52

Life and Death Planning for Retirement Benefits

be considered his RBD when determining whether he died before or after his RBD

for purposes of computing post-death RMDs. See

¶ 1.4.09 (B).

Step 4: Are you computing the RMD for the year of death, or for a later year?

If you are

computing the RMD for the year of the participant’s death, see

¶ 1.5.03 (A) (if participant

died before his RBD)

, ¶ 1.5.04 (A) (if participant died on or after his RBD), and

¶ 1.7.06 (A)

(if there are multiple beneficiaries); and skip the rest of thi

s ¶ 1.5.02 .If you are computing

RMDs for years AFTER the year of the participant’s death, go on to Step 5.

Step 5: Are there are multiple beneficiaries?

If there are multiple beneficiaries, you need to

determine whether the “separate accounts rule” applies for purposes of determining the

beneficiaries’ ADPs. See

¶ 1.8.01 (B). If the beneficiaries’ interests constitute separate

accounts for ADP purposes, then the beneficiary (and resulting ADP) are determined

separately for each such separate account and the distribution options described in

¶ 1.5.03 (B)–(F) o

r ¶ 1.5.04 (B)–(F) (whichever is applicable) apply to

each separate account

.

If there are multiple beneficiaries whose interests do

not

qualify as separate accounts for

ADP purposes, then the distribution options are as described at

¶ 1.5.03 (F) or

¶ 1.5.04 (F),

whichever is applicable.

Step 6: Do the benefits pass to a Designated Beneficiary, and if so who?

See

¶ 1.7.03for the

definition of Designated Beneficiary. Note that the identity of the beneficiary is not finally

fixed, for purposes of these rules, until September 30 of the year following the year of the

participant’s death; see

¶ 1.8.03 .Accordingly, the “quiz answers” in

¶ 1.5.03 (B)–(F) or

¶ 1.5.04 (B)–(F) apply

once the identity of the beneficiary is finalized on September 30 of the

year following the year of the participant’s death

. Your choices for completing Step 6 are:

the participant’s surviving spouse

( ¶ 1.6.02 ); an individual who is not the participant’s

surviving spouse

( ¶ 1.7.03 ); a see-through trust

( ¶ 6.2.03 ); an estate, non-see-through trust,

or other nonindividual beneficiary

( ¶ 1.7.04 ); and multiple beneficiaries (

i.e.,

any

combination of the foregoing)

( ¶ 1.7.05 ).

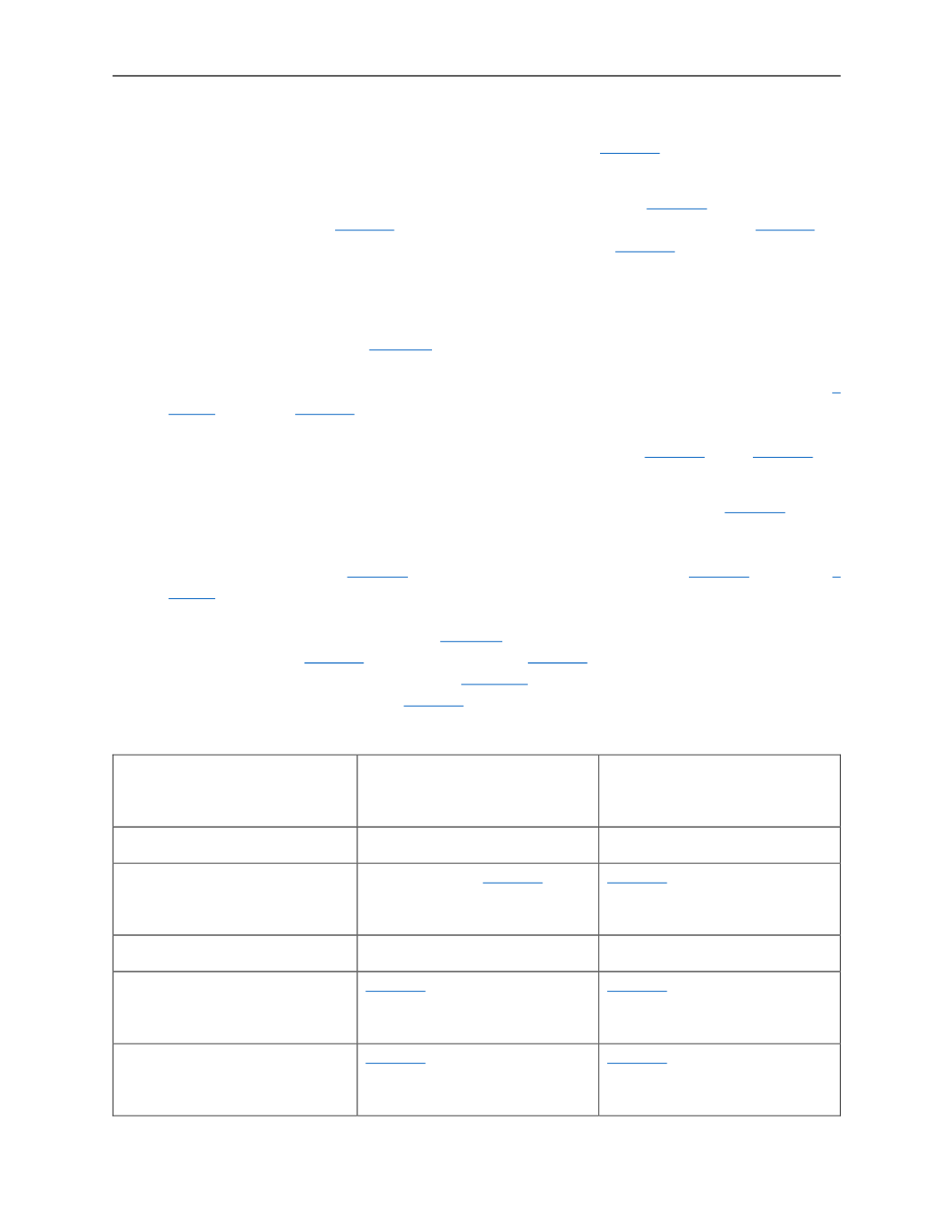

Step 7: Compute the RMDs:

If the beneficiary is ...

...and the participant died

before the RBD, see:

...and the participant died

after the RBD, see:

Year of participant’s death:

Any beneficiary

N/A; no RMD

. ¶ 1.5.03 (A).

¶ 1.5.04 (A).

Later years:

The participant’s surviving

spouse

¶ 1.5.03 (B)

¶ 1.5.04 (B)

An individual (not the

surviving spouse)

¶ 1.5.03 (C)

¶ 1.5.04 (C)