OVERVIEW

TECH METRICS

OVERVIEW

TECH METRICS

9

THE TECH 25•

Top investments by industry in 2016 were software, pharma & biotech, health care devices & supplies,

commercial services, and health care services & systems.

•

Regarding funding stages, it was somewhat of a mixed bag:

--

The average VC round for the angel/seed category has climbed each year since 2011; the number of deals,

however, did decline from 2015 to 2016.

--

The average size of early-stage VC funding climbed in 2016 as well; like the angel/seed category above, though,

the number of deals declined.

--

Regarding later stage VC funding, both the average size of the deal and the number of deals declined in 2016.

It was the first year-over-year decline in size since 2013.

•

VC-backed exits were down from 2015 to 2016 across all major methods — whether acquisition, IPO, or buyout.

Total exits fell to 1,152 from 1,507 year-over-year.

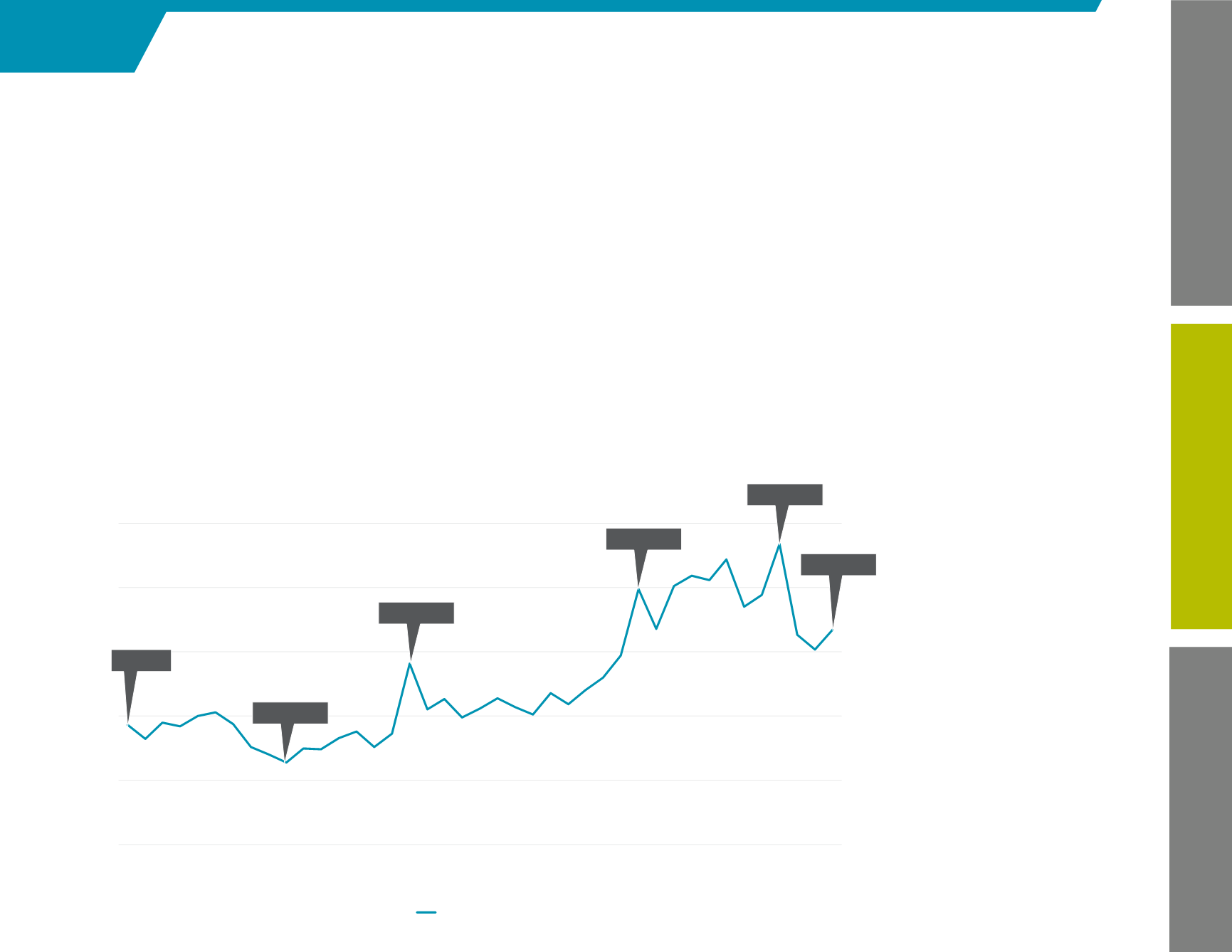

One or two major

VC transactions can

greatly influence the

activity by quarter –

a lack of major deals

in Q4 2016 resulted

in a sharp decline.

Venture Capital Funding

U.S. HISTORICAL VC FUNDING

Source: PitchBook

$0

$5

$10

$15

$20

$25

Q1 2007

Q3 2007

Q1 2008

Q3 2008

Q1 2009

Q3 2009

Q1 2010

Q3 2010

Q1 2011

Q3 2011

Q1 2012

Q3 2012

Q1 2013

Q3 2013

Q1 2014

Q3 2014

Q1 2015

Q3 2015

Q1 2016

Q3 2016

Q1 2017

Deal Value ($B)

$9.3B

$16.7B

$14.1B

$6.4B

$19.9B

$23.4B