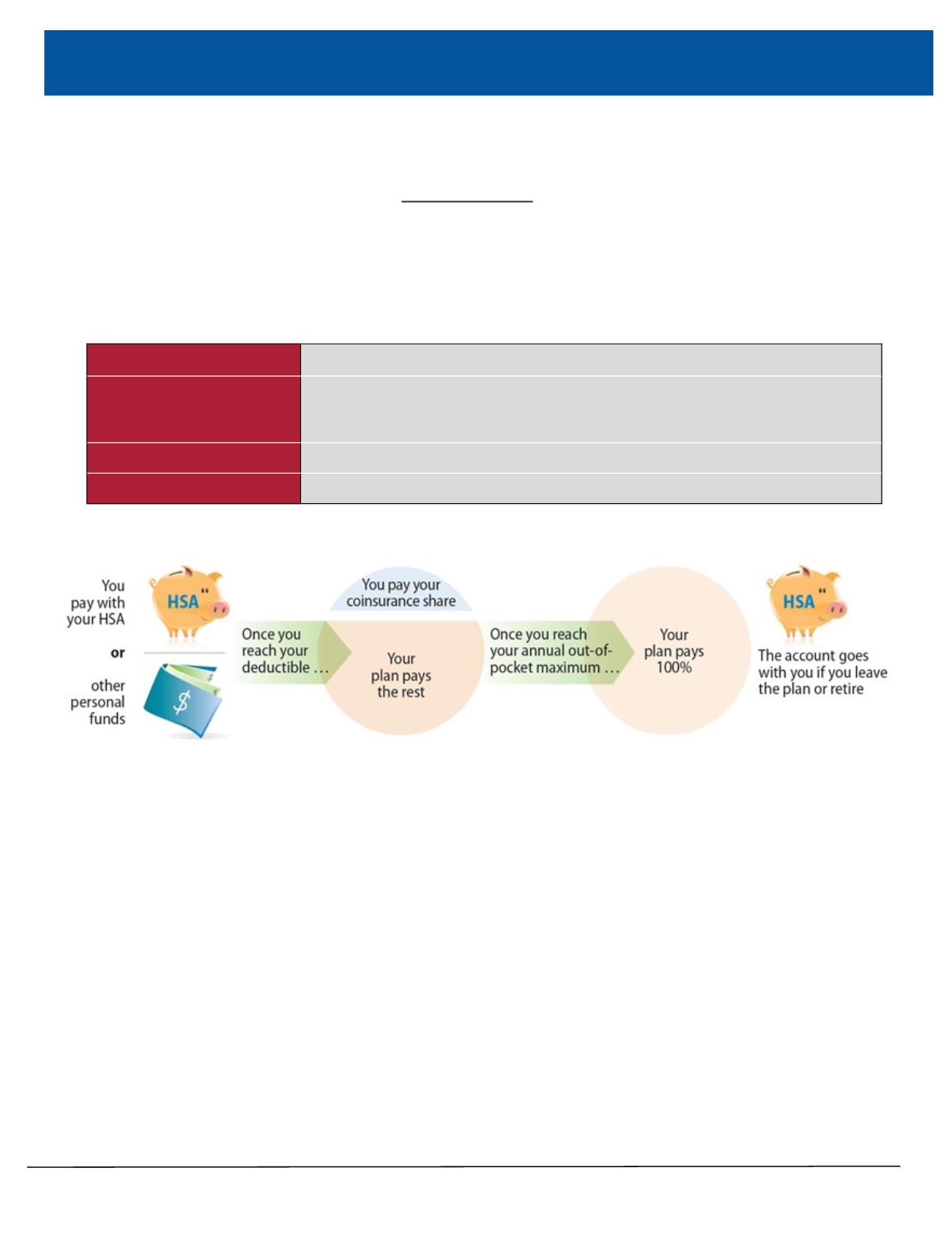

How an HSA works

What happens to the money in my HSA at the end of the year?

Should you have funds left in your account at the end of the year, the money will rollover to the next year. This is true

even if you select another health plan at the next open enrollment, but in order to contribute to the account, you must re-

main enrolled in a qualified medical plan.

In addition, you retain your account even if you leave the company. The money in your account can continue to grow to

help cover future health care expenses.

Please note that should you withdraw the money for anything other than

eligible health care expenses, you must pay income tax and a 20% penalty.

How much can I contribute to the HSA?

The amounts can differ from year to year and are based on the calendar year. For 2017, the maximum contribution for an

individual is $3400 and $6750 for those that cover their dependents If you are over age 55 you can contribute an extra

$1000.

Bitumar Contributes $71 monthly for single coverage and $141 a month for Employee+Dependents cover-

age (this includes the $1 monthly administration fee).

What are eligible medical expenses?

Generally, your HSA funds can be used for deductibles, copays, dental and vision bills. For a complete list, see IRS Publi-

cation 502 which can be found on www.irs.gov. You can use the money in your HSA for all of your tax dependents even if

they are not covered in your health plan.