6

/

Cushman & Wakefield

AMERICAS EUROPE APAC GLOBAL APPENDIXECONOMIC DRIVERS

After several years of mostly disappointing growth, the global

economy is finally showing clear signs of momentum. Although

the growth spurts vary greatly from one country/city to the

next, the economic upswing in mid-2017 is more ubiquitous

than at any other point in the current cycle. From the U.S. to

Continental Europe to Asia Pacific, in mature markets as well

as emerging ones, from Tier-1 to Tier-2 cities, from commodity-

producing to commodity-consuming nations—a multitude of

signs indicate that the world economy is set to grow faster.

World GDP growth is projected to rise from 3.1% in 2016—the

nadir of the current cycle—to 3.5% in 2017 and 3.6% in 2018.

If these developments come to fruition, those would be the

strongest back-to-back years for global growth since the

initial rebound years of 2010 and 2011. Moreover, there are still

significant tailwinds and scenarios that may push growth rates

even higher in the near term; fiscal policy-easing in the U.S.,

The economic momentum is

more ubiquitous now, inmid-

2017, than it has been at any

other point in the current cycle.

Global

soaring equity prices and rebounds in confidence may translate

into higher consumption and business investment than is

currently assumed.

A number of developments could still derail the momentum.

Global equity markets have been riding the euphoria wave

of a still very hypothetical fiscal stimulus scenario in the U.S.

If policymakers don’t deliver, a negative wealth effect could

very well ensue, ultimately dragging economic and real estate

conditions down. Another downside risk to the expansion

comes from protectionist movements. A policy shift towards

more isolationism and greater trade warfare would certainly

impact capital and trade flows, and thus harm economic

growth. Another threat comes from diverging global monetary

policy conditions at a time when many central banks are in

uncharted territory: e.g., negative interest rates, asset purchase

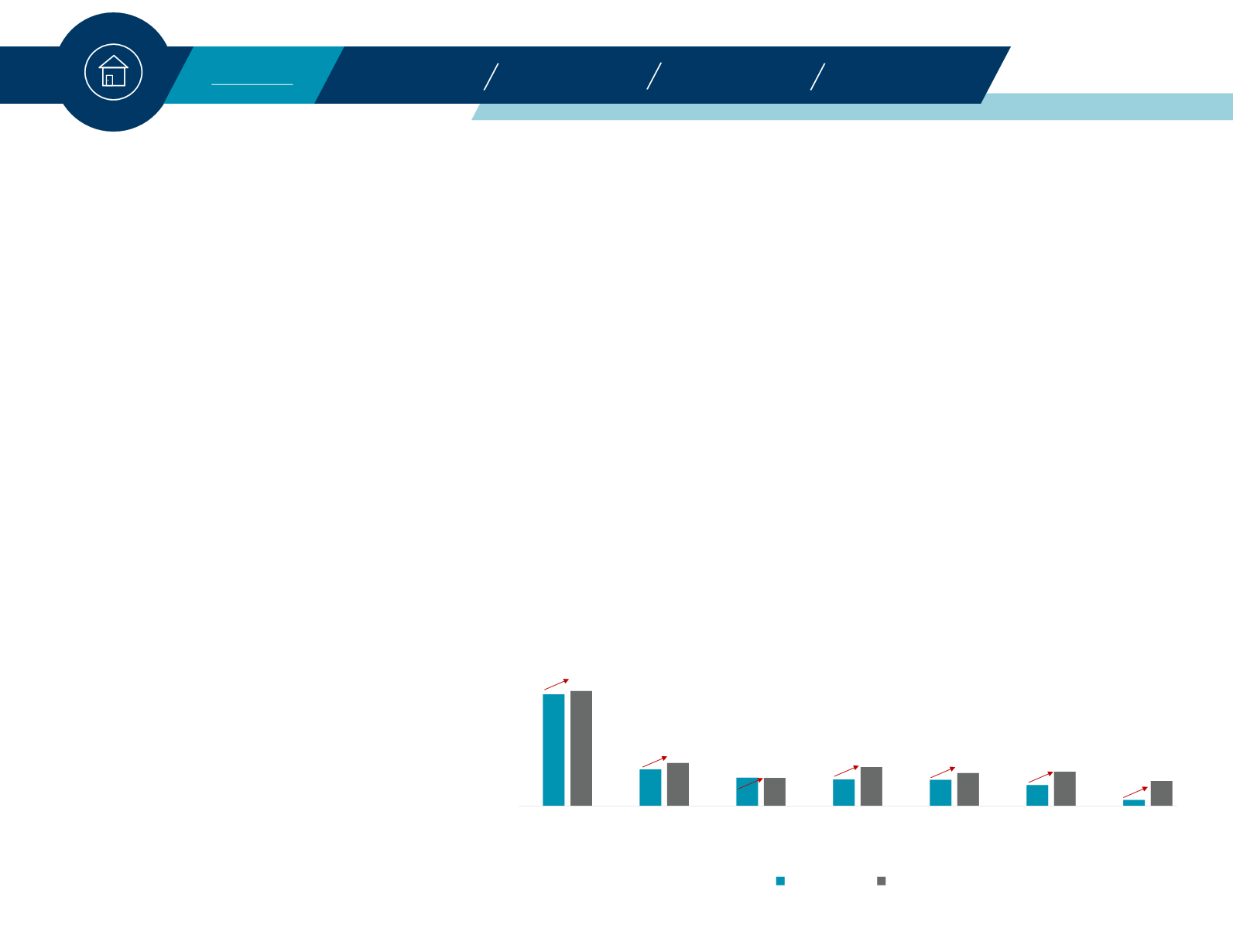

SYNCHRONIZED GROWTH

REAL GDP, Yr/Yr%

Source:

U.S. BEA, Oxford Economics, Cushman & Wakefield Research

0

2

4

6

8

China

World Eurozone United

Kingdom

United

States

Canada Japan

2016Q1

2017Q1