Financial Planning Process

2016-2020 FINANCIAL PLAN

Ensure that current revenues support

current programs.

The Financial Plan should provide that

current programs are funded from current

revenues and that reserves are used only

as a temporary balancing measure. Any

reserves that are used to balance the

Operating Financial Plan should be

subsequently replenished.

Reward cost-effective innovations.

The Financial Plan should reward

cost-saving initiatives through a "save and

invest" philosophy rather than a “spend it

or lose it” approach. This philosophy

allows City departments to reinvest their

savings from innovation.

Maintain appropriate level of Reserves as

determined by Council.

The Financial Plan should allocate an

appropriate level of funds to reserves in

order to maintain services throughout

economic cycles. Specifically, the

Financial Plan should:

Provide adequate funding for

unforeseen costs and revenue

reductions;

Provide bridge financing for Capital

Projects; and

Allow the City to take advantage of

market opportunities.

Council will determine the appropriate

level of these reserves.

PRINCIPLES SPECIFIC TO OPERATING FINANCIAL PLANNING

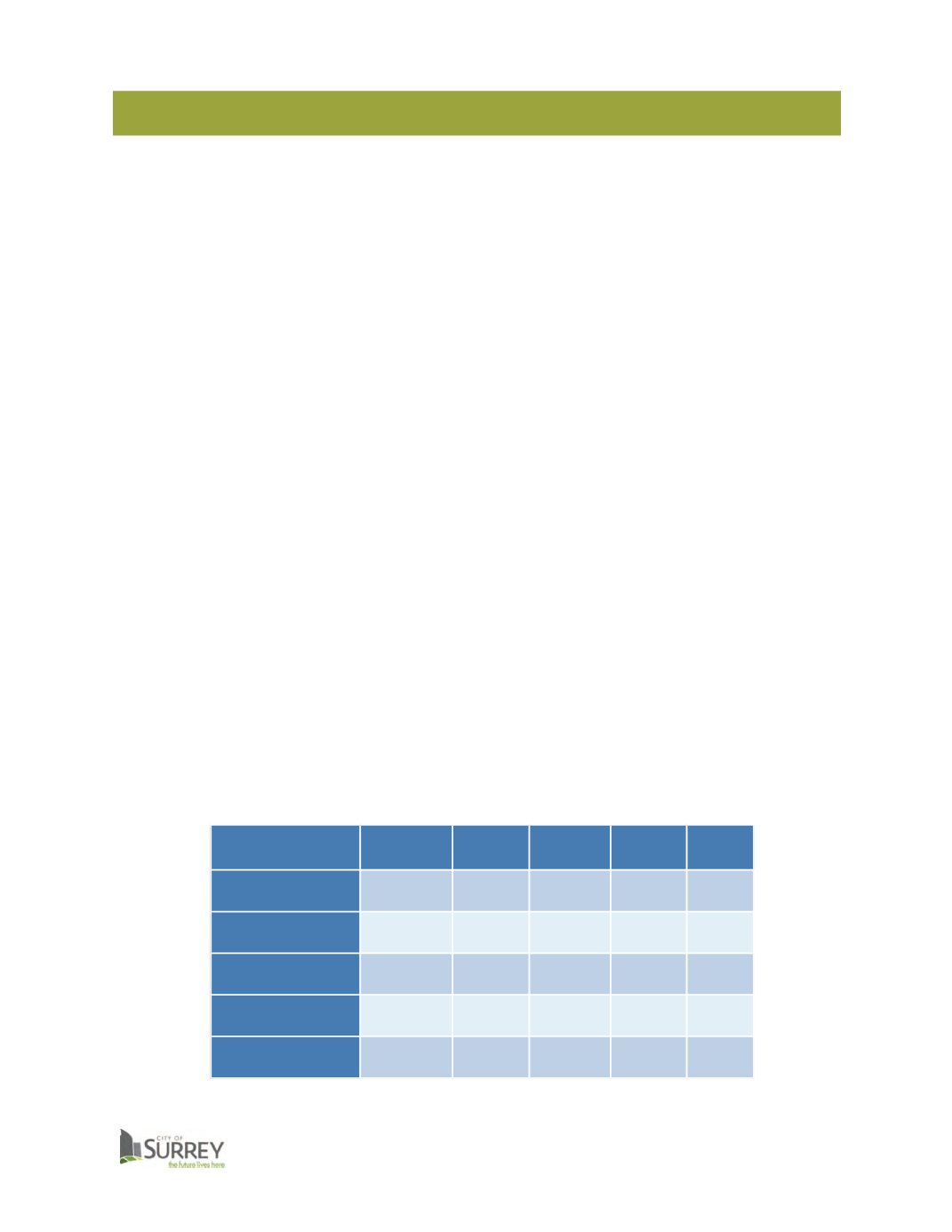

INFLATIONARY INCREASES

2016 inflation has been projected at 1.0%. However, City departments have been

cautioned to allow for inflationary increases only as necessary where uncontrollable cost

increases may be anticipated or where contracts warrant inflationary increases.

Departments have also been provided with the following inflationary increase estimates,

as calculated by City vendors.

2016

2017

2018

2019 2020

Water

2.8%

6.7%

6.0%

6.0%

4.9%

Sewer

4.3%

6.6%

7.2%

7.7%

7.2%

Drainage

6.0%

2.3%

2.3%

2.2%

2.2%

Solid Waste

0.0%

1.8%

1.7%

1.7%

1.7%

Equipment

0.5%

0.5%

0.5%

0.5%

0.5%

14