FINANCIAL OVERVIEW

MAJOR REVENUE SOURCES

2016-2020 FINANCIAL PLAN

PROPERTY TAXES

Surrey has three major sources of revenue, the most significant of which is property

taxes. In the recent past, Surrey has enacted moderate general tax increases. To fund

increasing costs related to protective services and other City operations, the City will

increase the annual property taxes by approximately $70 along with an $18 increase in

the Roads and Traffic Safety levy for the average single family dwelling for 2016.

Individual property taxes are calculated based on the assessed value of the property.

For 2016, the average residential dwelling was assessed at approximately $720,989 and

assessment growth from new development was estimated at 1.68%. The 2016 tax rates

are available now based on the BC Assessment value for each property.

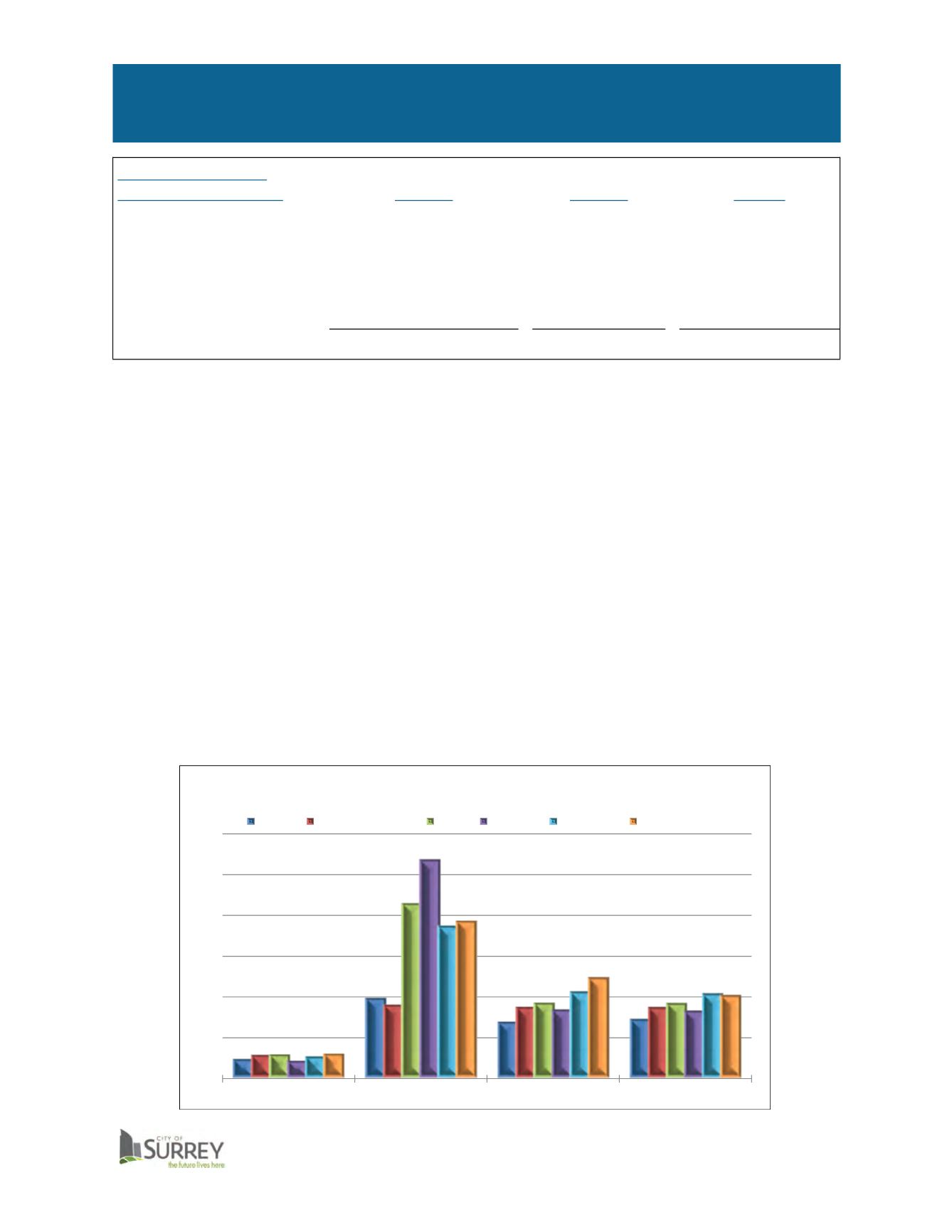

In 2015, Surrey generated approximately 30.20% of its general property tax revenue

from business and industry. Surrey’s 2015 business, light industrial, and major

industrial tax rates compare favourably to neighbouring municipalities. Surrey’s tax

rates are among the lowest in the region, providing a climate conducive to attracting

new commercial and industrial ventures.

General Operating

Revenue ($ millions)

2016

Budget

2015

Budget

2015

Actual

Taxation

$309.6

$294.5

$290.7

Departmental Revenues

$ 79.4

$ 74.4

$ 76.5

Investment Income

$ 13.8

$ 14.1

$ 13.5

Other

$ 36.8

$ 34.5

$ 34.7

Total

$439.6

$417.5

$415.4

$0

$10

$20

$30

$40

$50

$60

Residential

Major Industry

Light Industry

Business

2015 Tax Rates

(per $1,000 assessed value)

Surrey Langley Township Delta Burnaby Coquitlam New Westminster

56