8

MODERN MINING

February 2017

MINING News

In its latest trading update for the six

months ended 31 December 2016 (H1

FY 2017), Petra Diamonds says that pro-

duction was up 24 % to 2,01 million carats

(compared to 1,63 Mct for H1 FY 2016)

due to increased contribution from undi-

luted ROM ore leading to improved ROM

grades, and additional tailings production

from Kimberley Ekapa Mining.

The Group says it remains on track to

deliver full year production of approxi-

mately 4,4 to 4,6 Mct.

Underground expansion projects

remain on track with Finsch’s Block 5 SLC

and Cullinan’s C-Cut Phase 1 delivering

initial production during the period as

evidenced by the improving ROM grade

profiles.

Finsch’s ROM carat produc tion

increased 9 % to 816 001 carats, driven by

improved ROM grades of 54,5 cpht due to

continued pillar mining in Block 4 and the

increasing contribution from the newly

established Block 5 SLC, partially offset

by lower ROM tonnes. Overall production

reduced by 6 % to 1,03 Mct, due to the

Petra’s expansion projects improve ROM grade profiles

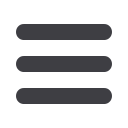

Tips and impact breakers on 839 level – the new production/extraction level for Cullinan’s C-Cut project

(photo: Petra Diamonds).

planned reduction in tailings production.

Cullinan’s diamond produc tion

increased 30% to 419 754 carats, in linewith

the company’s guidance. Initial production

from the C-Cut phase 1 block cave, coupled

with continued pillar and reclamation min-

ing, resulted in a ROM grade of 34,5 cpht

for the period, an increase of approximately

15 % on ROM grades achieved in H2 FY

2016, and in line with company guidance

of 33 to 35 cpht for H1 FY 2017.

As announced during the Q1 FY 2017

Trading Update, production at Koffie

fontein was hampered by downtime

required to resolve issues encountered in

the SLC ore handling infrastructure. The

mine is now set to deliver planned levels

of production from H2 FY 2017 onwards.

Kimberley Ekapa Mining’s attributable

production delivered 432 174 carats fur-

ther to the acquisition of the Kimberley

Mines and the associated tailings resources

during January 2016. Undergroundmining

production continued as expected and

treatment of ROM tonnes was restricted

due to the planned installation of a crush-

ing circuit at the Central Treatment Plant to

process fresh ROM ore.

ROM stockpiles of around 200 000

tonnes were built up during the period

and these will be processed during H2

FY 2017. Tailings grades of 12,1 cpht were

achieved, above the 9-10 cpht grades pre-

viously guided, due to increased recovery

of diamonds in the smaller size categories.

At the Williamson mine in Tanzania,

diamond production increased 12 % to

106 831 carats (with larger volumes of

ROM tonnes treated). During the period,

commissioning of the newly installed mill

section commenced and is expected to

be completed during Q3 FY 2017. Once

fully commissioned, both ROM grades and

throughput will improve and therefore

Petra is maintaining its full year produc-

tion guidance.

The commissioning of the new Cullinan

plant is due to commence towards the

end of the current quarter (Q3 FY 2017),

with production from the old plant ceas-

ing by the end of February, allowing for

tie-ins between the new and existing

infrastructure and the commencement of

sectional commissioning of the new plant.

Petra says that ramp up to full production

is expected in Q4 FY 2017.

Afarak restarts opencast mining at Mecklenburg

Afarak Group has entered into a ‘Mining

Services Agreement’ with Pholagolwa

Mining to continue the opencast mining

at its Mecklenburg chrome mine on the

Eastern Limb of the Bushveld Complex.

Work is currently underway on increasing

the high wall to 65 m from 40 m. The first

tonnages are expected shortly and full pro-

duction is expected to be reached by April

for a period of six months.

Full production will be 30 000 tons

of chrome ore per month and the total

opencast for the project is expected to be

just over 200 000 tons of chrome ore. This

will also allow better access to the under-

ground mining area which has the potential

to produce 4,5 million tons of chrome ore.

Development of the shaft is scheduled to

start later this year.

Dr Alistair Ruiters, outgoing CEO of

Afarak, said that this project highlights

Afarak’s responsiveness to market condi-

tions.“In response to themarket upswing, an

opportunity was identified in increasing the

highwall andwhichwill allowopencast min-

ing and facilitate underground mining. This

added production capacity allows us to reap

the benefits of the current market upswing.”

Afarak is a global vertically-integrated

producer of speciality alloys with opera-

tions in South Africa, Turkey, Germany,

London, Helsinki and Malta. It is listed on

the NASDAQ OMX Helsinki Stock Exchange

and the London Stock Exchange.