6

MULTIFAMILY INVESTMENT PROPERTIES GROUP

| SOUTH FLORIDA

MIAMI-DADE

MULTIFAMILY MARKET SUMMARY

YEAR $ SALES VOLUME

# OF

SALES

TOTAL #

OF UNITS

ASKING

RENT

ASKING

RENT

PSF

ASKING

RENT

GROWTH

EFFECTIVE

RENT

EFFECTIVE

RENT PSF

EFFECTIVE

RENT

GROWTH

VACANCY

NET

ABSORP

NEW

UNITS

2016 711,183,000 102 151,787 $1,247 $1.48

2.4% $1,211

$1.44

2.0% 2.5% 2,137 1,596

2015 918,139,900 148 150,303 $1,218 $1.44 7.9% $1,187

$1.41

6.7% 2.7% 3,016 3,356

2014 706,373,000 165 147,197 $1,129 $1.34

5.4% $1,112

$1.33

4.9% 2.6% 3,149 3,665

2013 550,882,000 114 144,127 $1,071 $1.28

5.0% $1,060

$1.27

5.3% 2.6% 2,064 1,666

2012 576,245,000 108 142,748 $1,020 $1.23

3.9% $1,007

$1.21

4.7% 2.8% 2,054 1,896

2011

236,787,200 84 141,402 $982

$1.18

3.3% $962

$1.16

3.6% 3.2% 1,251

1,703

2010 202,912,833 57 140,579 $951

$1.15

1.5% $929

$1.13

2.0% 3.3% 1,947 922

2009 188,255,924 41

139,785 $937

$1.14

-2.9% $911

$1.10

-1.9% 4.1% 1,950 2,120

2008 122,251,200 50 137,885 $965

$1.17

-0.9% $929

$1.13

-2.1% 4.3% 514 1,790

2007 366,148,835

66 136,177 $974

$1.18

N/A $949

$1.15

N/A 3.8% -13

1,624

$710 MILLION $6.97 MILLION

$178 PSF

$125,000

2016 Sales

2016 Average Sale Price YTD Median Average Sale PSF YTD Median Sale per Unit

$1,247

97.5%

2,137 UNITS

151,787 UNITS

Average Rent Per Unit

Occupancy Rate

Annual Unit Net Absorption Inventory of Rentable Units

Miami-Dade Apartments Under Construction

24

apartment buildings

totaling

9,023

units under construction

in Miami-Dade

BUILDING

CITY

# OF

UNITS

EXPECTED

COMPLETION

Soleste Prado

Miami

194 2017

Modera Station II

Coral Gables

181

2017

Panorama Tower

Miami

821

2017

Solitair Brickell

Miami

438 2018

Gables Aventura

Aventura

400 2017

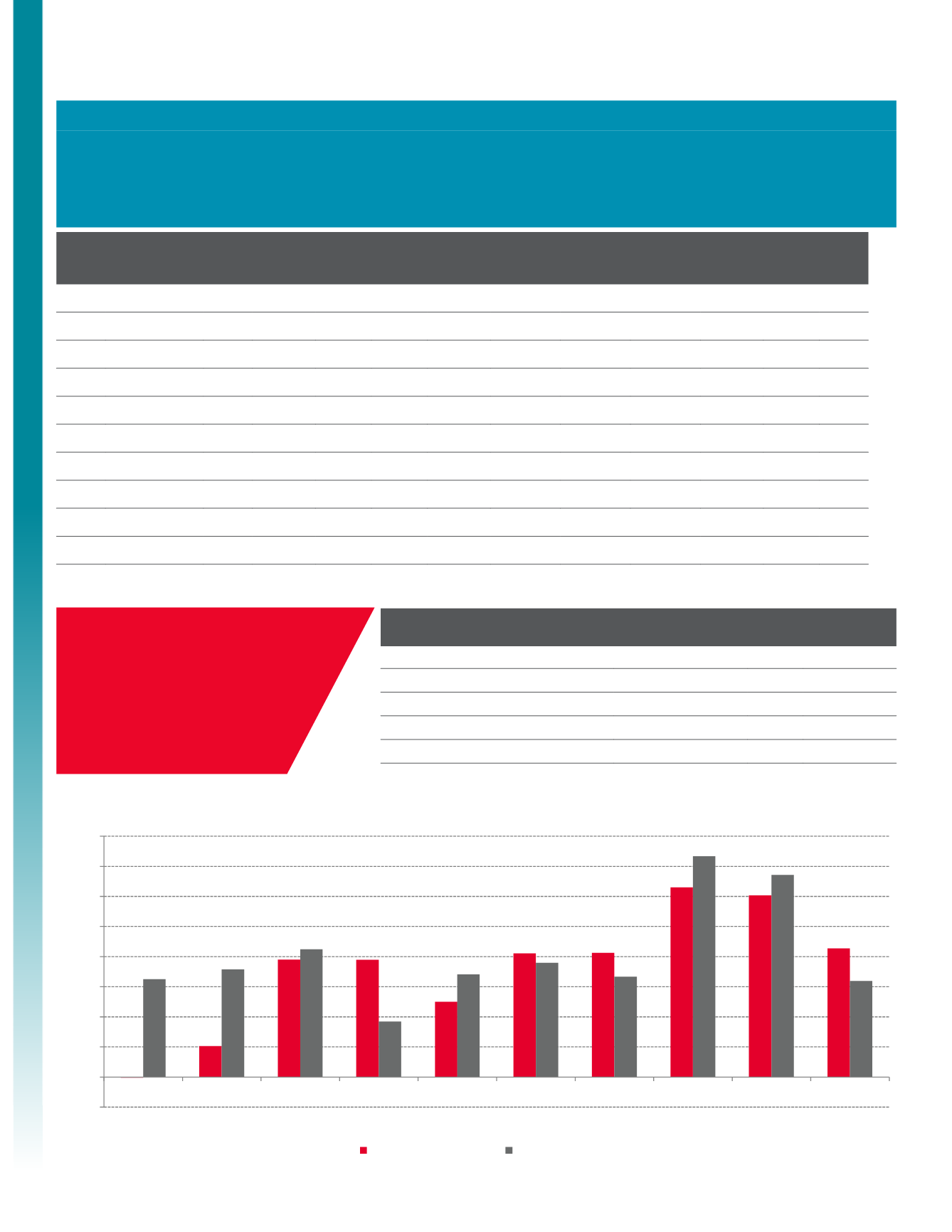

Miami-Dade Deliveries Versus Absorption

-500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Net Absorption (Units)

Deliveries (Units)