of 3.3%, the year prior the growth rate was

3.7%. We anticipate growth in 2016 will be

close to 4.0%.

While Americans are spending more money

on food of all types, just in March 2016,

Americans spent more money dining out

than they did purchasing groceries. In

recent years the gap between grocery and

restaurant spending had been consistently

narrowing; this was the first time that “away

from home” expenditures ever surpassed “at

home” food spending. The trend has repeat-

ed itself every month since.

It is easy to understand the strong growth

that the restaurant sector has experienced.

Americans spent roughly $1 trillion on food

expenditures in 2005 and just over $1.5 trillion

in 2015. The food pie has gotten bigger.

Cushman & Wakefield has been tracking

retailer and restaurant chain growth plans

for the past decade. In 2007, restaurants

accounted for roughly 25% of all the

planned unit growth across all retail sectors

tracked. By 2010 that number had increased

to 35%. For the last three years, restaurant

concepts have consistently accounted for

50% of all the planned unit growth. Restau-

rants have, by far, been the most active

sector of the marketplace regardless of the

geography (urban or suburban) or type of

retail property type (whether freestanding

or shopping center).

Yet the restaurant industry has not been

immune from the same trend of elevated

bankruptcies that has impacted hard goods

retailers, even in 2016. The recent failures of

concepts like Buffets, Inc., Logan’s Road-

house, Garden Fresh and others stands in

stark contrast to this trend of growth. But

market saturation, not waning consumer

demand, is the culprit here. Nearly every

major restaurant chain that filed for bank-

ruptcy in 2016 has been a casual dining

player; that sector is where we are seeing the

greatest weakness as older concepts find

themselves caught between changing

FOOD HALLS OF AMERICA

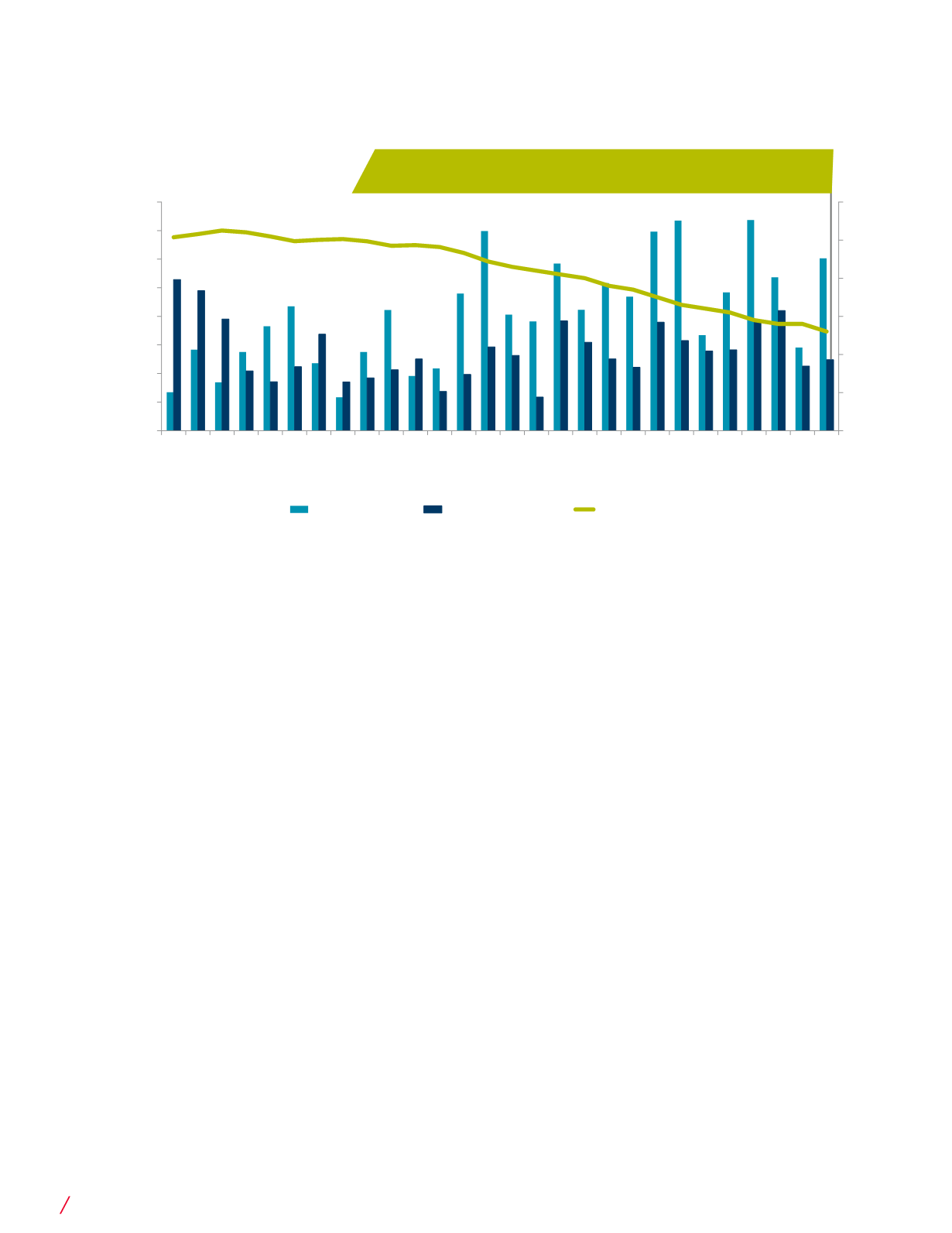

Shopping Center Vacancy is Actually Down! (For Now)

Source: Costar Group, Cushman & Wakefield Research

5%

6%

7%

8%

9%

10%

11%

0

2

4

6

8

10

12

14

16

2009 Q3

2010 Q3

2011 Q3

2012 Q3

2013 Q3

2014 Q3

2015 Q3

Million Square Feet

Net Absorption

New Construction

Overall Vacancy

8

CUSHMAN & WAKEFIELD