5

OFFERING

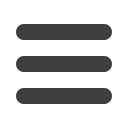

Cushman &Wakefield has been retained by owner as the exclusive agent in the sale

of One Chesterfield Place, located in Chesterfield (suburban St. Louis), Missouri.

One Chesterfield Place is a premier Class A office building containing 143,473 SF.

Premier Asset

Constructed in 2003, One Chesterfield

Place is one of the premier office

buildings in the St. Louis’ strongest

suburb, Chesterfield, offering high

quality finishes, abundant parking,

proximity to amenities and outstanding

visibility and access.

Exceptional Location

Strategically located along I-64, One

Chesterfield Place sits in the heart

of St. Louis’ dynamic West County

submarket. West County is the largest

office submarket in the metropolitan

area containing 16.1 million square

feet, accounting for over 43% of the

suburban office product in St. Louis.

Top Performing Submarket

Ches te r f i e l d has cons i s ten t l y

outperformed the entire West County

market, absorbing 740,000 square

feet over the last three years.

Extremely Low Vacancy Rate

Class A vacancy in Chesterfield is

currently 7.4% and it is projected to be

approximately 5% by year end.

New Construction Rental Rate Gap

Construction costs continue to increase

creating a gap of approximately 20%

between current market rental rates

and rental rates that are needed to

support new construction, providing

plenty of room for continued rental

growth.

Outstanding Visibility and Access

The property has outstanding visibility

from I-64/US 40, the major east-west

interstate route in the metro area,

and excellent access from both the

Chesterfield Parkway/I-64 interchange

and the Timberlake Parkway/I-64

interchange.

Strong Credit Tenancy

Approximately 74% of the property is

leased to investment grade tenants,

including Principal Life Insurance,

Protective Life Insurance, Midwest

Emp l oyer s Casua l ty Company,

Ameriprise Financial, Novo Nordisk,

and Lowe’s.

Long-Term, Increasing Cash Flows

With nearly 7 years of weighted

average lease term and contractual

rent increases, One Chesterfield Place

offers stable, increasing cash flows.

Priced Below Replacement Cost

One Chesterfield Place is expected

to sell well below replacement cost,

providing an investor with long term

appreciation potential.

Investment Highlights