2016-2017 Benefits Guide

4

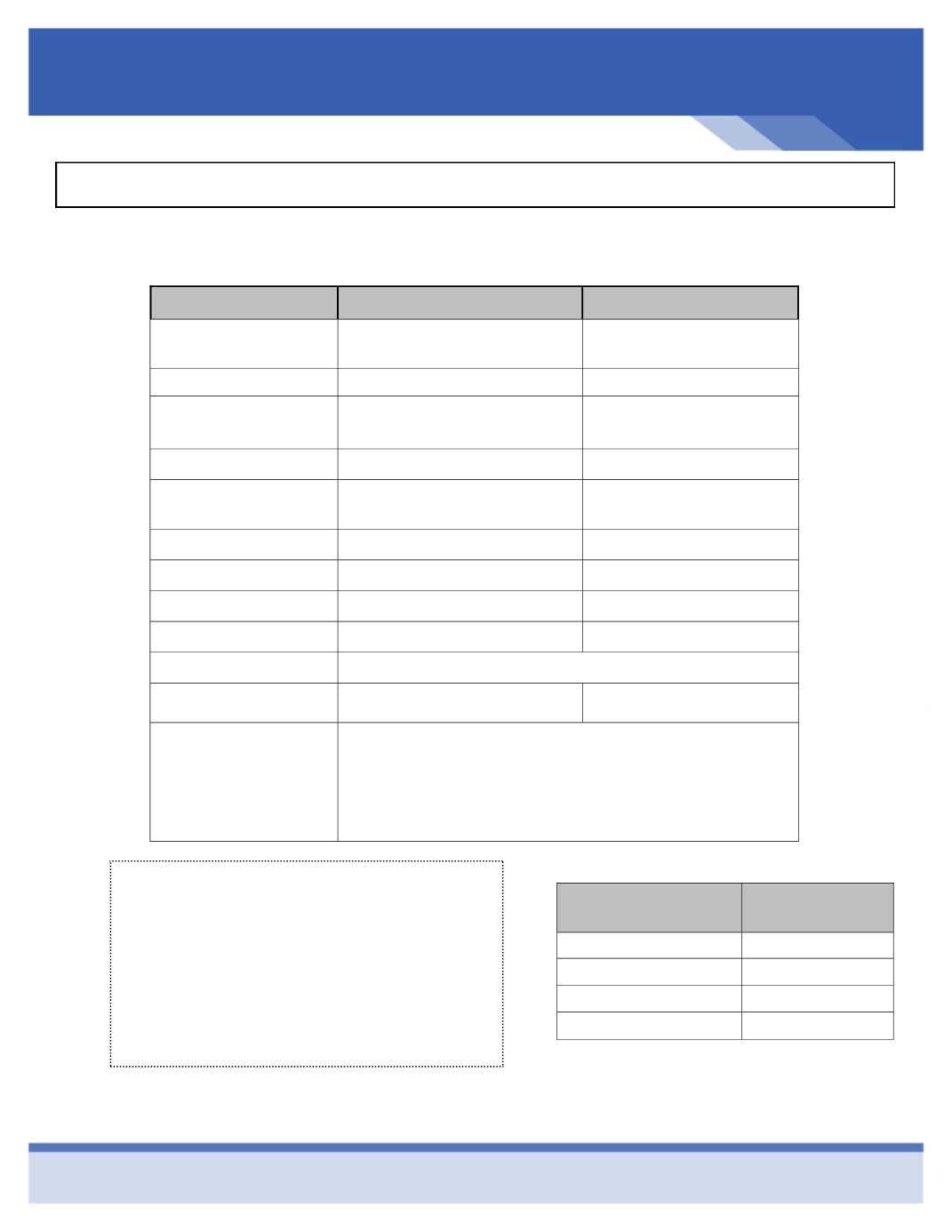

Health Savings Account (HSA)

Anthem HSA Plan Summary

(E3,AH)

Benefit/Service

In-Network

Out-of-Network

Deductible

(Individual/family)

$5,000 / $10,000

$10,000 / $20,000

Coinsurance

100%

70%

Out-of-Pocket Max.

(Individual/family)

$6,050 / $12,100

$20,000 / $40,000

Office Visit

$25/50 Co-Pay After Deductible

70% after Deductible

Virtual Visits

Office Visit Co-Pay

after deductible

50% after Deductible

Well care Benefits

100%

70% after Deductible

Lab & X-ray/Diagnostics

100% after Deductible

70% after Deductible

Inpatient Hospital

100% after Deductible

70% after Deductible

Outpatient Surgery

100% after Deductible

70% after Deductible

Emergency Room

$250 Co-Pay After In Network Deductible

Urgent Care

$75 Co-Pay After Deductible

70% After Deductible

Prescription:

Retail

Mail Order

Deductible, then

:

$10 / $35 / $60 / 25% to $200 max

$10 / $90 / $180 / 25% to $200 max

Type of

Coverage

Employee

Bi-Weekly Cost

Employee

$47.21

Employee & Spouse

$175.19

Employee & Child(ren)

$143.20

Employee & Family

$271.18

Upon establishing an HSA Account through Optum Bank,

RAFCO will contribute $100 to each employee’s account.

Thereafter, RAFCO will match, dollar for dollar, up to $900

for each employee who continues to contribute to their

HSA. For example, if an employee chooses to contribute

$25 per pay period to their HSA, then RAFCO will

contribute $25 per pay period until the total contribution

from RAFCO reaches $900 ($1,000 total for the year).