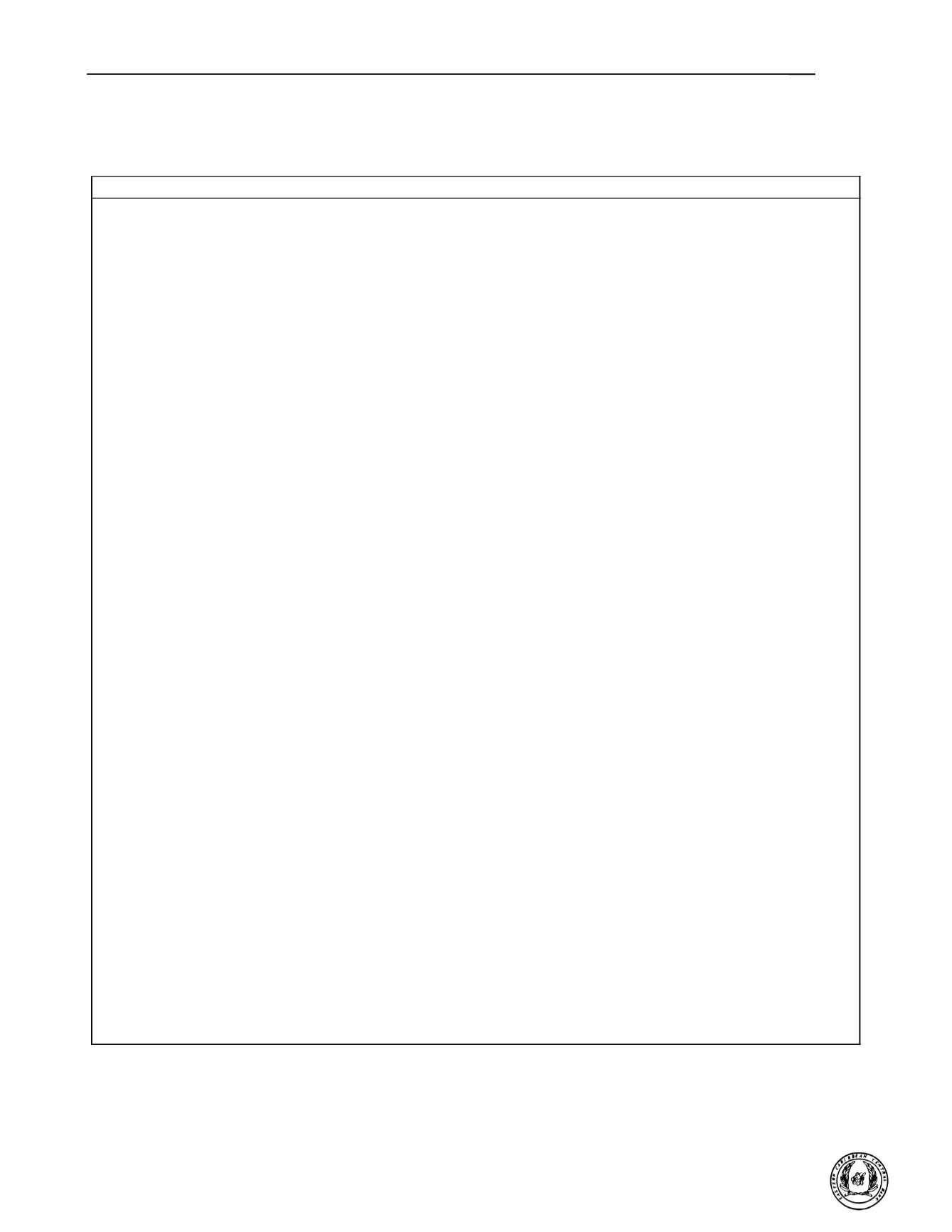

2018 Economic and Financial Review

ST

ATISTICAL TABLES

______________________________________________________________________________

160

Eastern Caribbean Central Bank

2014

2015

2016

2017

2018ᴾ

Current Revenue

535.19

518.82

592.58

582.64

594.57

Taxes on Income and Profits

140.03

129.70

155.83

150.93

147.65

Individuals

71.65

70.43

77.80

81.07

77.80

Corporate

40.18

46.31

64.89

56.08

54.29

Non Resident

28.21

12.96

13.14

13.79

15.56

Taxes on Property

34.49

29.02

45.11

50.76

37.43

Taxes on Domestic Goods and Services

181.55

201.02

234.24

232.89

254.91

of which:

TelecommBroadcast licence

4.17

7.43

0.85

3.07

3.67

Excise Tax

33.04

35.29

41.32

41.42

41.26

Value Added Tax

110.83

115.14

153.85

149.29

170.29

Motor Vehicle Licence

10.17

10.79

13.11

13.66

14.14

Taxes on International Trade and Transactions

79.34

84.07

62.98

71.26

69.76

of which:

Import Duties

49.35

52.27

56.72

54.10

60.23

Other Revenue

99.77

75.01

94.42

76.79

84.82

Current Expenditure

508.92

512.90

514.63

563.61

573.53

Compensation of Employees

260.11

268.87

275.14

280.81

288.02

Use of Goods and Services

73.95

73.26

64.24

78.14

73.95

Interest Payments

45.67

44.84

42.73

49.74

49.89

Domestic

18.37

17.97

14.93

18.62

18.87

External

27.29

26.87

27.79

31.12

31.02

Transfers and Subsidies

122.31

120.12

118.74

132.30

139.14

of which:

Other Grants and Contributions

54.59

51.73

42.63

50.79

60.73

Employment Related Social Benefit

46.45

49.00

50.84

59.40

57.51

Current Account Balance

26.27

29.32

77.95

19.02

21.04

Capital Revenue

9.46

26.09

20.26

5.83

0.96

Grants

Of which: Capital Grants

9.34

28.02

25.72

28.67

23.49

Capital Expenditure

107.62

86.24

78.16

88.65

68.39

Primary Balance before grants

(34.26)

(10.96)

62.77

(14.06)

3.51

Primary Balance after grants

5.22

40.46

88.50

14.61

27.00

Overall Balance before grants

(55.79)

20.05

(63.79)

(46.39)

Overall Balance after grants

(40.45)

(4.37)

45.77

(35.12)

(22.89)

Financing

40.45

4.37

(45.77)

35.12

22.89

Domestic

(120.86)

(52.30)

(87.71)

43.33

(20.19)

Central Banks (net)

2.18

6.73

(1.57)

0.77

3.85

Commercial Banks (net)

22.35

15.82

(49.17)

33.98

7.26

Other

(145.38)

(74.85)

(36.97)

8.58

(31.30)

External

150.04

85.65

65.58

(8.82)

23.52

Net Disbursements/(Amortisation)

150.04

85.65

65.58

(8.82)

23.52

Disbursements

192.51

131.19

114.21

55.83

87.12

Amortisation

42.47

45.54

48.63

64.65

63.60

Change in Govt. Foreign Assets

0.00

0.00

0.00

0.00

0.00

Arrears

11.26

(28.98)

(23.64)

0.61

19.57

Domestic

11.26

(28.98)

(23.64)

0.61

19.57

External

0.00

0.00

0.00

0.00

0.00

Other Financing

0.00

0.00

0.00

0.00

0.00

Source: Ministry of Finance and Economic Planning, St Vincent and the Grenadines and Eastern Caribbean Central Bank

Data as at 14 February 2019

Table 40

St Vincent and the Grenadines - Central Government Fiscal Operations

(In millions of Eastern Caribbean dollars)

VAT is a tax on goods and services therefore all receipts including those payable on imports of goods and services have been

consolidated under Taxes on Domestic Goods and Services