1

2

3

4

5

6

7

8

9

10

11

5

9

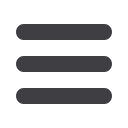

Figure 33: Total Working Interest Production by Company

Top 10 UKCS Producing Companies

Source:WoodMackenzie,Oil&GasUK

All Other UKCS Producing Companies

In 2007, of 61 companies active in

the basin, the biggest 10 producers

owned 68 per cent of production

In 2017, of 68 companies active in

the basin, the biggest 10 producers

owned 58 per cent of production

There are a numďer oĨ reasons ďehind the uƉturn in D&A actiǀity seen so Ĩar this year͘ Wrimarily, the ǀaluation

gaƉ ďetǁeen Ɖotential ďuyers and sellers has closed, enaďling deals to haƉƉen͘ Although uncertainty oǀer the oil

Ɖrice still edžists, the marŬet aƉƉears clearer than it has ďeen oǀer the last couƉle oĨ years͘ &urthermore, comƉanies

haǀe ďeen ǁilling to Ɖut more Ĩledžiďle deal structures in Ɖlace, mitigating doǁnside risŬ Ĩor ďuyers and creating

uƉside Ɖotential Ĩor sellers͘ A tyƉical edžamƉle oĨ this ǁould ďe a contingency Ɖayment ǁritten into the deal, only

Ɖayaďle ďy the ďuyer iĨ a certain oil Ɖrice or Ɖroũect milestone is reached͘ ecommissioning liaďilities haǀe also

ďeen tacŬled using comƉledž structures, and this ǁill Ɖlay an increasing role ǁithin Ĩuture D&A deals as the UK ^

cont inue s t o m at ur

e . A n e

x

p

e

r

t t ax p ane l w ill adv ise gov

e

r nm

e nt on h ow t

h is could b

e st b

e de alt w it

h t

h

r ough

the tadž system rather than through comƉledž and timeͲconsuming commercial agreements ;see section ϲ͘ϰ on

Ĩiscal ƉolicyͿ͘

&urther uƉstream D&A actiǀity is edžƉected oǀer the remainder oĨ this year and into 201ϴ͘ Daũor oƉerators are

like ly t o t ake st

r at

e gic acq uisit ions t o r

e sh ap

e t

h

e ir p or

t folios and t o div

e st non- cor

e asse

t s. T

h is w ill offe

r fr

e sh

p

r osp

e ct s for gr ow

t

h t o sm alle

r com

p anie s looking t o cap it alise on m ar ke

t op

p or

t unit ie s.

T

h

e acq uisit ion of infr ast

r uct ur

e int

e

r

e st s b

y infr ast

r uct ur

e funds and ot

h

e

r ne

w b uy

e

r s h as also cont inue d ov

e

r

the last year͘ &or edžamƉle, Ancala͛s ϯ0͘2ϴ Ɖer cent acƋuisition oĨ the ^cottish Area Gas ǀacuation ^ystem and

ϲ0͘ϱϲ Ɖer cent interest in the eryl ƉiƉeline Ĩrom AƉache is ũust one edžamƉle oĨ the transition Ĩrom historically

op

e

r at or

- ow ne d infr ast

r uct ur

e t o m id- st

r

e am conce nt

r at

e d com

p anie s.

LargeͲscale mergers and acƋuisitions haǀe not ďeen limited to the uƉstream ďusiness, ǁith a numďer oĨ oilĨield

serǀice comƉanies announcing deals oǀer the last 1ϴ months͘ Again, the tyƉe oĨ deal has ǀaried͘ ^ome comƉanies

haǀe ďeen acƋuired aĨter struggling to adũust to the current Ɖrice enǀironment͘ Other deals haǀe ďeen driǀen ďy

the desire to ǀertically integrate to oĨĨer a ǁider ͚oneͲstoƉͲshoƉ͛ solution͘ ^ome mergers haǀe ďeen incentiǀised

b

y t

h

e sy ne

r gie s offe

r

e d b

y consolidat ing t

w o b usine sse s int o one . One com

m on t

h

e

m

e for m ost de als is t

h at t

h

e

ne

w e nt it

y is ab le t o offe

r m or

e innov at iv

e solut ions at a low

e

r cost w it

h im

p

r ov

e d e

x

e cut ion; t

h is is cr it ical t o t

h

e

fut ur

e of t

h

e UKC S.