2007 Best Practices Study

2007 Best Practices Study

So, for example, an agency that generates an EBITDA

margin (as a percent of revenue) of 20% and grows

organically by 10% achieves a “Rule of 20” score of

exactly 20%. (20% times 50% plus 10% = 20%.)

The higher the score, the better. The secret to the

Rule of 20 is the weighting of the relative importance

of organic growth versus EBITDA when it comes to

creating shareholder value (the weighting is 2 to 1).

Generally speaking, an outcome of 20 means an

agency is generating a shareholder return of

approximately 15%-16%, which is commonly viewed

as the “expected” rate of return for a well-run

insurance agency. A score of less than 20 indicates

room for improvement, while a score above 20 is

outstanding.

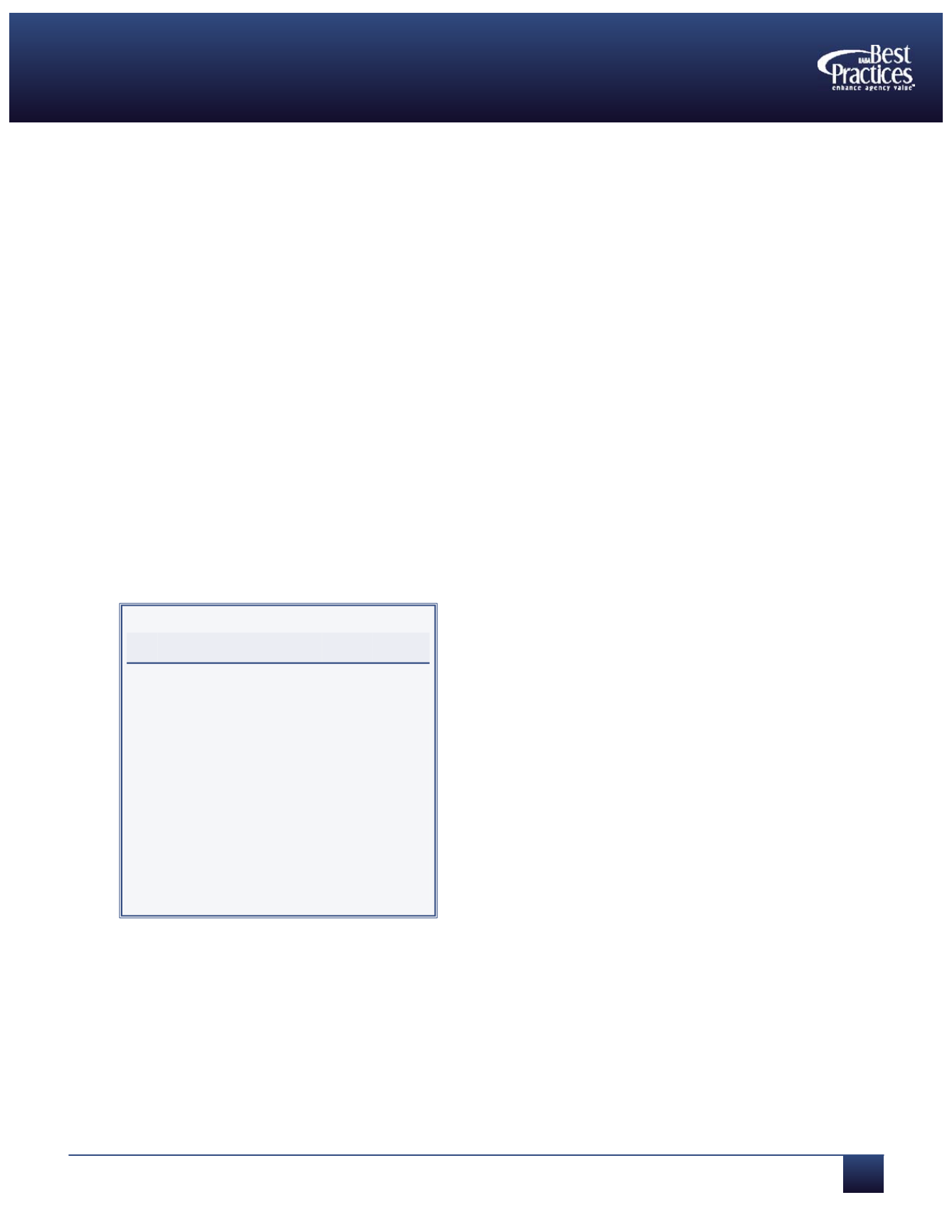

In 2006, only one public broker, Brown & Brown,

achieved a Rule of 20 outcome of 20 or more, as is

shown in the table below.

The comprehensive 2007 study can be purchased from

the Independent Insurance Agents & Brokers of

American (IIABA) Education Department. Order forms

can be downloaded at

http://bp.reaganconsulting.com/or at

www.independentagent.com.For more

information please call 1-800-221-7917.

About the Study

The History

The annual

Best Practices Study

originated in 1993 as

an initiative by the Independent Insurance Agents &

Brokers of America (IIABA) to help its members build

and maintain the value of their most important assets,

their agencies. By studying the leading agencies and

brokers in the country, the association hoped to

provide member agents with meaningful performance

benchmarks and business strategies that could be

adopted or adapted for use in improving agency

performance, thus enhancing agency value.

The IIABA retained the principals of Reagan Consulting

to create and perform the first

Best Practices Study

.

Annual updates conducted by Reagan Consulting

continue to provide important financial and

operational benchmarks, and the study is recognized

as one of the most thoughtful, effective and valuable

resources ever made available to the industry.

The Process

Once every three years, the IIABA asks insurance

companies, state association affiliates, and other

industry organizations to nominate for each of the

studies’ revenue categories those agencies they believe

to be among the better, more professional agencies in

the industry.

The nominated agencies are then invited to

participate. They must be willing to share key

business practices/philosophies and to complete an in-

depth survey detailing their financial and operational

year-end results. Those results are then scored and

ranked objectively for inclusion on the basis of

operational excellence.

This year, the beginning of a new three-year study

cycle, more than 800 independent agencies

throughout the U.S. were nominated to take part in

the annual study, but only 195 agencies qualified for

the honor. To be chosen, the agency had to be

Rank Public Brokers

Organic

Growth

EBITDA

Margin

Rule of 20

Outcome

1 Brown & Brown

4.5% 38.8% 23.9%

2 Willis Group

8.0% 21.3% 18.7%

3 Hub Group

5.0% 26.7% 18.4%

4 Hilb, Rogal & Hobbs

4.4% 27.0% 17.9%

5 Arthur J. Gallagher

6.0% 21.2% 16.6%

6 USI

1.8% 20.7% 12.2%

7 Marsh & McLennan 2.0% 14.2% 9.1%

8 Aon

2.0% 13.9% 9.0%

Rule of 20 Outcome