6

MODERN MINING

January 2015

MINING News

Canada’s B2Gold Corp reports that the first

gold pour has occurred, ahead of schedule,

at its new Otjikoto gold mine in Namibia.

Otjikoto is only the second Namibian gold

mine and – says B2Gold – has made his-

tory as one of the fastest-moving mine

construction projects in the country.

B2Gold received the Otjikoto mining

licence in late 2012 and bush-clearing

started in January 2013. With the ground-

breaking ceremony held on 26 April, 2013,

construction of the Otjikoto gold mine

was officially underway. Since that time,

the team has placed over 1,3 million m

3

of

earthfill, over 20 000 m

3

of concrete and

has worked over 3 million man hours.

The nations represented in the con-

struction crew include Namibia, South

Africa, Canada, the US, Russia, Ghana,

Italy, Portugal, Mexico, Peru, Chile, the

Philippines and Nicaragua. “As a result of

their incredible work, B2Gold now has a

world-class mine and processing facility in

Namibia,” says the company.

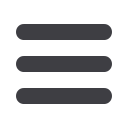

The metallurgical plant at Otjikoto (photo: B2Gold).

New Namibian mine pours its first gold

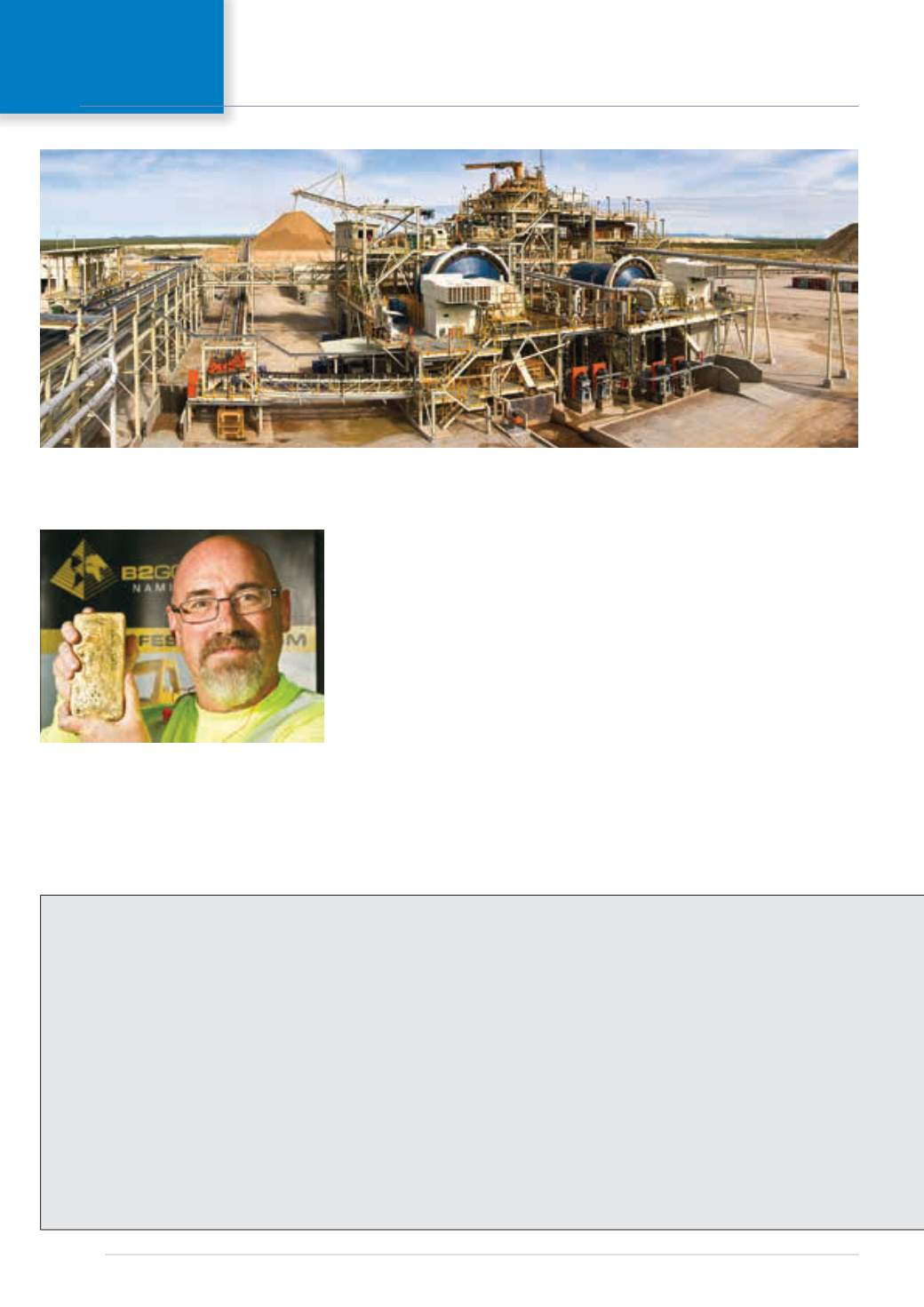

Bill Lytle, MD of B2Gold Namibia, with Otjikoto’s

first gold bar (photo: B2Gold)

B2Gold’s wholly owned subsidiary,

B2Gold Namibia, entered a transition

phase several months ago from construc-

tion to steady state. The focus of this plan

is the end of construction and preparation

for production and operations.

Otjikoto achieved a substantial and sig-

nificant overall safety performance during

2013 and 2014. During the construction

phase of the project a number of signifi-

cant safety achievements were recorded:

there were no fatal incidents, there was a

year-to-date Lost Time Accident Frequency

rate of only 0,08 (project-to-date 0,16) and

over 2 million man hours were worked

without a single Lost Time Injury (reached

on 29 June 2014).

The mine is located approximately

300 km north of Windhoek between

Otjiwarongo and Otavi and is owned

90 % by B2Gold and 10 % by EVI Mining

ASX-listed Universal Coal has reported

that its Kangala colliery near Delmas in

Mpumalanga has successfully met pro

ject Completion Tests to the satisfaction of

debt financier Rand Merchant Bank (RMB).

Universal says this represents another sig-

nificant milestone for the company, marking

the official transition to steady state opera-

tions for Kangala.

Located near Delmas in the Witbank coal

field of South Africa, Kangala is a 2,4Mt/a run-

of-mine (ROM) operation, with installed plant

capacity to expand to 4,25 Mt/a. The opera-

tion is cashflow positive, with the majority

of its thermal coal product supplying South

Africa’s primary power utility, Eskom.

Kangala colliery passes its project Completion Tests

Completion testing for a continu-

ous period of 90 days commencing on

1 August 2014 and running through to

31 October 2014 was deemed satisfactory

according to the ‘Independent Technical

Advisor’ based on their assessment of the

mine safety record, various designs, mine

plan, mine production performance, prod-

uct yields and qualities, plant performance

and customer delivery.

Universal Coal has now fully com-

plied with its performance obligations

and qualifies for more attractive project

finance facility terms. Furthermore, the

Kangala colliery is now entitled, under

certain circumstances, to make permitted

cash distributions to its shareholders in the

form of shareholder loan repayments and/

or dividend distributions.

Universal Coal has also provided

an update on its NCC (New Clydesdale

Colliery) project in the Kriel District south

of Witbank and says it only awaits approval

of the Section 11 from the Department

of Mineral Resources prior to finalising

the impending NCC acquisition, which is

expected to conclude early this year. At

present, the opencast tendering process is

underway on Roodekop while discussions

are ongoing with underground mining

contractors in order to re-activate the

workings once NCC is started up.

A bankable feasibility study as part

of the debt funding is also progressing,