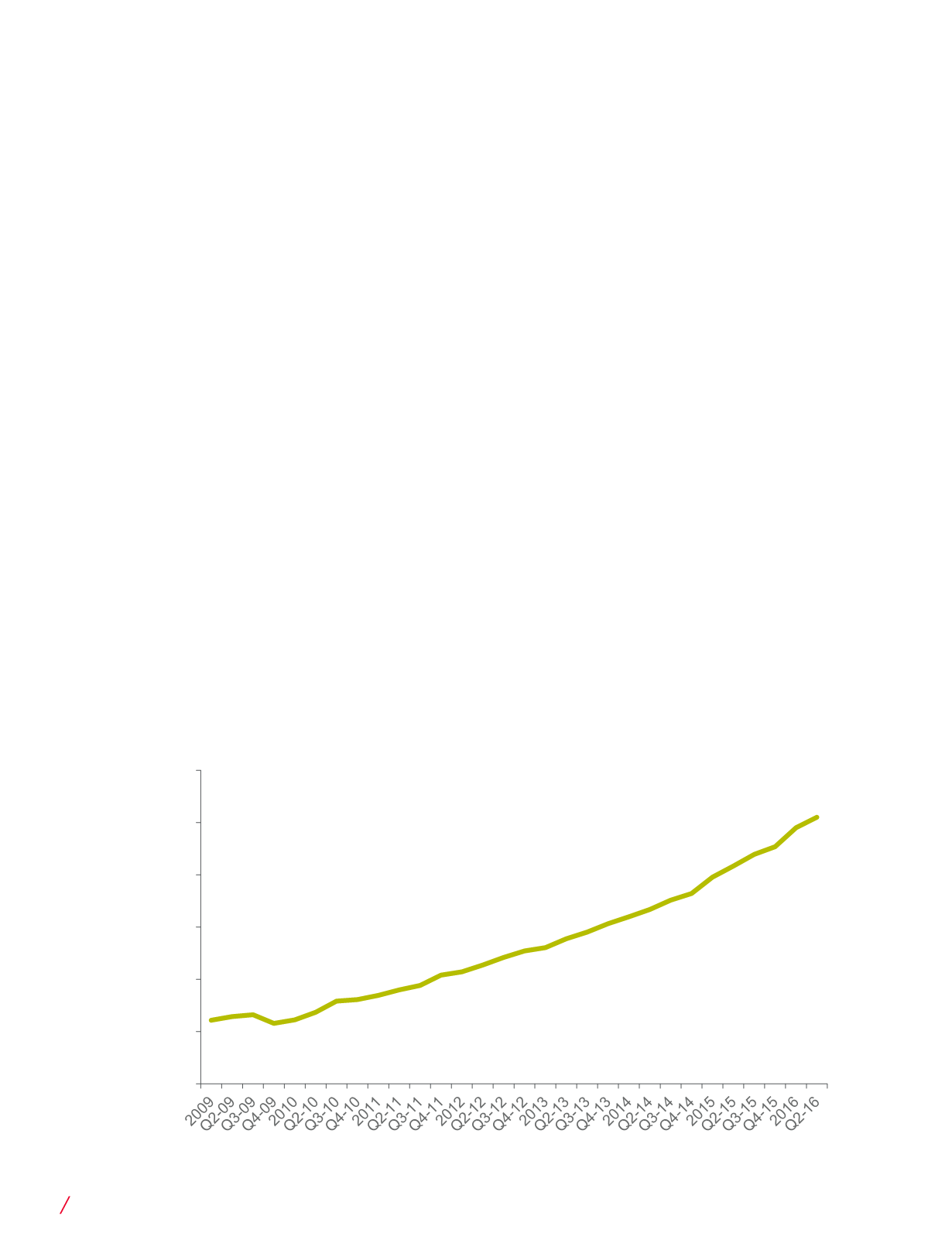

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Millions of Dollars

Retail Growth in the Age

of eCommerce

The continued consumer focus on value,

especially since the recession, has created

significant challenges for bricks-and-mortar

retailers and landlords alike. But it is the

acceleration of eCommerce around the

globe that has been the big disruptor. The

introduction of the tablet in 2010 marked

a turning point. Beginning that year, annual

eCommerce sales growth nearly doubled,

from a consistent range of 7.0% to 8.0% to

15.0% or greater each year after that. Com-

pare that growth rate to overall U.S. retail

sales growth which since 2010 has consis-

tently been in the 2.0% to 3.0% range.

But the rise and success of eCommerce

hasn’t impacted all retail categories evenly.

The story becomes clearer when you

explore eCommerce sales figures as they

apply to a much narrower portion of the

retail world: GAFO. GAFO—the acronym for

general merchandise, apparel and

accessories, furniture and other sales—is

a combination of individual retail categories

that the Commerce Department tracks that

reflect most U.S. mall retail tenants. GAFO

includes the following categories:

• General Merchandise

• Clothing and Clothing Accessories

• Furniture and Home Furnishings

• Electronics and Appliances

• Sporting Goods, Hobbies, Books and

Music

• Office Supplies, Stationery and Gifts

As of August 2016, eCommerce accounted

for 28.2% of all retail sales for these catego-

ries (GAFO). The steady drumbeat of bad

news in 2016 has been dominated by

retailer closures and bankruptcies in these

categories, particularly for apparel and

department stores. Gains from eCommerce

FOOD HALLS OF AMERICA

Source: U.S. Census Bureau

U.S. eCommerce Share of TOTAL Retail Sales

4.2%

9.5%

8.1%

2009

Q2 2016

Current eCommerce total share of U.S. retail sales,

excluding automotive and fuel sales

6

CUSHMAN & WAKEFIELD