14

Strategic Report

|

Whistl Annual Report 2016

CFO Financial Review

Financial position

Focus on profitable and cash generative core activities

has put the Group in a strong financial position, with the

resources to invest and grow. Net cash at the end of the

year was £22.9m (2015: £14.4m) and net assets were £13.7m

(2015: £6.4m).

Cash flow from operating activities was £12.7m (2015:

(£0.4m)). The increase in cash flow compared to the prior

year, was due to profitable trading in 2016 and the adverse

impact from closure of Whistl’s final mile delivery activities

in 2015. The net increase in cash during the year was £8.5m.

In addition to cash at bank, the Group can draw on

a £65m fully committed credit facility from Royal Bank

of Scotland, for a further four years to support investment

and working capital.

Group structure

On 13 February 2017, Whistl NN1 Limited changed its name

to Whistl Limited.

The Whistl Limited (formerly Whistl NN1 Limited) Group

is comprised of ten companies. As at 31 December 2016

there are two main trading companies and eight holding or

dormant companies. Whistl UK Limited is the trading entity

of the Mail and Parcels business units and Whistl (Doordrop

Media) Ltd is the trading entity of Doordrop Media. On 6

March 2016, the Group’s trading structure was simplified

when four companies transferred their entire business

and assets into Whistl UK Limited at net book value, and

subsequently became dormant.

The ultimate holding company of the Group, Whistl Group

Holdings Limited, was incorporated on 16 September 2015

and was the vehicle used to execute the MBO.

Group revenues of £591.7m (2015: £605.6m) reduced by 2.3%

Downstream

Access Mail

and Parcels

Doordrop Media

Total Revenue

2016

£m

528.4

63.3

591.7

2015

£m

552.7

52.9

605.6

Change

(4.4)%

19.7%

(2.3)%

Revenue

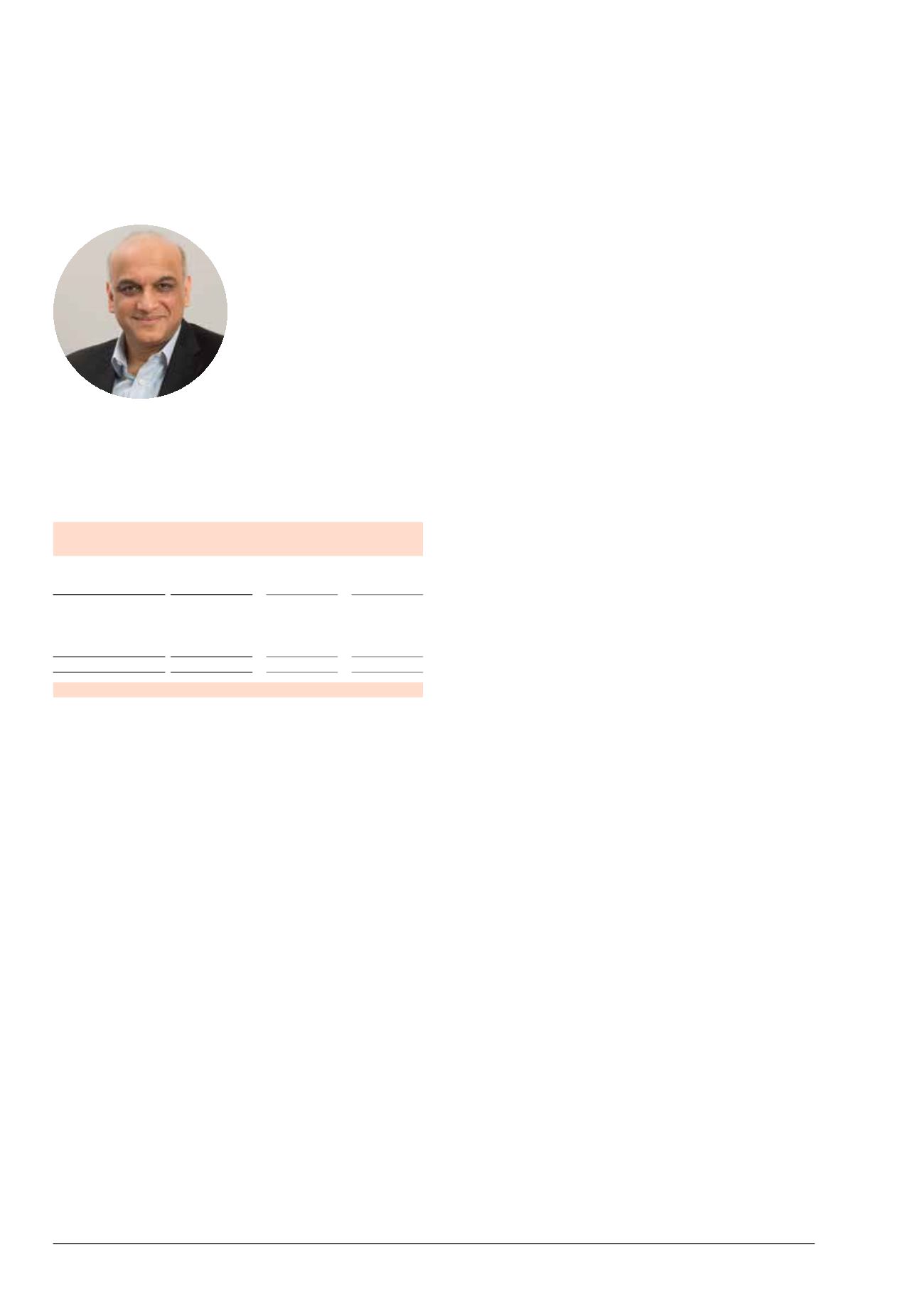

Manoj Parmar

Chief Financial Officer

Segment