10

CONSTRUCTION WORLD

SEPTEMBER

2016

>

>

MARKETPLACE

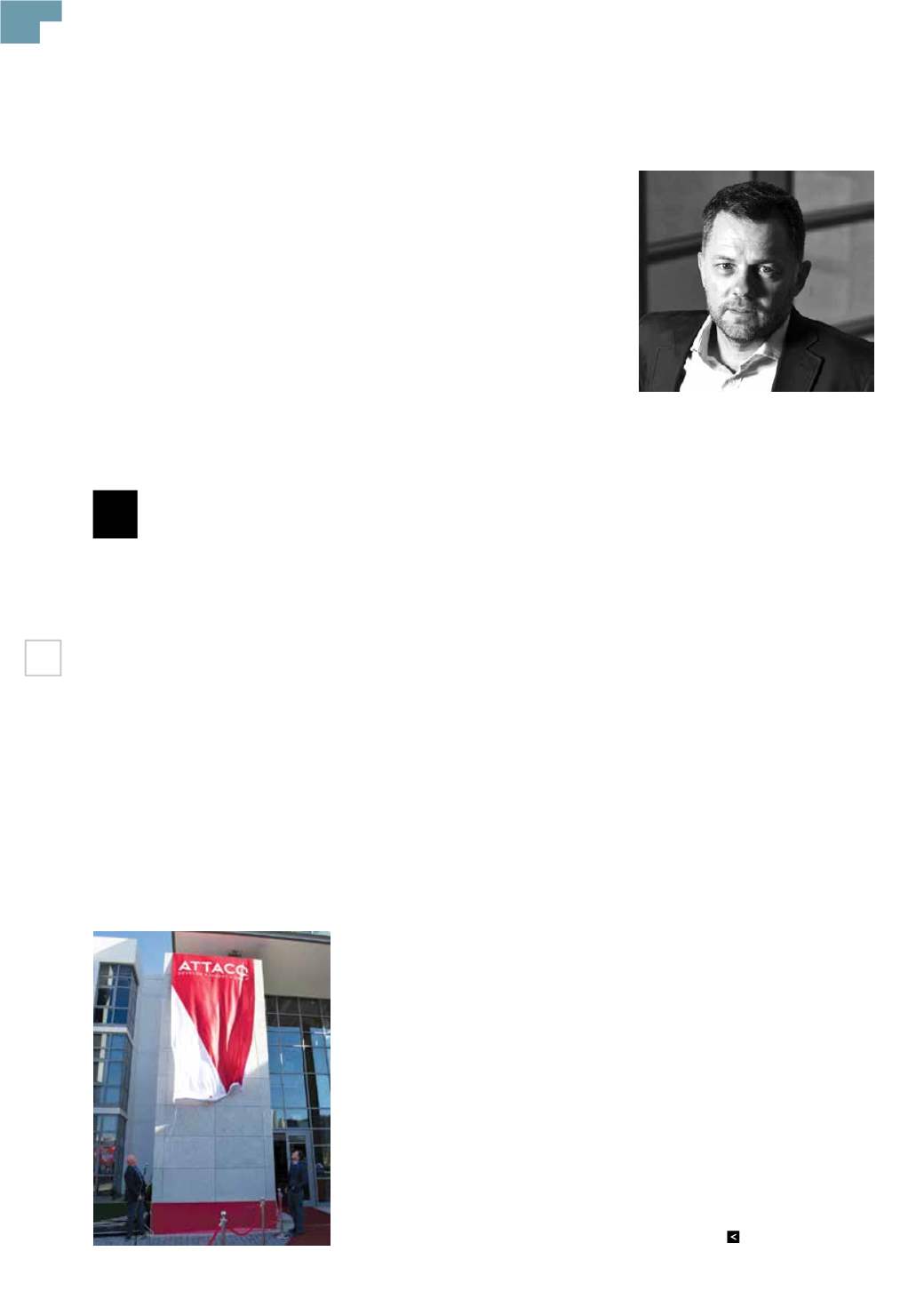

Attacq recently unveiled its newly

refreshed brand to members of the

media and key stakeholders. “The

vibrantly refreshed brand boasts

a new colour palette dominated by red and

grey, denoting confidence in our future

sustainability and is akin to the investment

leadership position Attacq has carved for

itself as a successful listed capital growth

fund,” says Morné Wilken, chief executive

officer of Attacq. “The modern and vibrant

logo supported by an equally recognisable

icon element to identify and differentiate

Attacq both in the real estate segment and

the investment world,” explains Wilken.

“The new brand resonates with our

creative approach to business and is

supported by our business philosophy of

‘Develop, Invest and Grow’. The brand refresh

is the next salient step of our fully integrated

marketing communication and stakeholder

engagement strategy that was adopted early

in 2016,” says Wilken.

Wilken said that Attacq as a capital

growth fund, differentiates itself from its

real estate peers. Its relatively new, quality

property portfolio, including its stake in the

recently launched Mall of Africa as well as

its offshore assets which are now in excess

of 24% of gross assets, are bearing fruit for

investors. “Our vision is to create sustain-

able capital growth for shareholders and to

become the premier property fund in South

Africa. Hence to effectively communicate this

with the market we have created a powerful

new brand for Attacq that aligns with our

vision,” says Wilken.

Accelerated internalisation of

Waterfall development

Attacq has taken the strategic decision to

accelerate the internalisation of the Waterfall

development management function to

enable Attacq to take full control of the

strategic planning, marketing and roll-out

of the Waterfall developments. Attacq will

drive the development of Waterfall City and

its world-class infrastructure as the African

headquarter destination for years to come.

“Attacq and Atterbury have agreed to

amend the existing development manage-

ment agreement to terminate the exclusivity

of Atterbury’s appointment as development

manager to Waterfall effective 1 July 2016,”

explains Wilken. In anticipation of the expiry

of the exclusivity period, Attacq has been

assembling its own development team and

appointed Pete Mackenzie, who has over 25

years’ experience in the property develop-

ment and investment sector, as its head of

developments. As part of the internalisation

of the development function, Attacq has

appointed Morné Whitehead, who was previ-

ously with Atterbury.

“From a practical point of view, the

completion of certain developments in the

ground will remain the responsibility of

Atterbury so Atterbury will continue to earn

the remaining development fees in respect of

these developments,” explains Wilken. Wilken

concludes: “In addition to the benefits of

taking full control of Waterfall’s development

management, Attacq will also effectively earn

fees from its property developments”.

Exciting Sanlam and Equites

transactions

Attacq and Sanlam Properties recently

announced a significant strategic prop-

erty transaction for further light industrial

commercial and retail development in.

The joint venture has acquired 28 ha of

Waterfall land from Attacq and an additional

adjacent 100 ha from the Mia family, securing

a total of 128 ha of usable land on the eastern

side of the N1 freeway and south of the Allan-

dale interchange. This land is ideally located

in the visible Waterfall development node,

which is perfectly located between the Allan-

dale and Buccleuch interchanges. The area

benefits from easy and convenient access to

the road and rail infrastructure of the central

Gauteng economic development zone.

Sanlam holds 80% and Attacq holds

20% in the joint venture with Attacq having

the right to increase its shareholding to 50%.

Some 114 ha of the land will be utilised for

light industrial commercial developments

with the balance of 14 ha to be developed for

retail purposes. The development roll out will

be managed by Attacq.

Extensive demographic and feasibility

studies have been undertaken and fully

support the proposed retail development to

be done on the 14 ha of retail land in the near

future. In terms of the retail development,

Attacq has already elected to increase its

shareholding in the joint venture to 50%.

The 114 ha of light industrial commer-

cial land is ideally located for light indus-

trial activity and distribution centres. The

developments on this land will in future also

benefit from further infrastructure develop-

ment and the additional access links that

are foreseen for the area to the south of

Allandale Road.

Attacq has also concluded a transaction

with with Equites, in relation to eight indus-

trial buildings at Waterfall. The transaction

forges a strategic partnership between

Equites and Attacq for the purpose of jointly

pursuing opportunities in the industrial

property sector in and outside of South

Africa. The parties will be able to pursue

and unlock certain greenfield developments

around South Africa which is consistent

with the Attacq group’s value proposition of

developing properties as part of its strategy

of being a capital growth fund to earn devel-

opment profits.

A long term view is taken on property.

The overarching strategy of Attacq is rooted

in sustainable capital growth and robust

appreciation, with emphasis placed on a far

reaching outlook, similar to the asset class

we invest in. Its vision unfolds through the

development and ownership of a diversified

portfolio of properties with contractual

income streams.

Major

BUSINESS STRIDES

announced

ATTACQ is happy to

announce a major stride in

its business development

with the launch of a

refreshed brand, significant

new transactions that

expands the Attacq Waterfall

development footprint, and

an accelerated internalisation

of the Waterfall development

management function.

Morné Wilken, chief executive officer of Attacq.