10

/

Cushman & Wakefield

AMERICAS EUROPE APAC GLOBAL APPENDIXSUPPLY AND DEMAND

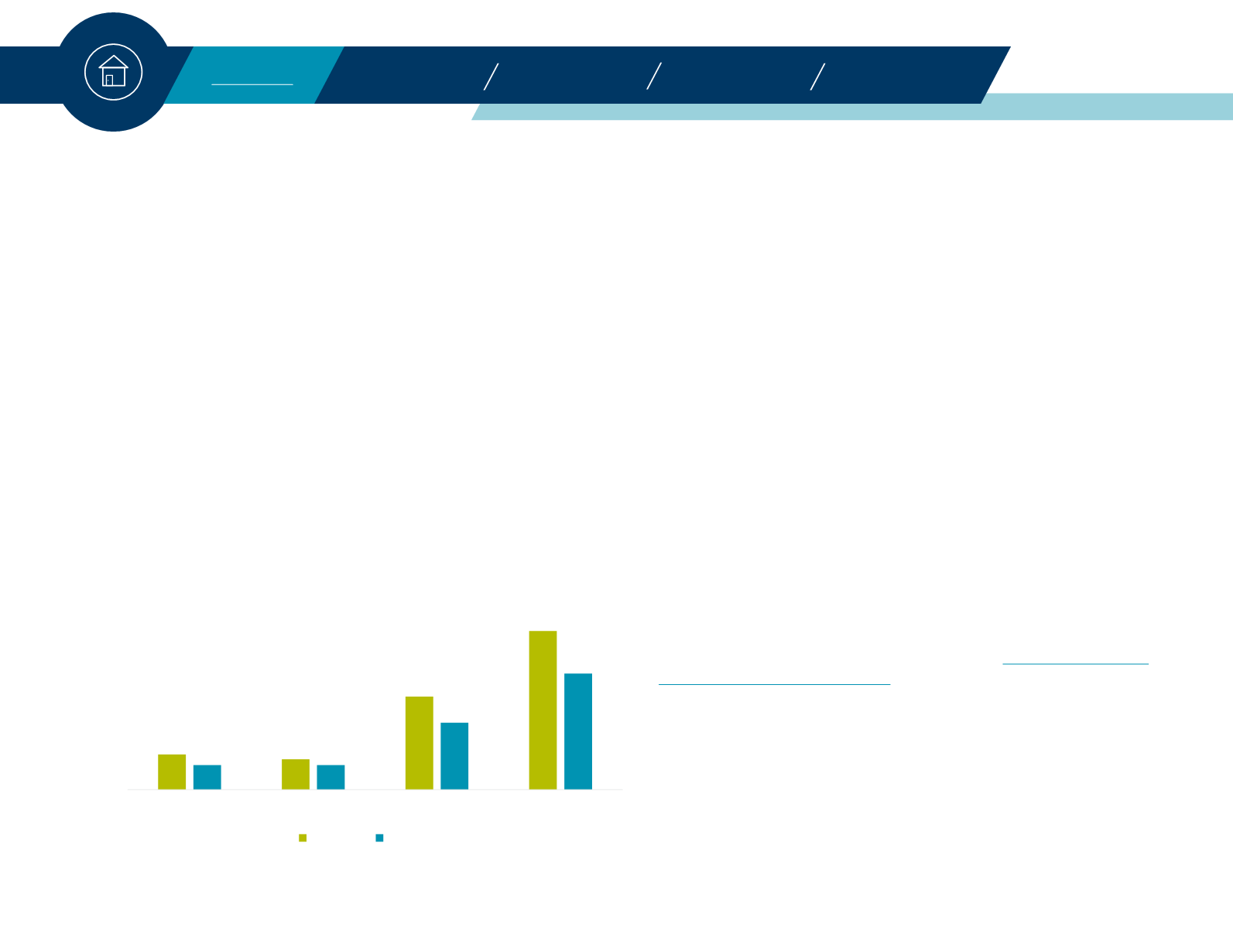

The world economy will need to create every single one of

those new jobs, and then some, because a building boom is

upon us. Around the globe, over 700 million square feet (msf)

of office space is under construction which will deliver between

mid-July 2017 and the end of 2019. That’s the equivalent of five

good-sized cities worth of office inventory (e.g., Washington,

DC, Dallas, London, Singapore and Shanghai). That new

construction will come online in the span of just three years.

Although demand will remain robust over that same time

period—totaling approximately 520 msf—it will fall far short of

supply. That will cause vacancy to rise in most cities around the

world. From that perspective, the world is overbuilding.

Or maybe it isn’t. Throughout this global expansion it is clear

that occupiers have generally favored newly-built-high-quality

space over older, Grade B & C product. In the U.S., for example,

newly built space has accounted for 65% of all of the office

space absorption since 2012. More often than not, developers

have been rewarded throughout this cycle for delivering prime

product, even in markets where vacancy is elevated.

Nevertheless, vacancy will generally be on the rise in most

cities around world. The development boom will be led by

Asia Pacific, particularly Greater China. In fact, nearly 60% of

the world’s new construction will be concentrated in the Asia

Pacific region. Within the region, new supply is concentrated

in a handful of markets: Beijing, Shenzen, Shanghai, Manila

and Bangalore. Indeed, those five markets account for 55% of

construction taking place in Asia Pacific and over one-third of

construction worldwide.

Much like the supply side, the demand side of the equation

is strongest in Asia Pacific. Beijing will have the distinction of

leading the world in both supply and demand growth. The

Americas region is also in midst of a robust construction cycle,

although construction will likely taper off somewhat after 2017.

Still, the U.S., Canada, and Latin America will all build more

space than they will absorb over the next few years. Again,

it varies greatly from one city to the next

( see the Americas section for detailed rankings ).

The development pipeline is also ramping up throughout

Europe, but not nearly to the same degree. Some European

cities—Paris, Vienna, London and Brussels—will hit a cyclical

high in new construction over the next two years. Again, those

cities report vacancy rates lower than pre-recession levels. It

could be argued that they are the most in need of new space.

Broadly speaking, supply and demand seem to be the most

balanced in Europe relative to the other global regions.

GLOBAL SUPPLY VS. DEMAND

2017 - 2019

Source:

Cushman & Wakefield Research

0

100

200

300

400

500

600

700

800

Americas

Europe

APAC

Global

MSF

Supply Demand