Chapter 1: The Minimum Distribution Rules

53

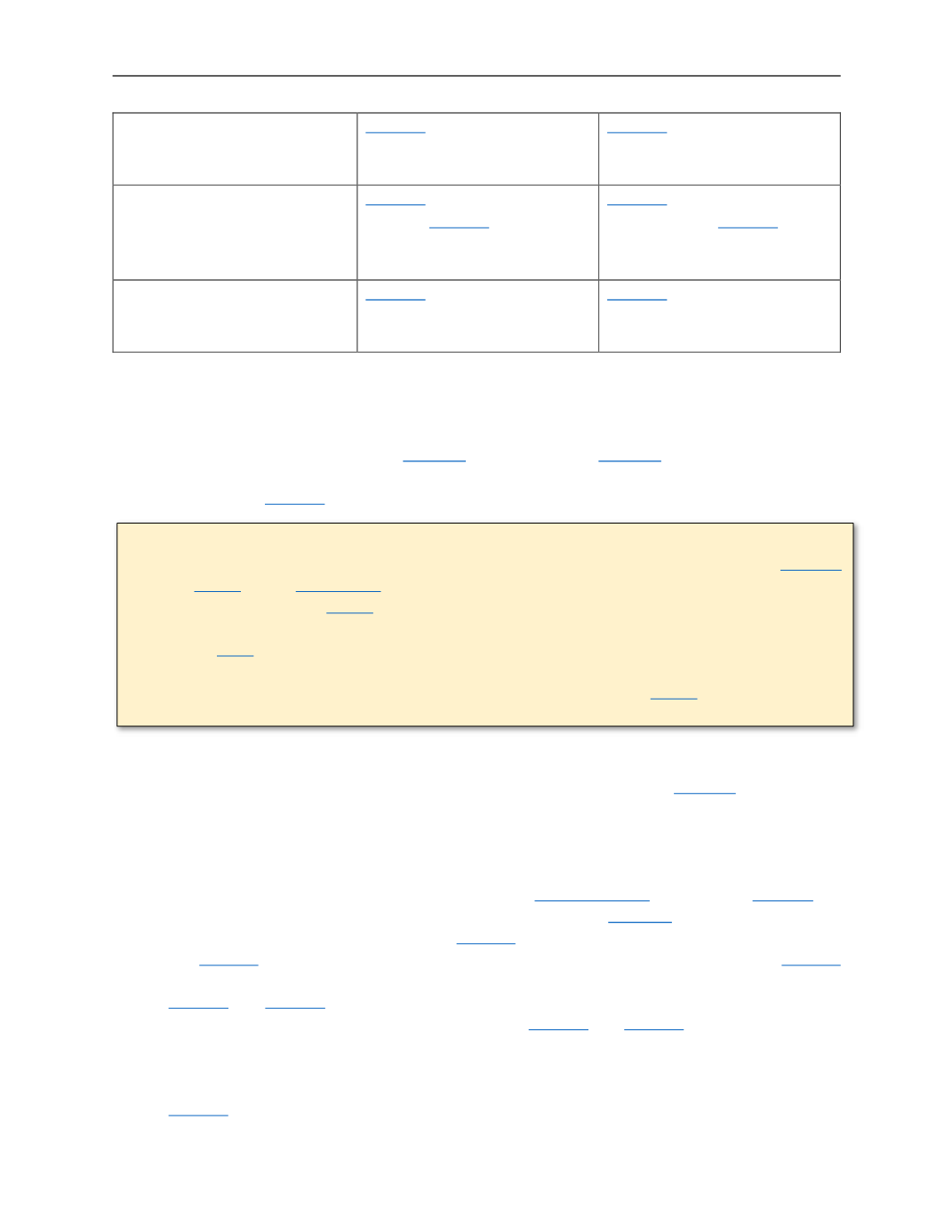

See-through trust

¶ 1.5.03 (D)

¶ 1.5.04 (D)

Participant’s estate; a non-

see-through trust; any

nonindividual beneficiary.

¶ 1.5.03 (E); 5-year rule

applies

( ¶ 1.5.06 ) ¶ 1.5.04 (E); life expectancy

of participant

( ¶ 1.5.08 )Multiple beneficiaries

¶ 1.5.03 (F)

¶ 1.5.04 (F)

1.5.03

Road Map, cont.: RMDs in case of death BEFORE the RBD

To determine required distributions for retirement benefits of a participant who died

before

his

RBD, first complete the steps at

¶ 1.5.02 .Then read this

¶ 1.5.03 .First read the general

comments and caveats, and paragraph A. Then read the particular paragraph (B–F) that describes

the beneficiary. See

¶ 1.5.02 ,Step 3, for explanation of the RBD.

A.

RMD for year of death (regardless of who is beneficiary).

Because the participant died

before his RBD, there is no RMD for the year of his death. See

¶ 1.4.07 (C). Required

distributions will begin, at the earliest, the year

after

the year of the participant’s death.

B.

Surviving spouse is sole beneficiary.

If the participant died before his RBD, leaving his

benefits to his surviving spouse as sole beneficiary, the ADP is the surviving spouse’s life

expectancy, unless the 5-year rule applies. Reg.

§ 1.401(a)(9)-3 ,A-1(a). See

¶ 1.5.07for

how to determine whether the 5-year rule applies; see

¶ 1.5.06for how to calculate

distributions under the 5-year rule. See

¶ 1.6.02for meaning of “spouse is sole beneficiary.”

Se

e ¶ 1.6.03for how to calculate RMDs based on the spouse’s life expectancy. Se

e ¶ 1.6.04for when distributions to the spouse must commence (Required Commencement Date). See

¶ 1.5.12and

¶ 1.6.05for what happens if the spouse, having survived the participant, dies

before

that Required Commencement Date. See

¶ 1.5.12an

d ¶ 1.6.03 (E) for what happens

if the spouse, having survived the participant and lived

beyond

her Required

Commencement Date, dies before having withdrawn all of the benefits. See ¶ 3.2 for the

surviving spouse’s ability to roll over the inherited benefits to another retirement plan; see

¶ 1.6.03 (A), (B), for RMD effects of such a rollover.

General Comments and Caveats

Post-death RMDs from a

Roth IRA

are always determined using rules in this

¶ 1.5.03(never ¶

1.5.04 ). Reg.

§ 1.408A-6 ,A-14(b).

In

all

cases, see ¶

1.5.10for the ability of the plan to require faster distribution of the

benefits than the RMD rules would require.

See

¶ 3.2regarding the ability of the participant’s surviving spouse to roll benefits over

to her own IRA (or elect to treat an inherited IRA as her own); such a rollover or election would

change the RMD rules applicable to the rolled over benefits; see ¶

1.6.03 (A), (B), for RMD

effects.