EXECUTIVE OVERVIEW

BUDGET SUMMARY

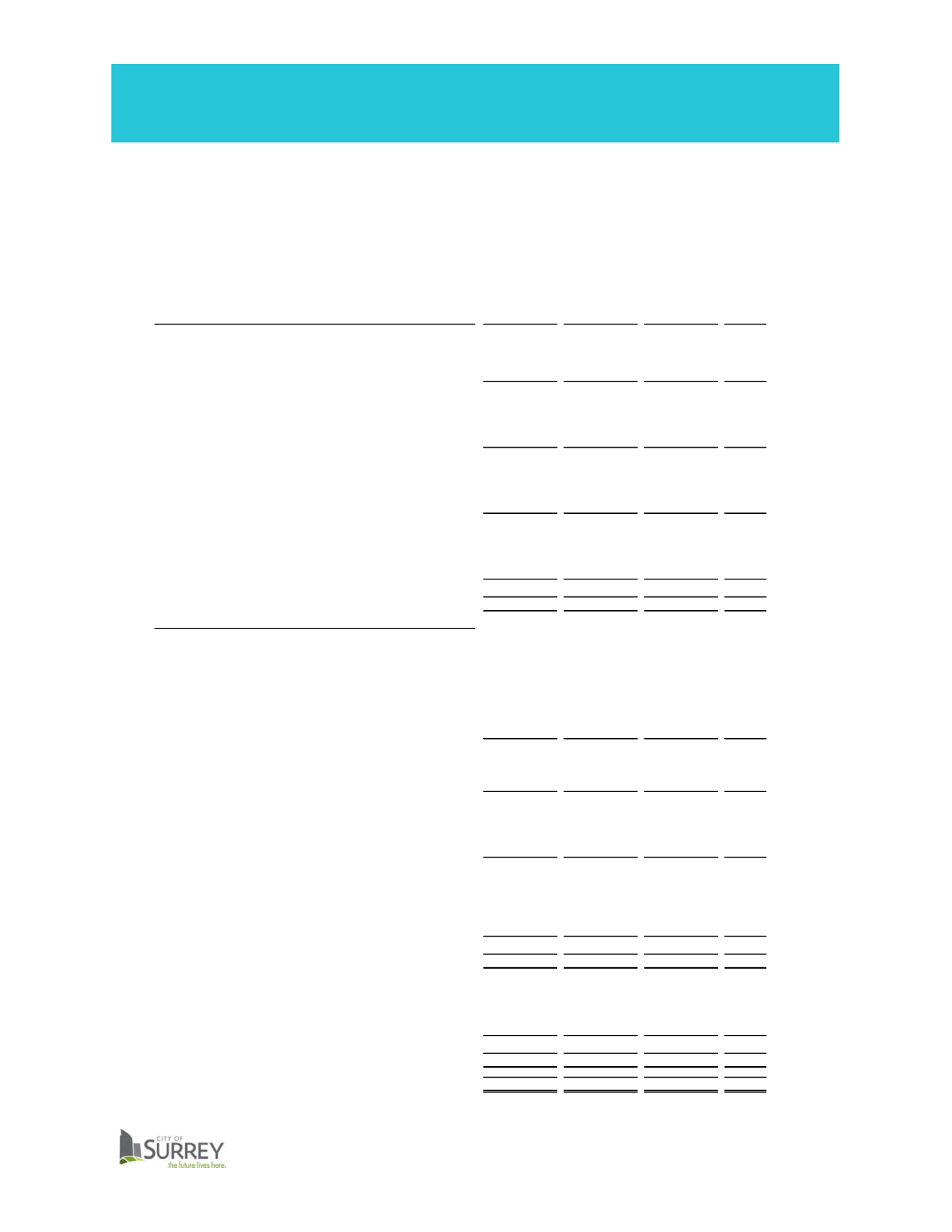

2017-2021 FINANCIAL PLAN

The 2017 Five Year (2017 - 2021) Financial Plan has been developed based on direction

provided by Council over the course of time and builds on the adopted 2016 Five Year

(2016 - 2020) Financial Plan. The following provides a summary of the 2017 Five Year

Financial Plan. See the General Operating Fund, Utilities Operating Fund and Capital

Program sections for detailed schedules and additional information.

CONSOLIDATED - BUDGET SUMMARY (in thousands)

2016

2017

REVENUE SUMMARY

BUDGET

BUDGET

$

%

General Operating Fund

Taxation

309,642

$

328,802

$

19,160

$

6.2%

Departmental Revenues

79,404

82,642

3,238

4.1%

Other

50,591

57,137

6,546

12.9%

439,637

468,581

28,944

6.6%

Utilities Operating Funds

Taxation

58,635

64,066

5,431

9.3%

Departmental Revenues

158,818

168,148

9,330

5.9%

Other

2,299

2,305

6

0.3%

219,752

234,519

14,767

6.7%

Capital Program

Development Cost Charges

133,486

142,168

8,682

6.5%

Other Development Charges

132,668

135,807

3,139

2.4%

Government Transfers

41,350

41,702

352

0.9%

307,504

319,677

12,173

4.0%

Other

Other Entities

17,015

14,169

(2,846)

-16.7%

Investment Income - Reserves & Capital

2,136

1,212

(924)

-43.3%

Land Sales

5,000

3,000

(2,000)

-40.0%

24,151

18,381

(5,770)

-23.9%

Budgeted Revenues

991,044

$

1,041,158

$

50,114

$

5.1%

EXPENDITURE SUMMARY

General Operating Fund

General Government

40,499

$

43,909

$

3,410

$

8.4%

Public Safety

212,757

227,177

14,420

6.8%

Other Departments

140,315

151,179

10,864

7.7%

Council Initiative Fund

250

250

-

0.0%

Fiscal Services

19,577

22,358

2,781

14.2%

Carbon Emission Offsets

400

400

-

0.0%

Contributions/Transfers to/(from)

25,839

23,308

(2,531)

-9.8%

439,637

468,581

28,944

6.6%

Utilities Operating Funds

Operating Expenditures

185,951

192,075

6,124

3.3%

Contributions/Transfers to/(from)

33,801

42,444

8,643

25.6%

219,752

234,519

14,767

6.7%

Capital Program

Capital Expenditures

434,708

425,820

(8,888)

-2.0%

Contributed Assets

100,000

100,000

-

0.0%

SCDC

63,600

44,546

(19,054)

-30.0%

598,308

570,366

(27,942)

-4.7%

Other

Amortization

116,775

122,987

6,212

5.3%

Other Entities

(46,585)

(30,377)

16,208

-34.8%

Internal Borrowing

(44,700)

(35,772)

8,928

-20.0%

Contributions/Transfers to/(from)

(292,143)

(289,146)

2,997

-1.0%

(266,653)

(232,308)

34,345

-12.9%

Budgeted Expenditures & Transfers per Bylaw

991,044

$

1,041,158

$

50,114

$

5.1%

Reconciliation to Annual Financial Statements:

Tangible Capital Asset expenditures

(598,308)

(570,366)

27,942

-4.7%

Contributions/Transfers (to)/from reserves

330,740

294,032

(36,708)

-11.1%

Municipal Debt

(10,429)

(13,276)

(2,847)

27.3%

(277,997)

(289,610)

(11,613)

4.2%

Expenditures per Financial Statements

713,047

$

751,548

$

38,501

$

5.4%

Excess Revenues Over Expenses per Financial Statements

277,997

$

289,610

$

11,613

$

4.2%

** Excess Revenues Over Expenses is used to fund the acquistion of tangible capital assets

CHANGE

10