Self Storage

Performance Quarterly

Source: Cushman & Wakefield, Inc. The

Self Storage Performance Quarterly

, a publication of Cushman & Wakefield, Inc., is intended solely for use by paid subscribers.

Reproduction or distribution in whole or part without written permission is prohibited and subject to legal action. Copyright® 2017

Cushman & Wakefield | Valuation & Advisory

34

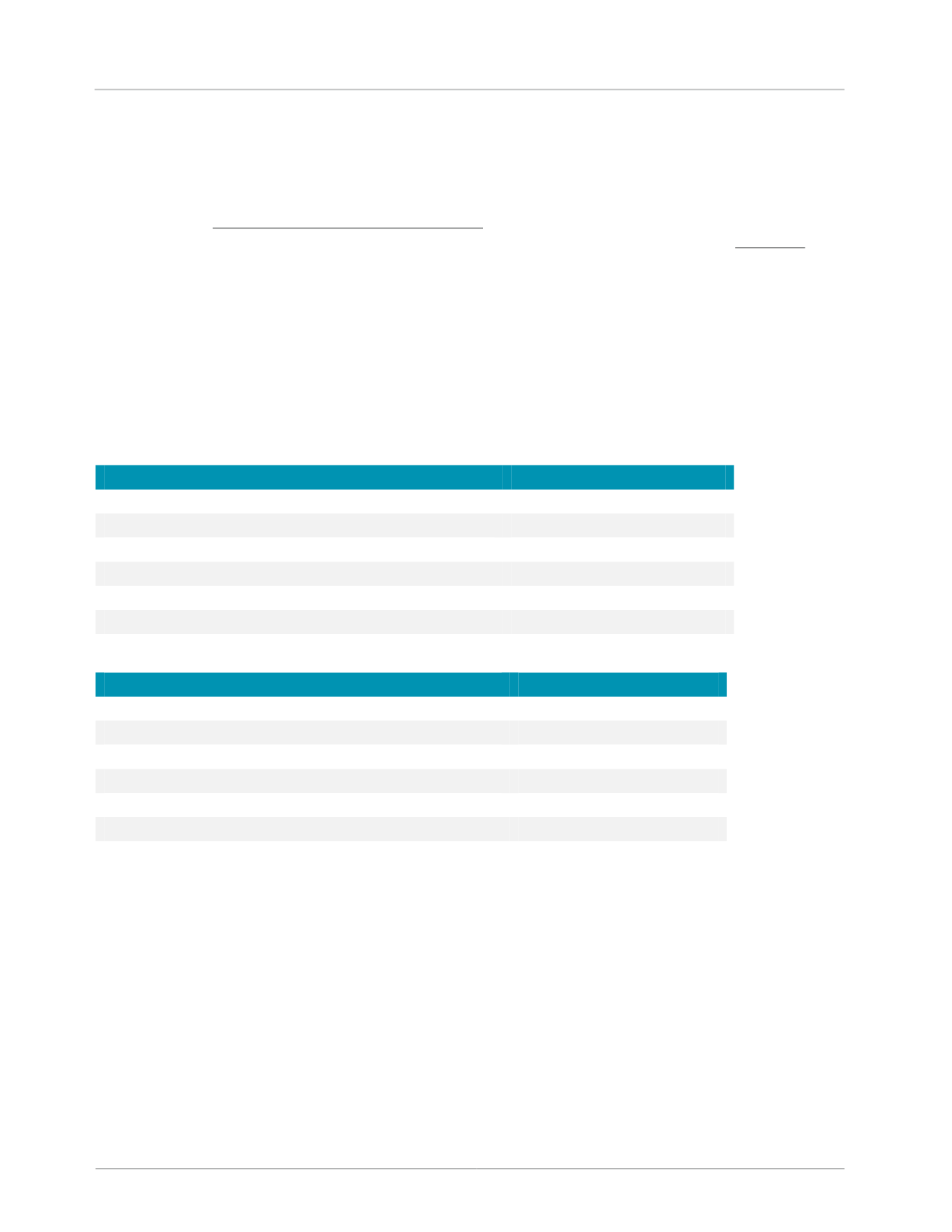

Operating Performance – By MSA

MOST IMPROVED AND WATCH LIST MARKETS

The intent of the Most Improved and Watch List Markets is to identify those markets that demonstrate the most

significant change during the current year. The ranking is based on the highest and lowest aggregate growth

scores.

The

growth score

is calculated by adding the percentage change in asking rental rates and physical occupancy

for the same period.

The a

ggregate growth score

is calculated as a moving average of the quarterly growth scores for the current

and three preceding quarters.

The higher the aggregate growth scores for a market, the greater the likelihood that facility earnings will improve.

Conversely, the lower the aggregate growth score, the greater the likelihood is for adverse change in facility

earnings. Hence, our Watch List Markets are those markets with the lowest aggregate growth scores. As of

quarter end, the results are as follows:

Six Most Improved Markets

Aggregate Growth Score

1. Portland-Vancouver-Beaverton, OR-WA MSA

16.8

2. San Francisco-Oakland-Fremont, CA MSA

14.9

3. Seattle-Tacoma-Bellevue, WA MSA

14.8

4. Jacksonville, FL MSA

14.7

5. Los Angeles-Long Beach-Santa Ana, CA MSA

13.8

6. Kansas City, MO-KS MSA

13.6

Watch List Markets (Highest Negative Scores)

Aggregate Growth Score

1. Washington-Arlington-Alexandria, DC-VA-MD-WV

MSA

-4.7

2. Oklahoma City, OK MSA

-1.4

3. Hartford-West Hartford-East Hartford, CT MSA

-0.7

4. Charlotte-Gastonia-Concord, NC-SC MSA

-0.4

5. Miami-Fort Lauderdale-Miami Beach, FL MSA

-0.1

6. Denver-Aurora, CO MSA

-0.1