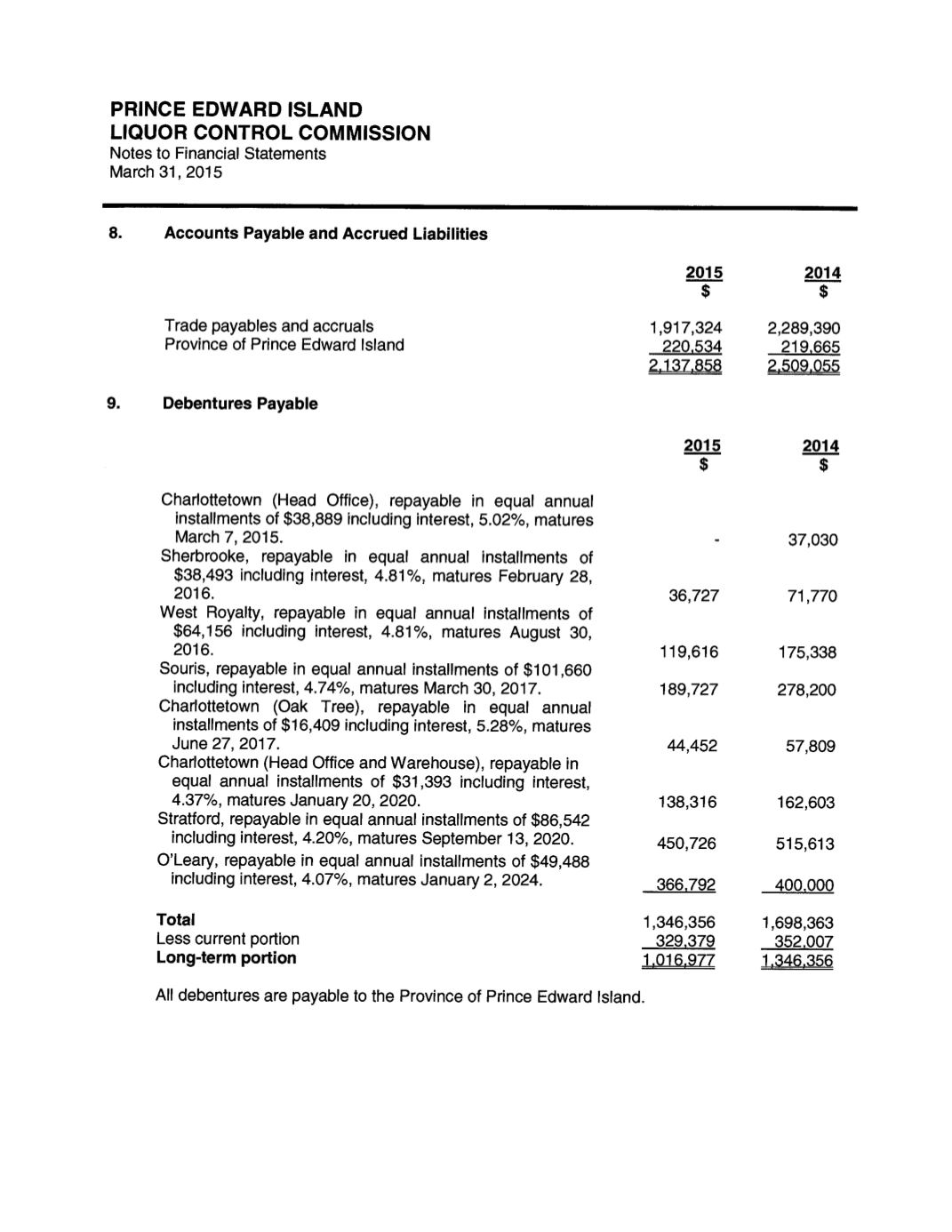

PRINCE EDWARD ISLAND

LIQUOR CONTROL COMMISSION

Notes to Financial Statements

March 31,2015

8.

Accounts Payable and Accrued Liabilities

2015

2014

$

$

Trade payables and accruals

1,917,324

2,289,390

Province of Prince Edward Island

220.534

219,665

2,137.858

2.509.055

9.

Debentures Payable

2015

2014

$

$

Charlottetown (Head Office),

repayable in equal annual

installments of $38,889 including interest, 5.02%, matures

March 7, 2015.

-

37,030

Sherbrooke,

repayable

in equal

annual

installments of

$38,493 including interest, 4.81%, matures February 28,

2016.

36,727

71,770

West Royalty,

repayable in equal annual

installments of

$64,156 including interest, 4.81%, matures August 30,

2016.

119,616

175,338

Souris, repayable in equal annual installments of $101,660

including interest, 4.74%, matures March 30, 2017.

189,727

278,200

Charlottetown

(Oak Tree),

repayable

in

equal

annual

installments of $16,409 including interest, 5.28%, matures

June 27, 2017.

44,452

57,809

Charlottetown (Head Office and Warehouse), repayable in

equal annual

installments of $31 ,393 including interest,

4.37%, matures January 20, 2020.

138,316

162,603

Stratford, repayable in equal annual installments of $86,542

including interest, 4.20%, matures September 13, 2020.

450,726

515,613

O’Leary, repayable in equal annual installments of $49,488

including interest, 4.07%, matures January 2, 2024.

366,792

400,000

Total

1,346,356

1,698,363

Less current porLion

329,379

352,007

Long-term portion

1.016+977

1,346.356

All debentures are payable to the Province of Prince Edward Island.