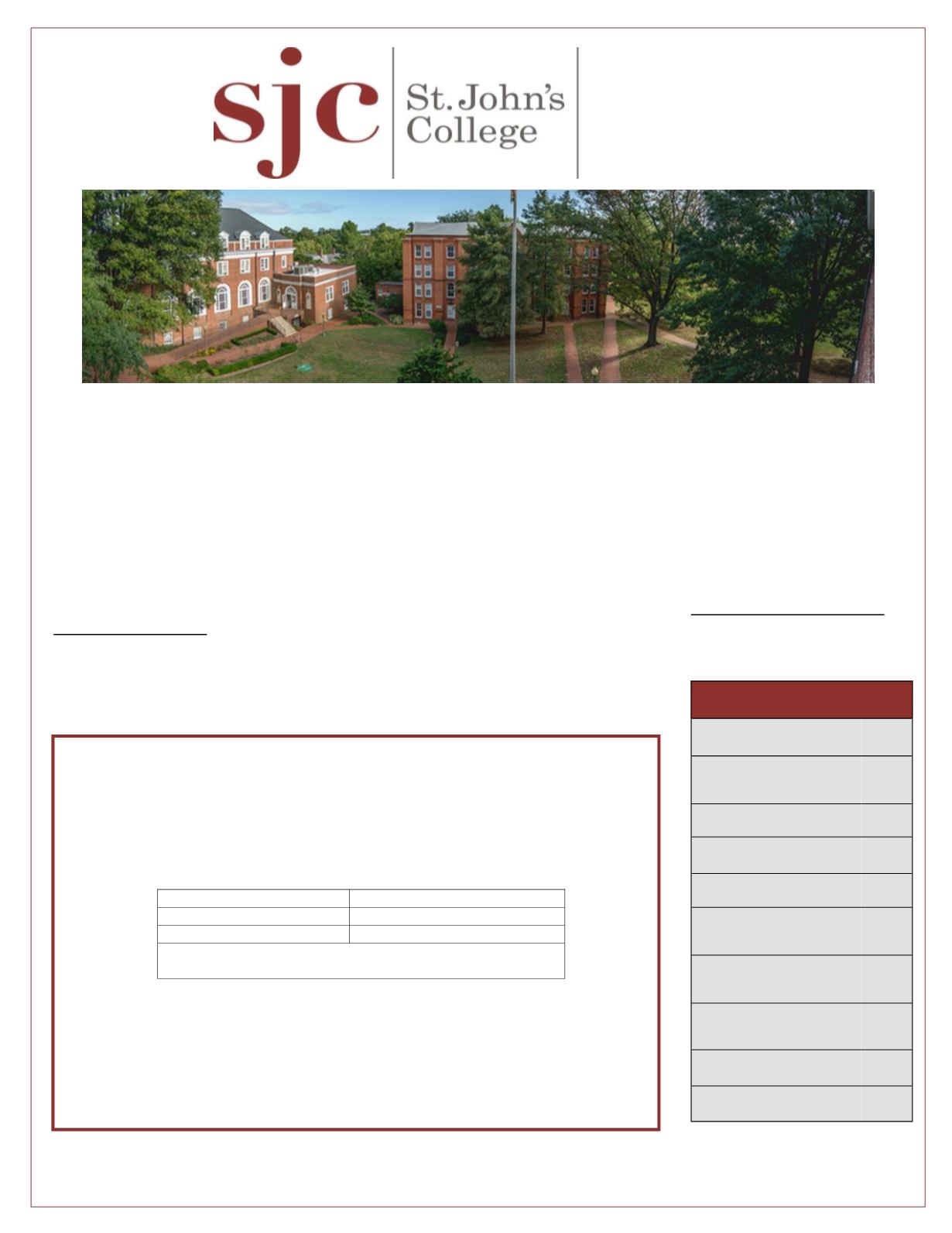

S

t. John’s College

takes pride in offering a comprehensive and competitive benefits package to its

employees. We, through all of our benefit partners, offer you a program that allows choice and

flexibility. Through this program, you can choose the benefits that are best for you

and

your family.

Please take the time to review all plan options prior to making your selections. Consider each benefit and

the associated cost carefully and choose the benefits package that will best meet your family’s needs

throughout the year.

The elections made during our open enrollment period will remain in place from

January 1, 2017 through

December 31, 2017. Options selected upon hire remain in place through the end of the plan year in which

you are hired. The exception to both of these is a qualifying event.

Please see the table below for a

description of what constitutes as a qualifying event.

2017

Benefits

INSIDE THIS GUIDE:

Medical Benefits

1-4

Medical Tools &

Resources

5-6

Dental Benefits

7

Vision Benefits

8

Life and Disability

9

Flexible Spending

Accounts

10

Employee Assistance

Program

10

403(b) Tax Deferred

Annuity

10

Compliance Notices

11-14

Contacts

15

The Internal Revenue Service (

IRS

) states that eligible employees may only

make elections to the plan at the time of hire and once a year at open enroll-

ment. Medical, Dental and Vision benefit elections are binding through De-

cember 31 of each year. The following circumstances are reasons you may

change your benefits during the year:

These special circumstances, often referred to as life event changes, allow

you to make plan changes at any time during the year in which they occur. For

any allowable change,

you must inform the Personnel Department within

30 days of the event

in order to make the change. All other changes are de-

ferred to open enrollment.

Marriage

Death of a Spouse

Divorce

Death of a Dependent

Birth & Adoption

Loss of Dependent Status

Loss of Spouse’s job where coverage is maintained

through a spouse’s plan