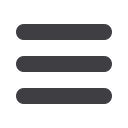

2015 Average Residential Tax and Utilities Bill*

Source: City of Surrey Financial Services Division

General Municipal, $1,772

School, $485

GVRD, $399

GVTA, $283

BC Assessment Authority, $1,166

Sewer, $37

Water, $213

Garbage & Recycling, $40

* Based on an Average Residential Dwelling with Assessed Value of $671,187.

Note: If Eligible for full Provincial Home Owner Grant, taxes are reduced by $570 ($845 if over 65 years of age or disabled)

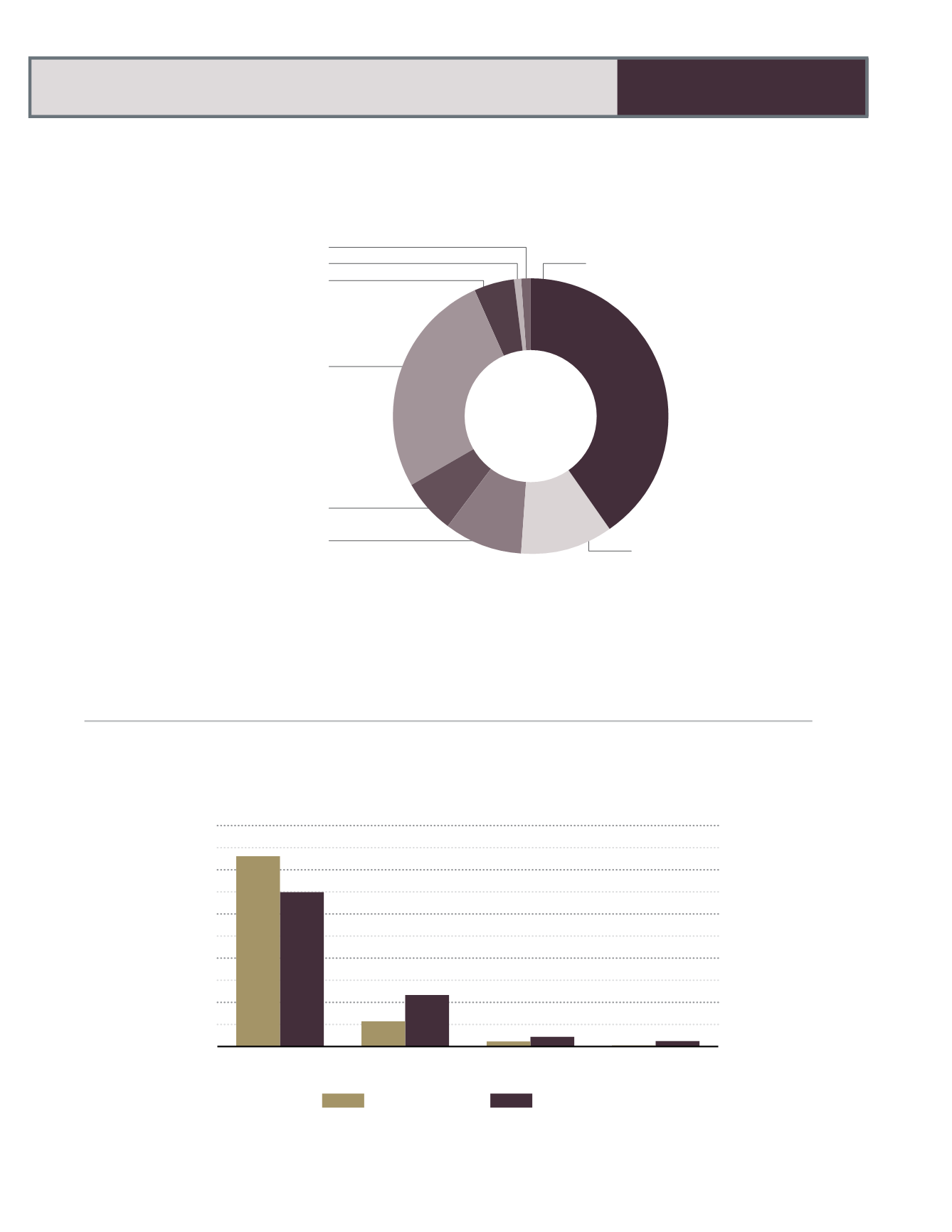

2015 General Revenue Fund Assessment and Taxation by Property Class

Source: City of Surrey Financial Services Division

0%

20%

40%

60%

80%

100%

Other

Industrial

Business

Residential

Taxation Revenue

Taxable Assessed Value

86.1

11.4

2.3

0.3

2.5

4.4

23.3

69.9

24

STATISTICAL REVIEW