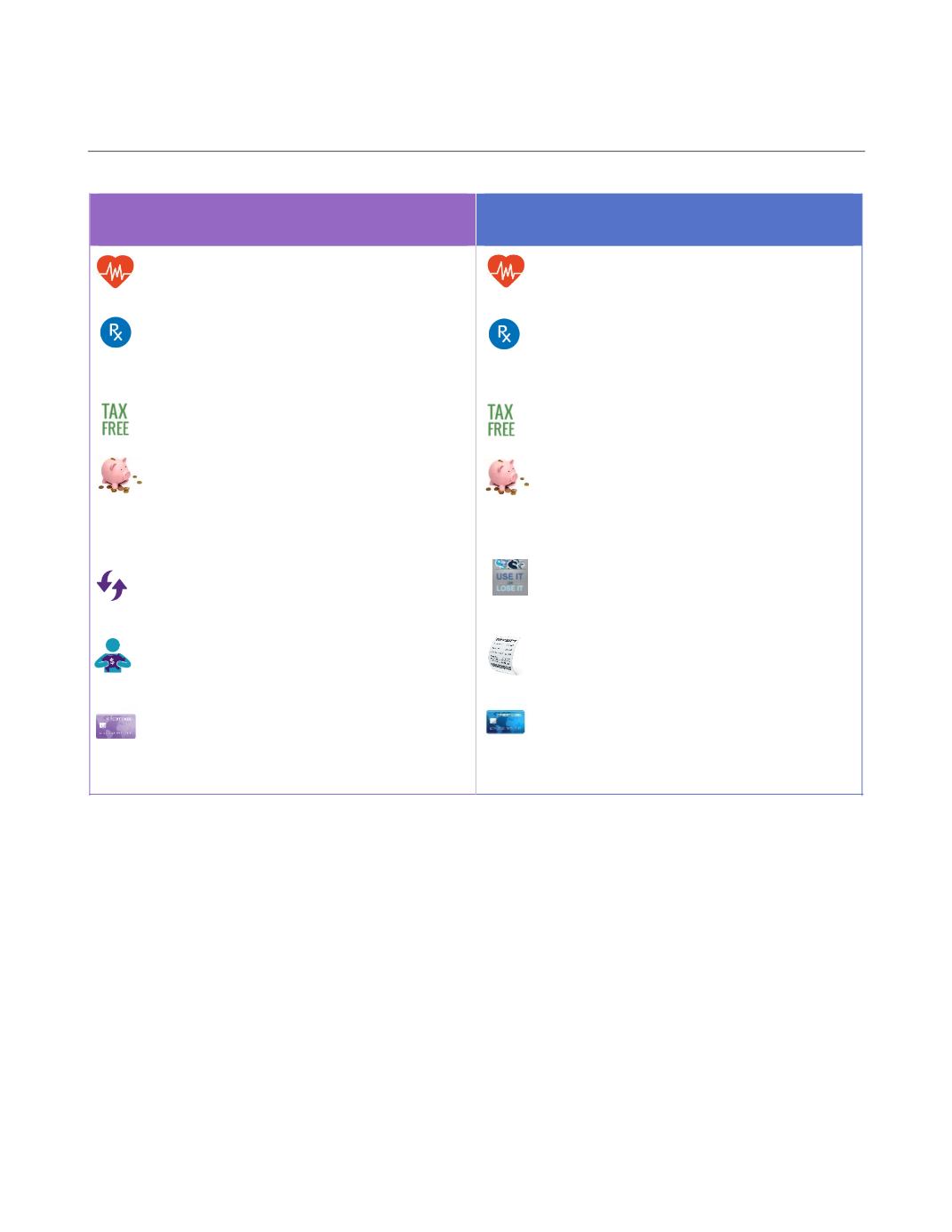

2017, can contribute up to $3,400/individual

& $6,750/family. 2018, can contribute up to

$3,450/individual & $6,900/family. Catch

Up contributions are also available for 55+

age.

HSA & FSA overvi ew

H e a l t h S a v i n g s A c c o u n t

F l e x i b l e s p e n d i n g a c c o u n t

Money put into your HSA is not taxed and you

earn tax-free interest on HSA balances

You own the account and all contributions, even

if you retire or leave the company. You can also

invest for increased tax-free earning potential.

The entire HSA balance rolls over each year

Funds can be used for qualified expenses

including medical, dental, vision, etc. Eligible

list of expenses is the same for HSA and FSA

Funds can be used for qualified expenses

including medical, dental, vision, etc. Eligible

list of expenses is the same for HSA and FSA

Works like a credit card, you don’t have to

wait for your payroll contributions to accumulate

before using.

Works like a debit card, you can only use

what you have accumulated through payroll

contributions.

Must validate every receipt for reimbursement

through Paychex.

Active employees can rollover up to $500

each year. Any leftover balance in your

account over $500 will be lost at the end of

the plan year.

Must be enrolled in the HDHP medical plan in

order to be eligible, cannot be in HMO or PPO

Can either be enrolled in the HMO plans or

the standard PPO, cannot be in the HDHP

2017, can contribute up to $1,000. 2018,

can contribute up to the IRS set maximum limit.

Choosing between the two ppo options

The HDHP PPO plan is often (but not always) less expensive for employees and their family,

however, the big adjustment is getting used to the sticker shock of the first 6 months of the year

when you are meeting your deductible on the HDHP plan. The standard PPO provides you with the

comfort of knowing exactly what each office visit and prescription drug cost is going to be. But, it

often results in you paying more than you would have under the HDHP PPO plan at year end.

The following two pages will give you examples comparing the two PPO plans and the total cost.

We recommend that you do your own calculations based on your own care to determine which

plan is better for you and your family.

Money put into your FSA is not taxed

Page | 11