5

Morningstar FundInvestor

January

2016

Data through December 31, 2015 FINRA members: For internal or institutional use only.

Artisan Global Value Investor

Ticker

ARTGX

Yield

0.3%

Total Assets

$1,576 mil

Mstar Category

World Stock

Benchmark 1:

MSCI ACWI NR USD

Benchmark 2:

MSCI ACWI Ex USA NR USD

Morningstar Analyst Rating

01-05-16

„

Morningstar Pillars

Process

∞

Positive

Performance

∞

Positive

People

∞

Positive

Parent

∞

Positive

Price

§

Negative

Morningstar Analyst Rating

Morningstar evaluates mutual funds based on five key pillars, which its

analysts believe lead to funds that are more likely to outperform over the

long term on a risk-adjusted basis.

Analyst Rating Spectrum

Œ „ ´ ‰ Á

Pillar Spectrum

∞

Positive

§

Negative

¶

Neutral

10.0

12.5

15.0

17.5

7.5

5.0

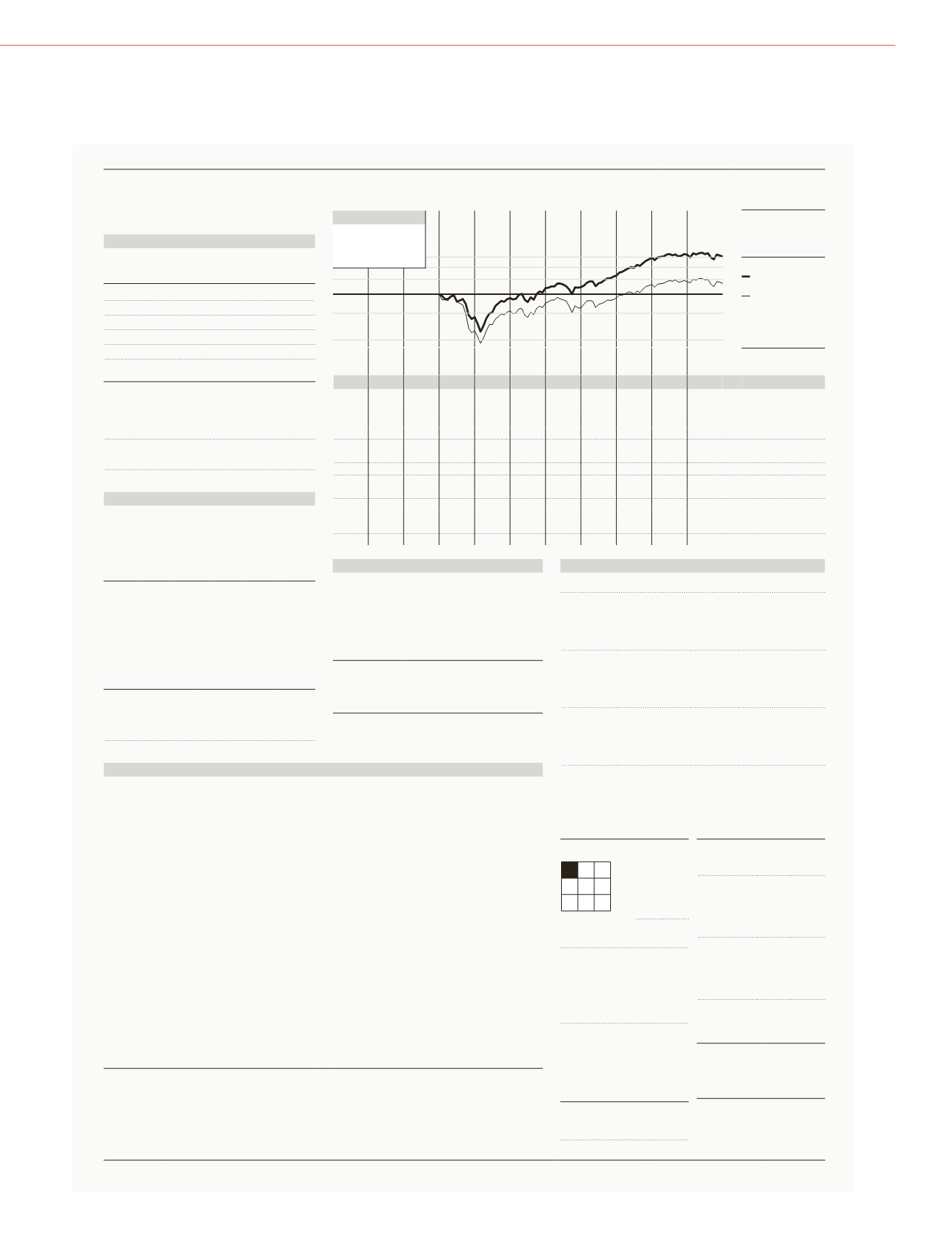

Historical Profile

Return

Risk

Rating

High

Below Avg

QQQQQ

Highest

4 4 4 7 4 7 4 1

Investment Style

Equity

Growth of $10,000

Investment Values of

Fund

Investment Values of

Benchmark 1

& * * & * & * (

Performance Quartile

(within Category)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 12-15

History

. .

9.63 6.76 8.81 10.16 10.14 11.97 15.34 15.51 14.24

NAV

. . .

-29.26 33.37 16.18 1.50 18.98 31.12 4.50 -2.87

Total Return %

. . .

12.94 -1.26 3.51 8.84 2.85 8.32 0.34 -0.51

+/- Bmark 1

. . .

16.27 -8.08 5.02 15.20 2.15 15.83 8.37 2.79

+/- Bmark 2

. . .

0.55 3.01 0.85 0.00 0.61 0.72 0.51 0.33

Income Return %

. . .

-29.81 30.36 15.33 1.50 18.36 30.40 3.99 -3.20

Capital Return %

. . .

6

46

26

9

27

16

29

68

Total Rtn % Rank Cat

. . .

0.05 0.20 0.08 0.00 0.06 0.09 0.08 0.05

Income $

. . .

0.00 0.00 0.00 0.17 0.03 0.26 0.44 0.80

Capital Gains $

. . .

3.53 1.50 1.96 1.72 1.51 1.37 1.30 1.28

Expense Ratio %

. . .

1.39 1.11 0.71 0.56 0.50 0.45 0.59 0.46

Income Ratio %

. . .

42

57

35

32

22

31

25

19

Turnover Rate %

. . .

17

31

43

91

239 1,064 1,303

.

Net Assets $mil

Performance

12-31-15

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Total

2011

2.56 2.98 -13.51 11.12 1.50

2012

9.17 -2.80 7.62 4.18 18.98

2013

8.77 3.46 7.20 8.69 31.12

2014

1.30 4.31 -3.58 2.56 4.50

2015

0.52 0.45 -7.60 4.11 -2.87

Trailing

Total

Return%

+/- Bmark

1

+/- Bmark

2

%Rank

Cat

Growth of

$10,000

3 Mo

4.11 -0.92 0.86

53 10,411

6 Mo

-3.80 1.10 5.52

33 9,620

1 Yr

-2.87 -0.51 2.79

68 9,713

3 Yr Avg

10.00 2.31 8.50

24 13,309

5 Yr Avg

9.95 3.86 8.89

5 16,071

10 Yr Avg

— — — — —

15 Yr Avg

— — — — —

Tax Analysis

Tax Adj Rtn% %Rank Cat Tax-Cost Rat %Rank Cat

3 Yr (estimated)

8.75

21

1.14

45

5 Yr (estimated)

9.09

4

0.78

41

10 Yr (estimated)

— — — —

Potential Capital Gain Exposure: 6% of assets

Rating and Risk

Time

Period

Load-Adj

Return %

Morningstar

Rtn vs Cat

Morningstar

Risk vs Cat

Morningstar

Risk-Adj Rating

1 Yr

-2.87

3 Yr

10.00

+Avg

-Avg

QQQQ

5 Yr

9.95

High

-Avg

QQQQQ

10 Yr

— — — —

Incept

6.78

Other Measures

Standard Index

Best Fit Index

Alpha

8.4

-4.0

Beta

0.75

0.96

R-Squared

77

94

Standard Deviation

10.54

Mean

10.00

Sharpe Ratio

0.95

Portfolio Analysis

09-30-15

Total Stocks: 47

Share change since 06-30-15

Sector

Country

% Assets

Y

Oracle Corporation

Technology United States

4.83

Y

Bank of New York Mellon C

Finan Svcs United States

4.22

Y

Royal Bank of Scotland Gr

Finan Svcs United Kingdom 4.01

Y

Arch Capital Group Ltd

Finan Svcs United States

3.99

Y

Citigroup Inc

Finan Svcs United States

3.62

Y

Microsoft Corp

Technology United States

3.49

T

Johnson & Johnson

Hlth Care United States

3.30

Y

Medtronic PLC

Hlth Care United States

3.15

T

Samsung Electronics Co Lt

Technology South Korea

3.09

T

Tesco PLC

Cnsmr Def

United Kingdom 3.09

Y

Chubb Corp

Finan Svcs United States

3.03

Y

Cisco Systems Inc

Technology United States

3.02

Y

Qualcomm Inc

Technology United States

2.96

Y

Marsh & McLennan Companie Finan Svcs United States

2.82

T

ABB Ltd

Industrl

Switzerland

2.71

T

UBS Group AG

Finan Svcs Switzerland

2.61

Y

ISS A/S

Industrl

Denmark

2.54

Y

American Express Co

Finan Svcs United States

2.16

Y

ING Groep N.V.

Finan Svcs Netherlands

2.12

Y

Progressive Corp

Finan Svcs United States

1.97

Current Investment Style

Large Mid Small

Value Blend Growth

Market Cap %

Giant

58.8

Large 28.9

Mid

11.7

Small

0.7

Micro

0.0

Avg $mil:

44,637

Value Measures

Rel Category

Price/Earnings 14.25

0.80

Price/Book

1.46

0.64

Price/Sales

1.36

0.88

Price/Cash Flow 7.70

0.88

Dividend Yield % 2.33

0.88

Growth Measures

% Rel Category

Long-Term Erngs 10.78

0.99

Book Value

3.22

0.83

Sales

0.08

0.12

Cash Flow

-6.60

-4.64

Historical Erngs 2.23

0.68

Composition - Net

Cash

8.0 Bonds

0.0

Stocks 92.0 Other

0.0

Foreign

(% of Stock)

42.6

Sector

Weightings

% of

Stocks

Rel

Bmark 1

h

Cyclical

43.67 1.14

r

BasicMat

0.00 0.00

t

CnsmrCyc

3.21 0.27

y

FinanSvcs

40.46 2.15

u

Real Est

0.00 0.00

j

Sensitive

38.89 1.09

i

CommSrvs

2.07 0.42

o

Energy

3.07 0.50

p

Industrl

8.39 0.82

a

Technlgy

25.36 1.78

k

Defensive

17.45 0.67

s

CnsmrDef

8.79 0.86

d

Hlthcare

8.66 0.68

f

Utilities

0.00 0.00

Regional Exposure

% Stock

UK/W. Europe 32 N. America 59

Japan

0 Latn America 2

Asia X Japan 7 Other

0

Country Exposure

% Stock

United States 57

UK

14

Switzerland 8

South Korea 5

Denmark

5

Morningstar's Take

by Greg Carlson 01-05-16

The recently reopened Artisan Global Value finally had an

off year, but its substantial virtues remain intact. Thus, it

continues to earn a Morningstar Analyst Rating of Silver.

The fund finished 2015 in the world stock Morningstar

Category’s 68th percentile and 2.9% behind its MSCI

ACWI benchmark as picks such as U.S. software maker

Oracle ORCL, Royal Bank of Scotland RBS, U.K. grocer

Tesco TSCO, and telecom chipmaker Qualcomm QCOM

all posted double-digit losses for the year. It’s not

surprising that the fund’s returns cooled off; it had never

trailed its typical peer in a calendar year since its 2007

inception, a period that encompassed years with strong

gains, modest losses, and a more substantial downturn.

The managers had trouble finding attractively valued

companies in recent years, thus cash had risen to double

digits. That changed in 2015’s third-quarter downturn,

when they began to find more compelling ideas and cash

dipped below 8% of assets. This shift, coupled with

modest net redemptions, prompted the managers to

reopen the fund in October 2015 to new investors for the

first time since 2013. (That move didn’t result in net

inflows to the fund in either October or November.) The

managers runatotalof$14.5billion inthisstrategy.While

their other charge, Artisan International Value ARTKX,

remains closed, that strategy has a larger asset base and

the portfolio includes fewer large, very liquid stocks than

this one.

The fund typically shines brightest in tough times and

in up-and-down markets due to the managers’ emphasis

on firms with steadier revenues and relatively solid

balance sheets. However, as economically sensitive fare

has latelyunderperformed, it'sbegun tomake itsway into

the portfolio. Thus, financial firms such as Citigroup C and

Royal Bank of Scotland are now among the fund’s largest

holdings.

The nature of these recent additions may cause

volatility--which has been low relative to peers--to rise a

bit in the future. But the fund's virtues remain. Samra and

O'Keefe are accomplished, disciplined investors who

invest substantially in the fund. It’s an excellent long-term

holding.

Address:

Artisan Funds Inc

Minimum Purchase:

$1000

Add: — IRA: —

Milwaukee, WI 53202

Min Auto Inv Plan:

$1000

Add: $50

800-344-1770

Sales Fees:

No-load, 2.00%R

Web Address:

www.artisanfunds.comManagement Fee:

1.00% mx./0.90% mn.

Inception:

12-10-07

Actual Fees:

Mgt:0.99% Dist:—

Advisor:

Artisan Partners Limited Partnership

Expense Projections:

3Yr:$418 5Yr:$724 10Yr:$1591

Subadvisor:

None

Income Distribution:

Annually

©2016Morningstar, Inc.All rights reserved. The information herein is not represented orwarranted to be accurate, complete or timely. Past

performance is no guarantee of future results.Access updated reports at

www.morningstar.com. To order reprints, call 312-696-6100.

ß

®

Mutual Funds

A