6

MODERN MINING

January 2016

MINING News

Update on BMR Mining’s

Kabwe tailings project

In our October issue on page 5, we pub-

lished a news item entitled ‘Peer Review vali-

dates process route for Kabwe project’. This

stated that BMR Mining, which is developing

the Kabwe treatment project in Zambia, had

entered into an agreement with Sable Zinc

Kabwe, a subsidiary of Glencore, in respect

of land adjacent to BMR’s tailings dump and

certain key items of equipment. The inten-

tion was that BMR Mining would lease the

land from Sable Zinc Kabwe and site its pilot

plant on it.

While our news story was correct at the

time of going to print, BMR Mining has sub-

sequently decided to construct its plant on

land owned solely by Enviro Processing Ltd,

Kabwe (EPL), its wholly owned subsidiary,

and we have been asked to point this out

to readers. As a result, BMR Mining will not

be proceeding with the leasing of land and

equipment from Sable Zinc Kabwe.

AIM-listed Hummingbird Resources has

announced its maiden ore reserves at the

Yanfolila gold project in Mali. The Reserve

Report is based on the resources at the

Komana East andWest pits as these will be

mined first (Phase 1).

The project has significant resources

at other nearby deposits including

Guiren West, Gonka, Sanioumale East and

Sanioumale West which will be mined at a

later stage (Phase 2).

The report puts probable reserves at

6,82 Mt at 3,03 g/t for 665 600 oz Au. This

is an increase of 118 600 oz Au from the in-

pit mineral resource inventory reported in

the March 2015 Optimisation Study mine

plan of 547 000 oz Au, with the grade

increasing by 15 %, using a US$1 100 pit

shell. According to Hummingbird, 100 % of

in-pit indicated resources have converted

into reserves.

Comments Dan Betts, CEOof Humming

bird Resources: “Achieving a maiden ore

reserve at Yanfolila is a significant mile-

stone for the company. With an increased

gold grade of 3,03 g/t, it confirms Yanfolila

as a quality, high-grade, low cost project.

“We have increased the size of our pro-

cessing plant to process up to 1,24 Mt/a, as

well as processing harder, fresh ore types.

The ability to process greater volumes of

fresh ore has allowed us to expand and

deepen the open pits of our maiden ore

reserve, resulting in more recoverable

gold. Together with a more flexible operat-

ing plan, it also gives us scope to further

expand our ore reserves from our existing

deposits. The 24 % increase in throughput

will also significantly enhance annual gold

production.

“Additionally, the plant has been

designed with the ability to further

increase capacity to 1,5 Mt/a. With so many

indicated ounces outside the mine plan at

nearby deposits and high-grade under-

ground potential at Gonka, the company

believes there remains significant produc-

tion upside at Yanfolila.”

The project has undergone an extensive

amount of development since the last tech-

nical update given in June 2015. This work

has focused on maximising the returns of

the project, an ability to withstand a sus-

tained low gold price environment and

satisfy the independent technical consul-

tants undertaking due diligence on behalf

of Taurus Funds Management.

Announcing the maiden ore reserves

is the first step to finalising an updated

Maiden ore reserves declared for Yanfolila

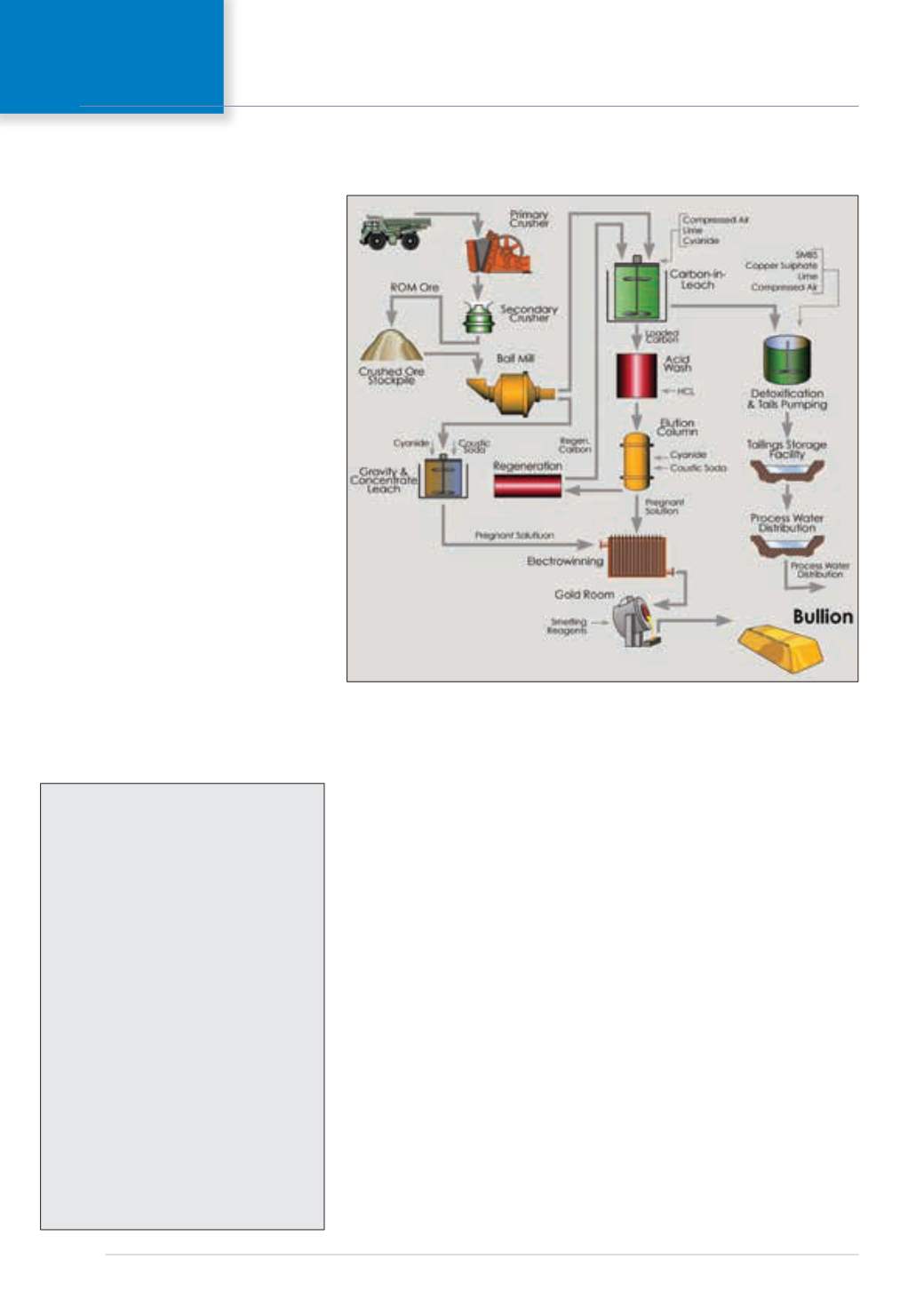

The new process flow sheet for the Yanfolila project.

mine schedule and economic analysis for

the project. Increasing the plant capacity

to 1,24 Mt/a from the previously reported

1 Mt/a (Optimisation Study, March 2015)

has increased annual gold production and

improved the ability of the plant to process

fresh ore material.

The processing route has beenmodified

to handle greater volumes of freshmaterial

and now includes a conventional two-

stage crushing circuit. Significant work has

been done on ore stockpiling to enhance

the mine schedule. Average recoveries

show 94 % recovery in oxide, 92 % in tran-

sitional and 91 % in fresh material.

Hummingbird says that detailed due

diligence on the project and technical

improvements have taken longer than

was anticipated by the company – a func-

tion of the revised plant flow sheet and

economic assumptions in a declining gold

price environment. It stresses, however,

that the project itself continues to improve

in all areas and that the construction time

remains constant. The extended due dili-

gence period will have a knock-on effect

to first gold pour and this will now most

likely occur during 2017.