20

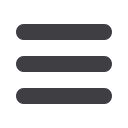

EMPLOYMENT GROWTH SINCE 2009

OCCUPANCY CHANGE SINCE 2010

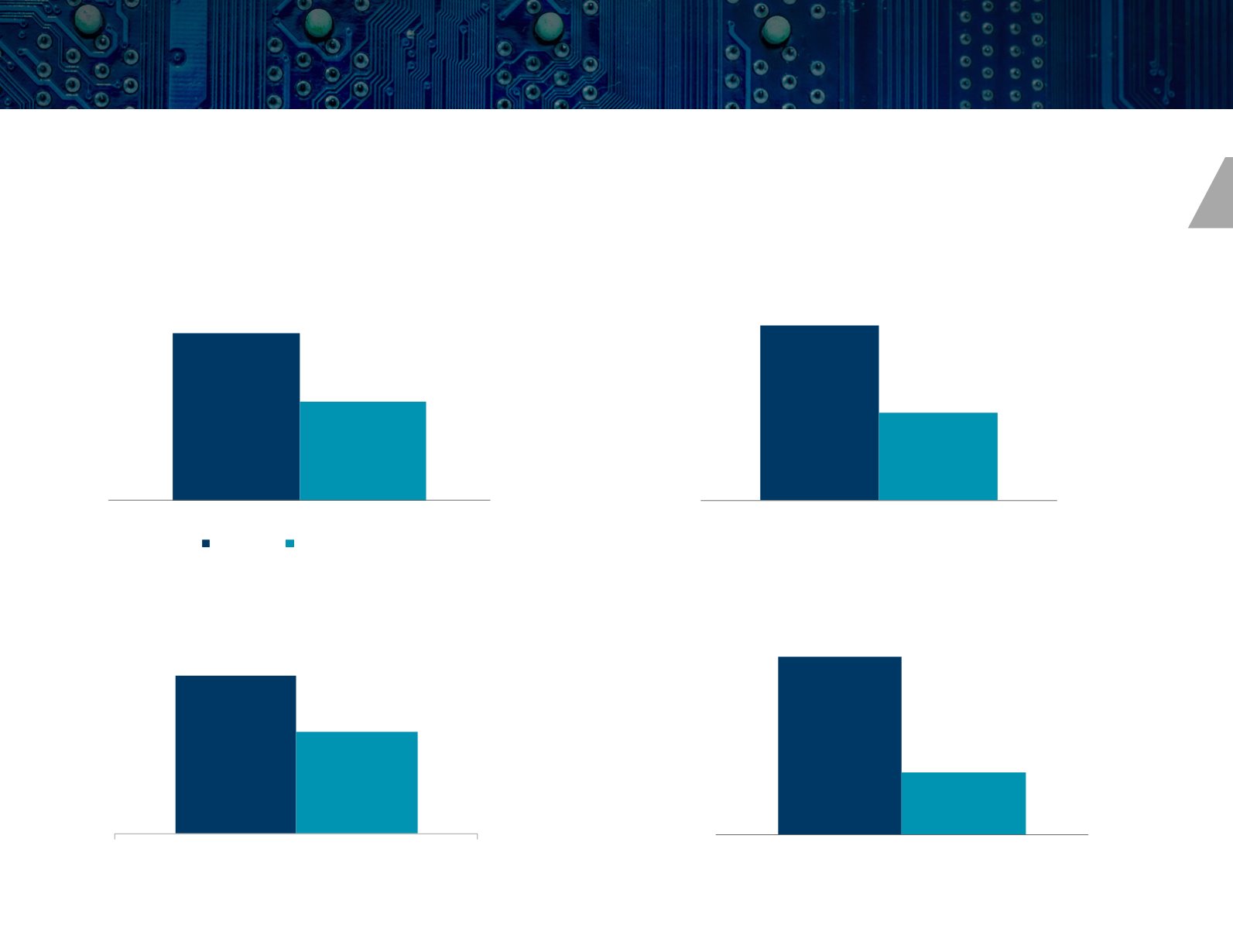

ABSORPTION SINCE 2010

RENT GROWTH SINCE 2010

Source: U.S. Bureau of Labor Statistics, Cushman & Wakefield

2.2%

1.7%

1.0%

1.2%

1.4%

1.6%

1.8%

2.0%

2.2%

2.4%

2009 - 2017

Tech 25 All Other Markets

233

116

0

50

100

150

200

250

Q2 2010 - Q1 2017

Millions of square feet

Tech All Other Markets

5.0%

3.2%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Q2 2010 - Q1 2017

Tech 25 All Other Markets

29.4%

11.0%

1.0%

6.0%

11.0%

16.0%

21.0%

26.0%

31.0%

Q2 2010 - Q1 2017

Tech All Other Markets

The following charts provide a snapshot of how key CRE fundamentals for the tech markets identified in this report (Tech 25)

have stacked up against all other U.S. markets. Overall, since 2009, the Tech 25 have outperformed markets across the U.S.

Tech 25 vs. U.S. Markets

Stronger job

growth among

the Tech 25

Change in

occupancy

greater within

the Tech 25

Tech 25 has

recorded

a sharper

increase in

occupancy

Asking rents up

much more within

the Tech 25