P A G E 4

The HSA Medical Plan may be a good choice if you have low to moderate health care needs. It offers many advantages

over traditional plans, such as:

Lower monthly premiums –

lowest per pay cost of any plan for 2016.

Health Savings Account that belongs to you –

you can use it for current or future medical expenses, including

medical expenses after you retire. If you leave Humanim, you take your account with you.

Tax-free savings -

all contributions and earnings are tax free.

You may not participate in this plan if you are covered by another traditional medical plan (i.e., a plan without a high

deductible), such as a spouse’s plan or Medicare.

The maximum is on a calendar-year basis even though our plan year is July 1 through June 30.

Why Choose the HSA Plan?

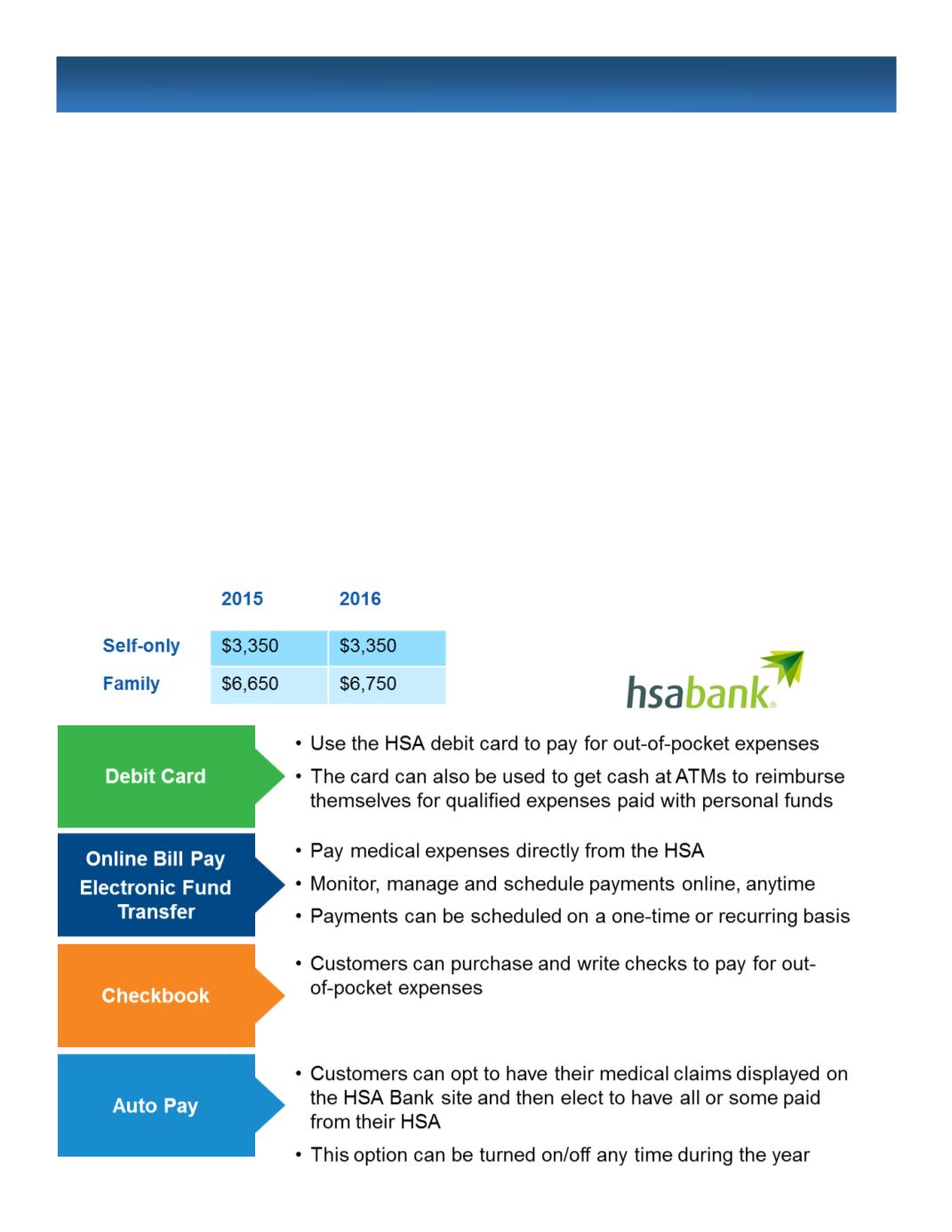

HSA Maximum Contributions

If you enroll in the HSA Plan, you may contribute towards a Health Saving Account through pre-tax payroll deductions.

All contributions are tax free and will grow tax free until you use them for qualified health care expenses. If you enroll

in the HSA plan, you will receive a welcome packet from CIGNA’s banking partner, HSA Bank with information about

setting up your account.

Health Savings Account (HSA)

Q.

How much can I contribute?

A.

Your total annual contribution, cannot exceed: