30.0%

35.0%

40.0%

$160,000

$180,000

$200,000

Retail Sales: GAFO, ($Mil.)

eCommerce Share

(whether from pure-play online retailers like

Amazon or bricks-and-mortar retailers

growing their omnichannel presence) have

been the primary driving force behind this

wave of consolidation. This trend is unlikely

to end any time soon.

Still, despite these challenges overall

shopping center vacancy has actually

continued to trend downward. Overall

shopping center vacancy in the U.S. was

7.4% at the end of Q3 2016, down from

7.5% three months earlier and down from

7.8% at the close of Q3 2015. The expan-

sion of food-related retail concepts, from

grocery stores to restaurants, is one of the

reasons why.

The Rise of Food Retail

There are plenty of reasons for the surging

popularity of food halls in the U.S. but let’s

start with the most basic one: Americans

are eating out more than ever before. The

Commerce Department and the U.S. De-

partment of Agriculture report on monthly

food sales in the U.S. in two categories;

food expenditures at home and food

expenditures away from home. These

essentially break out as grocery vs.

restaurant sales.

The good news for both grocery stores and

restaurant concepts is that overall numbers

have been consistently increasing since

2010 at a rate of 5.9% annually. Between

2014 and 2015 both concepts grew at a rate

Occupancy growth in the post-recession era has been

all about two factors; economics and eCommerce.

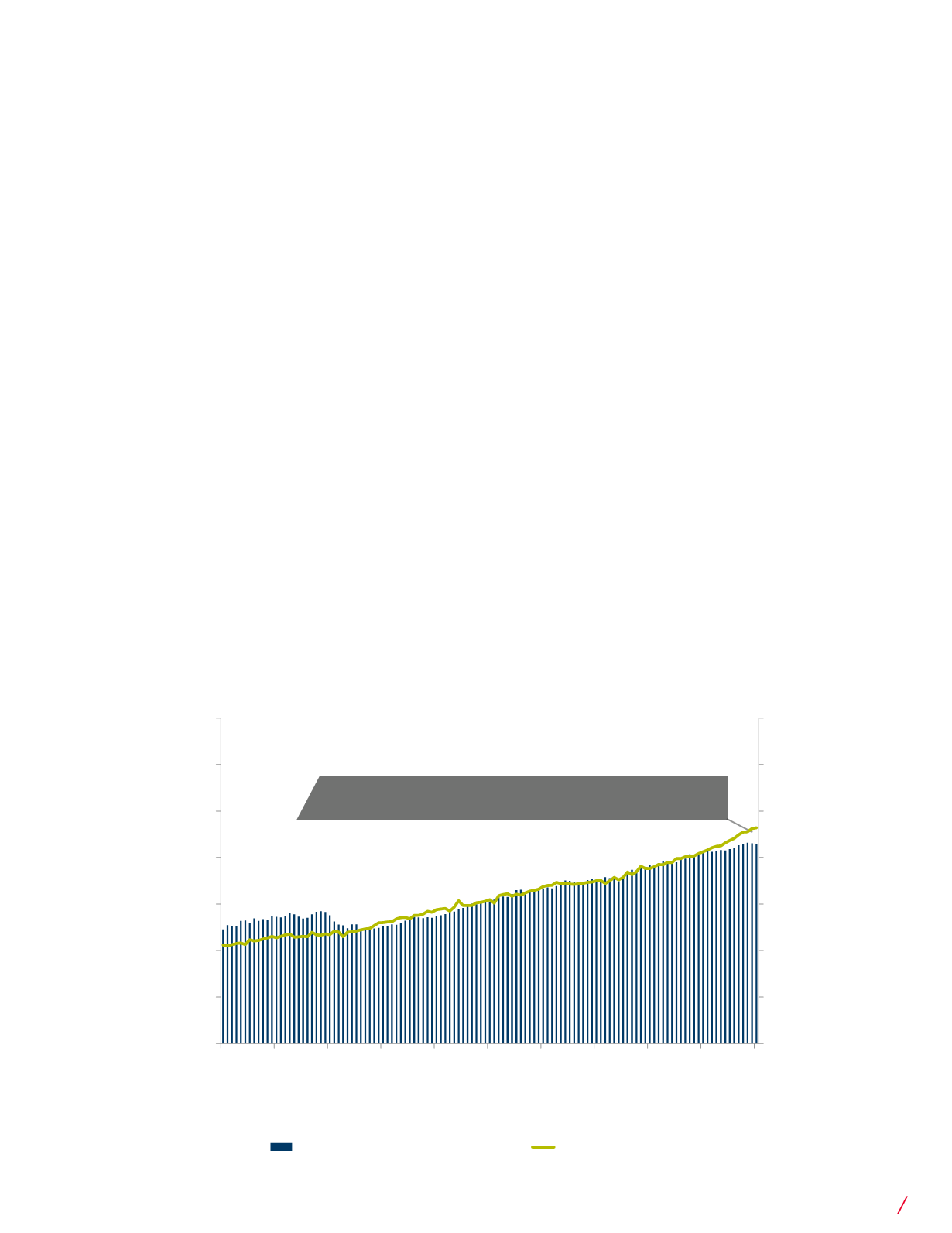

eCommerce Sales as a Percentage of GAFO are Significant

eCommerce Accounts for 28.2% of GAFO Sales

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

$180,000

$200,000

1-Aug-06

1-Aug-07

1-Aug-08

1-Aug-09

1-Aug-10

1-Aug-11

1-Aug-12

1-Aug-13

1-Aug-14

1-Aug-15

1-Aug-16

U.S. Department of Commerce

7

Food Halls of America 2016