Wire & Cable ASIA – January/February 2010

8

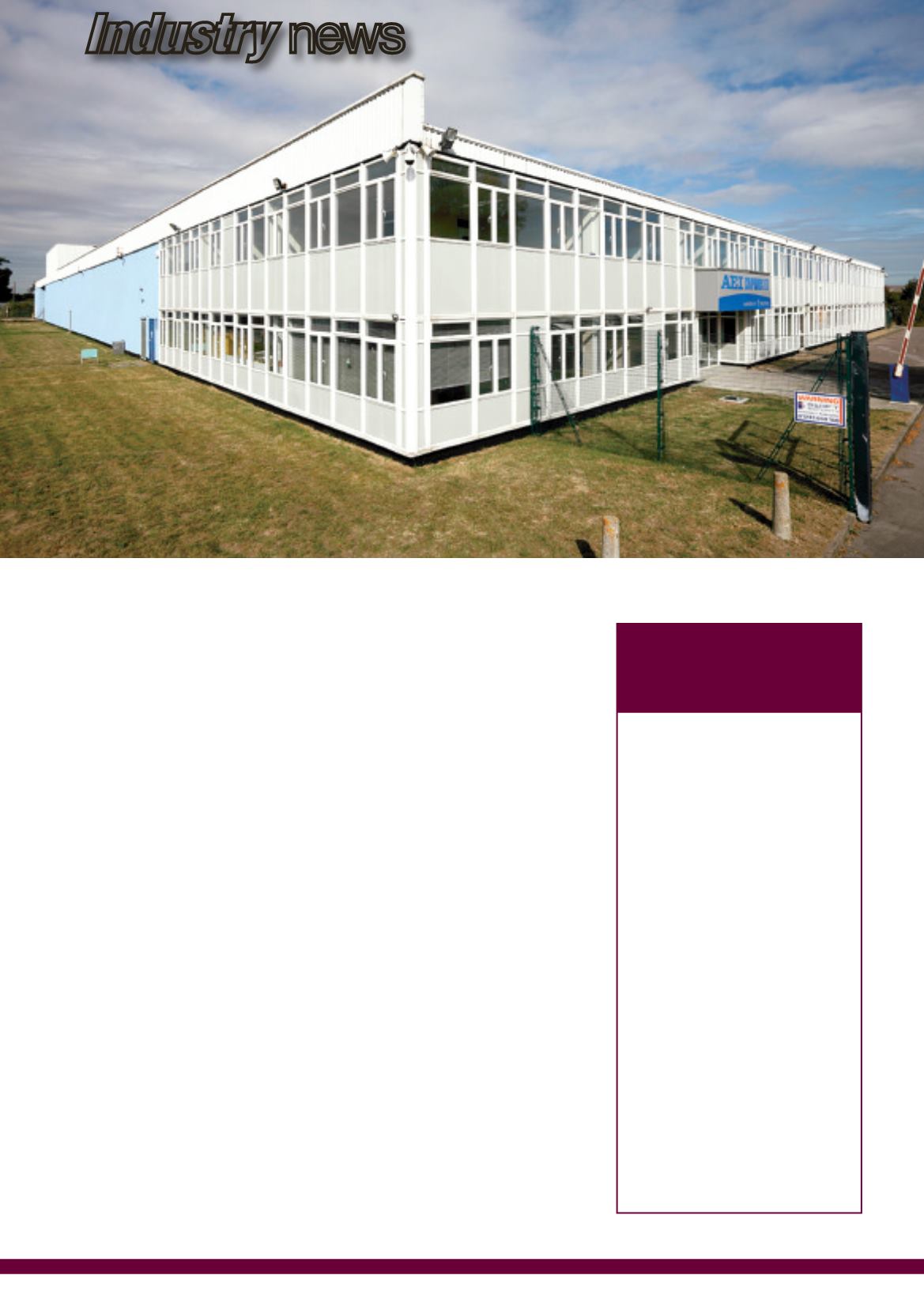

AEI Compounds Ltd, a subsidiary of

TT electronics plc and a specialist

producer of cross-linkable and thermo-

plastic polymer compounds, is to move

its operations from its current base in

Gravesend to Sandwich, Kent.

The company will also be installing new

production capacity for its range of

environmentally friendly, low smoke,

halogen free (LSFOH) cable compounds.

The new line will be capable of

producing up to 1,500kg per hour.

Mark Shaw, managing director of

AEI Compounds, commented: “This

investment in our business and

technical capability is critical to our

strategy of continuing to lead in the

supply and development of high

performance flame retardant solutions

to the polymer industry.

“Our customers are based in all regions

of the world and with competition

increasing from low-cost developing

economies we need to stay ahead by

investing in the very best equipment

and personnel.

“Despite the current challenging market

conditions the business has continued

to perform well, with a strong operating

profit performance in the last financial

year backed by revenue growth of

27 per cent and volume growth of

21 per cent.”

The new facility in Sandwich will

allow the business to develop all of its

current activities and will house the

company’s comprehensive R&D and

technical centre.

The project is scheduled to be complete

by the end of February 2010.

AEI Compounds Ltd – UK

:

sales@aeicompounds.co.ukWebsite

:

www.aeicompounds.comInvesting in

new facilities

AEI Compounds facility in Kent, UK

m

m

Cable maker Prysmian has called off

talks to take over the Dutch company

Draka Holding NV. In separate

statements on 10

th

September 2009,

Prysmian and Draka said they could

not reach agreement on the main

terms and conditions.

The proposed takeover, first announ-

ced in late June 2009, could have

created a market leader worth over

€3 billion. When talks were first

announced, Prysmian was worth

about €1.77 billion, and Draka about

€325 million, according to data

from Reuters. By 10

th

September,

Prysmian’s worth was estimated at

around €2.5 billion and Draka at

€548 million.

The deal talks were unusual in the

current climate of tight credit and

global recession, but analysts

recognised the possibility of cost

savings from the takeover.

Prysmian – Italy

Website

:

www.prysmian.comDraka Holding – The Netherlands

Website

:

www.draka.comTakeover talks

called off

news