ACTIVITY SURVEY

2016

page 22

Capital Investment in 2015

Capital investment fell by 22 per cent last year as some big capital projects reached completion and fewer

greenfield or brownfield developments were undertaken in difficult market conditions. Oil & Gas UK predicted

this fall last year, although, at £11.6 billion, capital investment for 2015 came in just above the forecast range.

The main factors that drove the higher than anticipated figure were:

• The sanction of greenfield projects (Culzean, the Glenlivet–Edradour development, the Scolty–Crathes

development) and significant brownfield investment in the Eastern Trough Area Project (ETAP). Fresh capital

sanctioned in greenfield developments last year totalled £4.4 billion with a further £670 million in the ETAP

area

8

. However, it is worth noting that only £0.5 billion of this investment was actually spent last year, the

remainder will be spent over the next five years as the projects are developed.

• Further slippage and cost overruns of major projects that were expected to start production in 2015.

• A longer than anticipated time-lag between global capital cost deflation and the impact of this on capital projects

on the UKCS.

• More capital than anticipated invested in UKCS infrastructure.

The majority of capital invested last year was spent developing new projects that were approved prior to the start

of 2015. Investment in existing assets accounted for over one third of the total spent last year, most of which was

essential to maintain production.

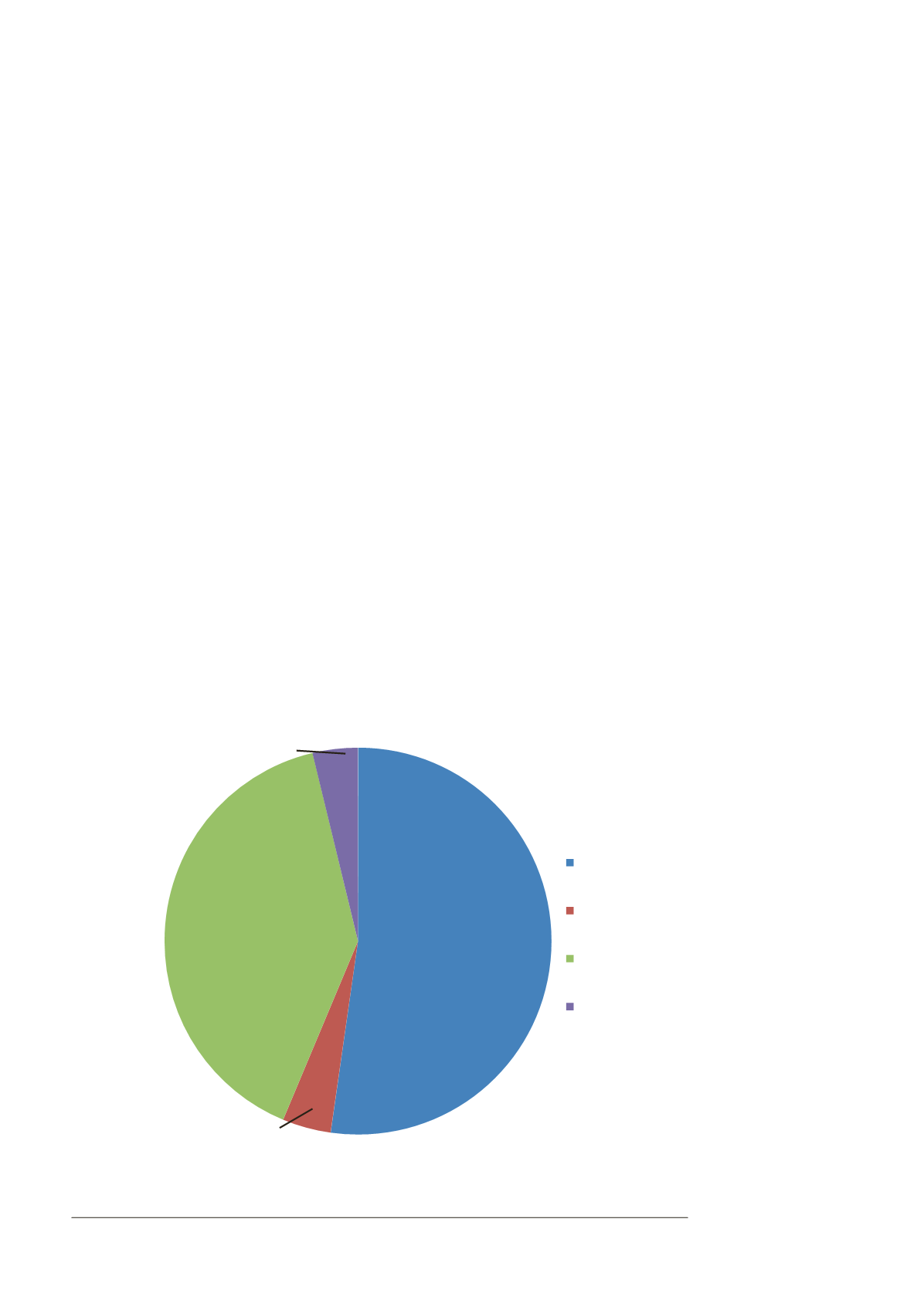

Figure 11: Capital Investment by Activity Type

Capital Invested in Projects

Sanctioned prior to 2015

Capital Invested in Projects

Sanctioned within 2015

Capital Invested in Existing Assets

Capital Invested in Pre-Sanction

Projects

£4.6 billion

£6.1 billion

£0.5 billion

£0.4 billion

Source: Oil & Gas UK

8

http://bit.ly/BP-ETAP