WELL SERVICES CONTRACTORS REPORT

2015

page 8

4. Financial Data

Companies were asked to provide financial data relating to their activity on the UKCS in 2014. This information

does not include revenue from the design, manufacture and sale of well equipment.

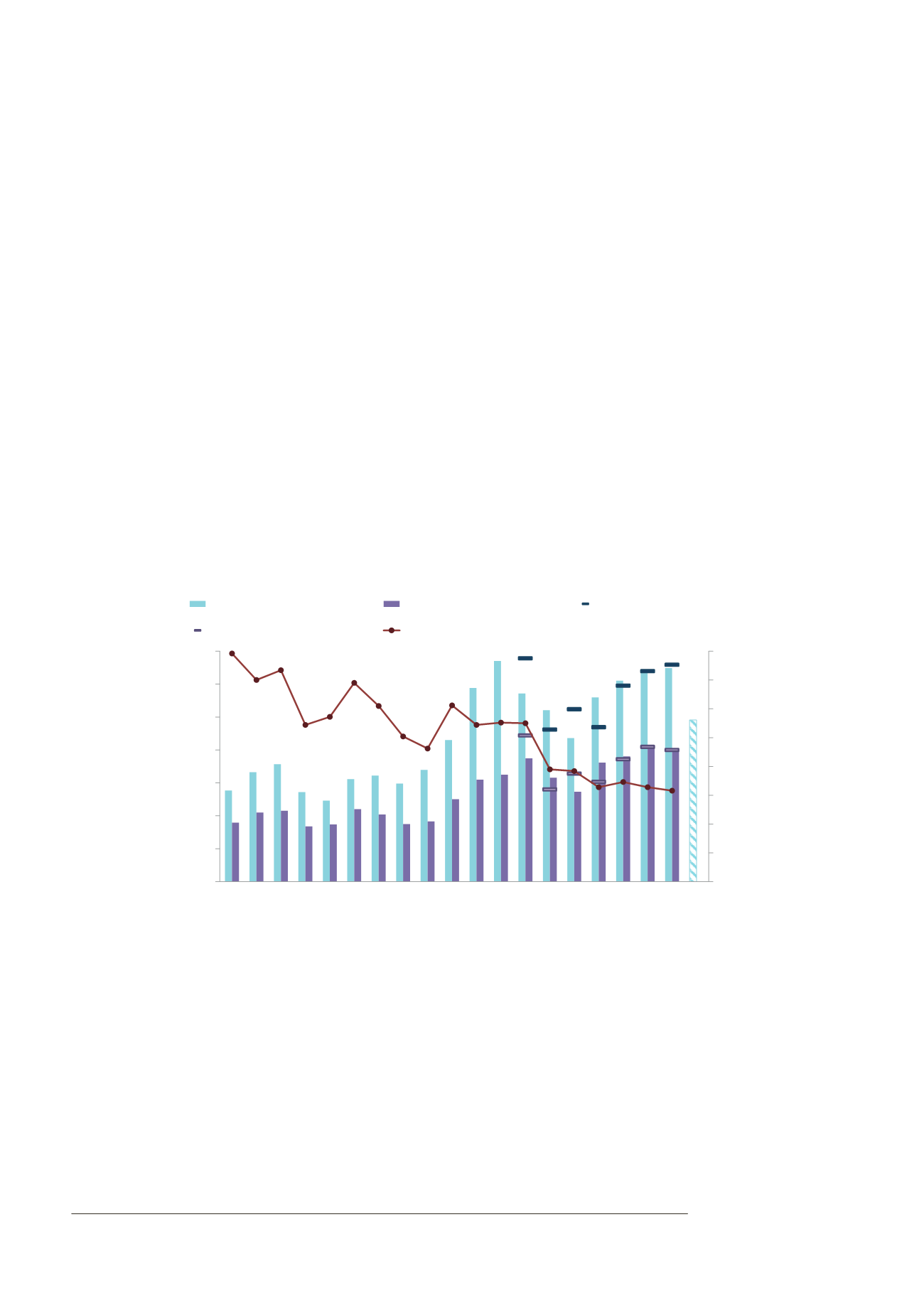

4.1 Gross Revenue

Gross revenue for the UK well services contractor sector was $3.24 billion (£1.97 billion) in 2014, a one per cent

increase on the $3.2 billion gross revenue recorded in 2013. It is important to note that the list of survey respondents

who submitted financial information for this year’s report is not completely identical to the previous year.

When like-for-like financial information is compared, a 4.8 per cent increase is observed from 2013 to 2014.

Figure 1 shows the forecast gross revenue for 2014 was $3.29 billion, which is $0.05 billion more than the actual

recorded revenue. For 2015, the forecast gross revenue is $2.5 billion, a projected decrease of nearly 23 per cent.

Furthermore, the Well Services Contractor Forum members recognise that the actual revenue in 2015 could be

even lower. For the last three years, the forecast revenues have been very close to the recorded values.

Figure 1: UK Well Services Contractor Sector Gross Revenue

0

50

100

150

200

250

300

350

400

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015 forecast

Number of Wells Drilled on the UKCS

Gross Revenue

Gross Revenue ($Billion)

Gross Revenue (£Billion)

Previous Year Forecast ($Billion)

Previous Year Forecast (£Billion)

Wells Drilled

Source: Oil & Gas UK

The total number of wells drilled, including sidetracks, decreased by 3.7 per cent from 164 in 2013 to 158 in 2014

1

.

Since 2010, the total number of wells drilled on the UKCS has decreased by 17.7 per cent. Despite this decline, the

revenue for the sector has remained consistently strong, with companies reporting activity in areas such as the

development and maintenance of existing wells. The forummembers forecast that the number of wells drilled will

fall significantly further in 2015 and, as such, they expect a large reduction in rig activity.

The fall in oil price that began in the last quarter of 2014 has not yet had a substantial impact on revenue.

A number of companies reported strong performance in early 2014 with demand reducing in quarter 4.

1

Oil & Gas UK’s

Activity Survey 2015

is available to download at

www.oilandgasuk.co.uk/activitysurvey