www.read-tpi.com

www.read-tpi.com

January 2015 Tube Products International

9

business & market news

Pressure pipes for

water and gas –

the European market

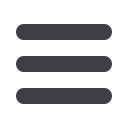

By the end of 2014, almost 300,000km

of drinking water and natural gas pipe

was installed in Europe, according to

the new edition of the study ‘Pressure

Pipes for Water and Gas – the European

Market’ by Applied Market Information.

Pipes for water supply and distribution

represented more than 70 per cent of

that volume, with the balance being gas

transmission and distribution pipes.

Between 2007 and 2013 the European

demand for pressure pipes lost roughly a

fifth of the volume. Demand is expected

to grow between 2014 and 2018, as

the European construction industry

recovers. However, 2018 volumes will

remain below those registered in 2007,

when demand peaked. In addition,

Europe will see a lot of variability, with

some markets performing very poorly,

while others exhibit a relatively robust

recovery.

The study covers 31 European countries

(the 28 European Union members, plus

Iceland, Norway and Switzerland). In

terms of pipe systems, it recognises

polyethylene pipes (PE80, PE100 and

PE100RC), PVC (including modified and

oriented PVC) and ductile iron pipes. In

addition to demand in

each country, it looks at

the supply side, as well

as at the market for raw

materials.

Plastic pipes continue

to gain market share

from ductile iron pipes,

but there are market sectors in which

the latter maintain strong positions.

Inter-polymer competition is driving

fast changes in demand for the various

plastic pipes systems.

A certain degree of consolidation has

occurred on the supply side: the market

share of the top ten pressure pipes

manufacturing groups has increased

from around 50 per cent in 2010, to

57 per cent in 2014. Nevertheless,

the supply continues to be relatively

fragmented, with a large number of

small players serving local markets.

Competition among European resin

manufacturers is growing in intensity.

Strong regulation and standardisation

prevent such competition from

negatively affecting the quality and

performance of products.

However, this drives a level

of commoditisation – product

differentiation becomes considerably

more difficult to achieve.

This does not mean that differentiation

cannot be generated. The key factor

remains new product development.

Progress in technology continues, in

terms of manufacturing processes,

component and system design,

installation techniques, etc. New,

improved raw material grades have also

been developed, providing solutions

to evolving market needs. Although

reputed to be conservative, this market

has a good track record of embracing

and rewarding valuable innovation.

Applied Market Information Ltd

– UK

info@amiplastics.com www.amiplastics.comIIL expansion plans

International Industries Limited (IIL), a

producer of GI pipes, API pipes, cold

rolled tubes, polyethylene and PPR C

pipes, is planning to commission a

stainless steel tube factory in Karachi,

Pakistan, from January 2015, and a

large diameter tube mill by mid-2015.

The company has also incorporated a

wholly owned subsidiary in Australia: IIL

Australia Pty Ltd.

IIL Stainless Steel Tubes will initially

cater to the needs of ornamental and

auto sectors for various applications

by manufacturing austenitic and

ferritic series in conformance with the

ASTM A-554 international standard. In

addition, the company is setting up a

12" diameter API and structural pipe mill

to cater to the growing demand of gas

companies and the construction sector

in the region.

IIL, which has 50 years of pipe

manufacturing experience, will also

participate in BORU 2015, in Istanbul,

Turkey.

International Industries Ltd

– Pakistan

inquiries@iil.com.pk www.iil.com.pkTrend in installed volume of pressure pipes

IIL’s manufacturing unit