page 21

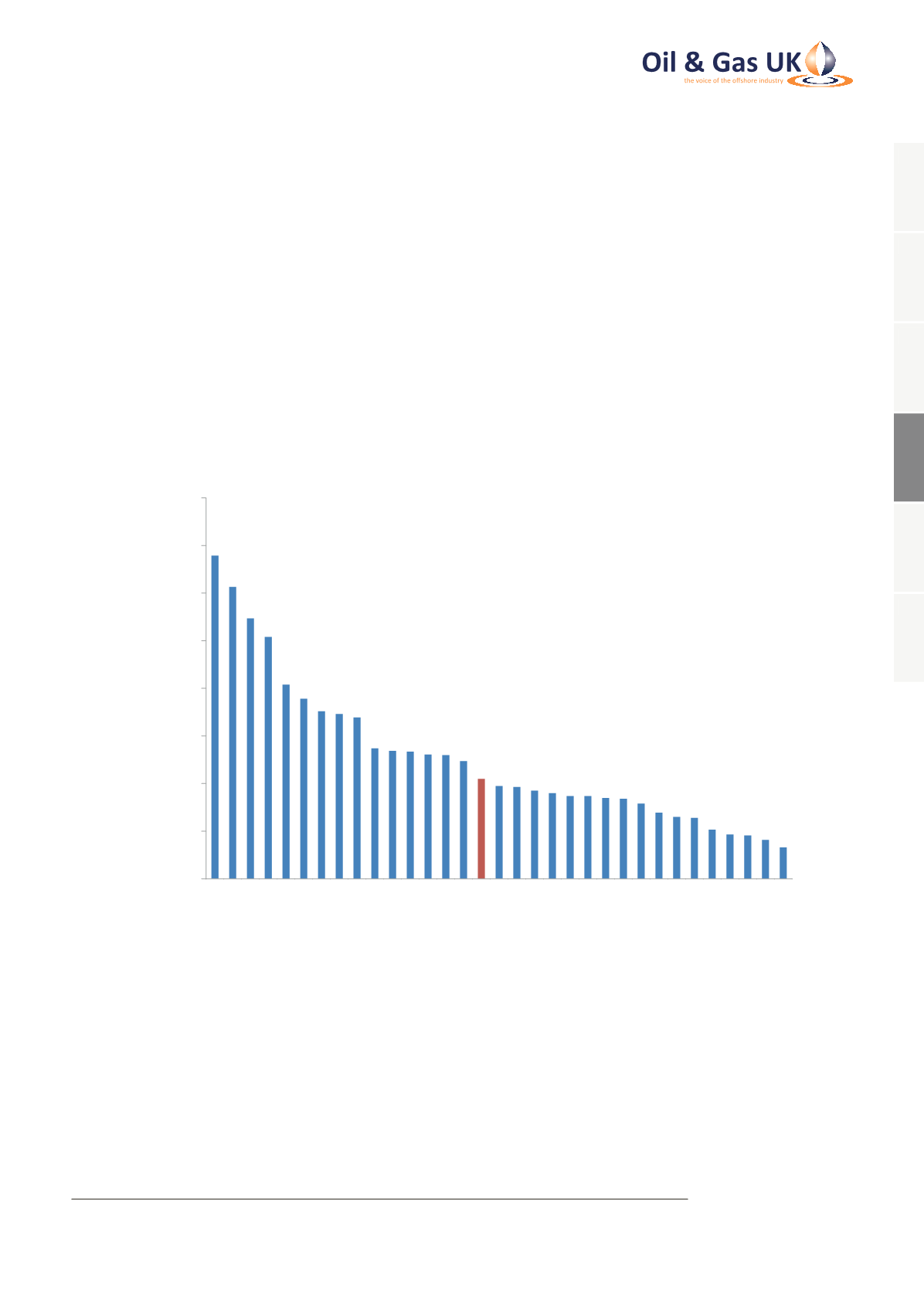

Combined with strong production performance, the cost reductions have led to a sharp fall in unit operating costs

(UOCs) from $29.30 to $20.95 (£17.80 to £13.70). However, it should be noted that even though production is

becoming cheaper on a unit basis right across the basin, some of the more mature fields on the UKCS with little

room for production growth and a higher proportion of fixed costs are heavily exposed to falling oil and gas prices.

This is a major concern in 2016.

The significant reduction in UOCs seen during 2015 must be commended, but companies are aware that the

work has only just begun. After a small rebound, the oil price continued to fall during the final quarter of the year

and, by the end of the year, almost one third of UKCS operators had a UOC higher than the prevailing Brent spot

price

7

. Even those companies operating below the UOC average last year were generating such small margins

that, combined with dampened price expectations for the future, there will be very little free cash available for

reinvestment in 2016 and beyond.

Figure 10: Unit Operating Cost by Company in 2015

0

10

20

30

40

50

60

70

80

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

UKCS AVERAGE

P

Q

R

S

T

U

V

W

X

Y

Z

AA

AB

AC

AD

AE

AF

Unit Operating Cost ($/boe)

Each bar represents a company on the UKCS (equity basis)

UKCS Average

Source: Wood Mackenzie

7

UOCs only consider the cash costs of operating assets. They do not encompass non-discretionary capital investment,

corporate overhead costs, general administrative costs, or the future cost of decommissioning liabilities.

1

2

3

4

5

6