32

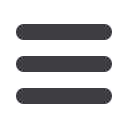

Figure 4:

Militias and collaborating subsidiary companies or dealers are involved in everything from road “taxes” and “taxes” on local

impoverished populations to massive scale exploitation of minerals, timber and charcoal.

In February 2000, De Beers, the international diamond market-

ing corporation and the world’s largest diamond mining opera-

tion, announced that it would stop purchasing diamonds from

conflict zones in Africa – an important step toward limiting the

market for illicit diamonds in Europe, Japan and the United

States. Lack of sufficient systems to monitor the import and ori-

gin of petroleum, minerals and fibre-products (pulp and timber)

complicate efforts of this sort. Multinational corporate networks

have on several occasions supplied loans or funds for arms or

even directly supplied arms or training in return for conces-

sions, but most often this is done through consultance firms

or subsidiaries with no liability towards the parent companies.

Funds are therefore often used to finance arms with which to

secure resource-rich locations for multinationals, leading to

the further aggravation of conflicts (Auvinen

et al.

, 1999; Blan-

ton, 1999; Craft and Smaldone, 2002; Addison

et al.

, 2002;

Nafziger and Auvinen, 2002).

Taxation system in eastern DR Congo conflict zone

Part of CNDP incomes from local resources

0

20

40

60

80

100

US dollars, 2008

50 kg sack of cement traded

30 kg bag of charcoal on sale in local markets

50 kg bag of coltan exported

Mud or straw house, per year

Iron roof house, per year

Small business owner, per year

Car passing check point

Small truck passing check point

Source: UN Security council, S/2008/773.

Big truck passing check point