8

MODERN MINING

June 2017

MINING News

ASX-listed mineral sands producer Base

Resources has announced that, following

completion of the Definitive Feasibility

Study (DFS), its board has approved

implementation of the Kwale Phase 2

project (KP2) at its Kwale Mineral Sands

Operations (Kwale Operations) in Kenya.

The incremental capital to implement KP2

is – says Base – a modest US$13,1 million,

which will be fully funded from operating

cashflows.

The DFS has confirmed the opportunity

for significant improvement in the financial

returns for Kwale Operations through fur-

ther optimisation of the remaining mine

life. The DFS was completed internally by

Base’s project development team, sup-

ported by several specialist consulting

firms, and included an independent peer

review process.

The objective of the KP2 project is to

maximise the overall economic returns of

the Kwale Operations by implementing a

solution to maintain maximum concen-

trate feed to the Mineral Separation Plant

(MSP), and therefore final production vol-

umes, in the face of declining ore grades

expected frommid-2018 onwards. The KP2

DFS has established that this objective can

be effectively and efficiently achieved.

Base Resources approves Kwale Phase 2 project

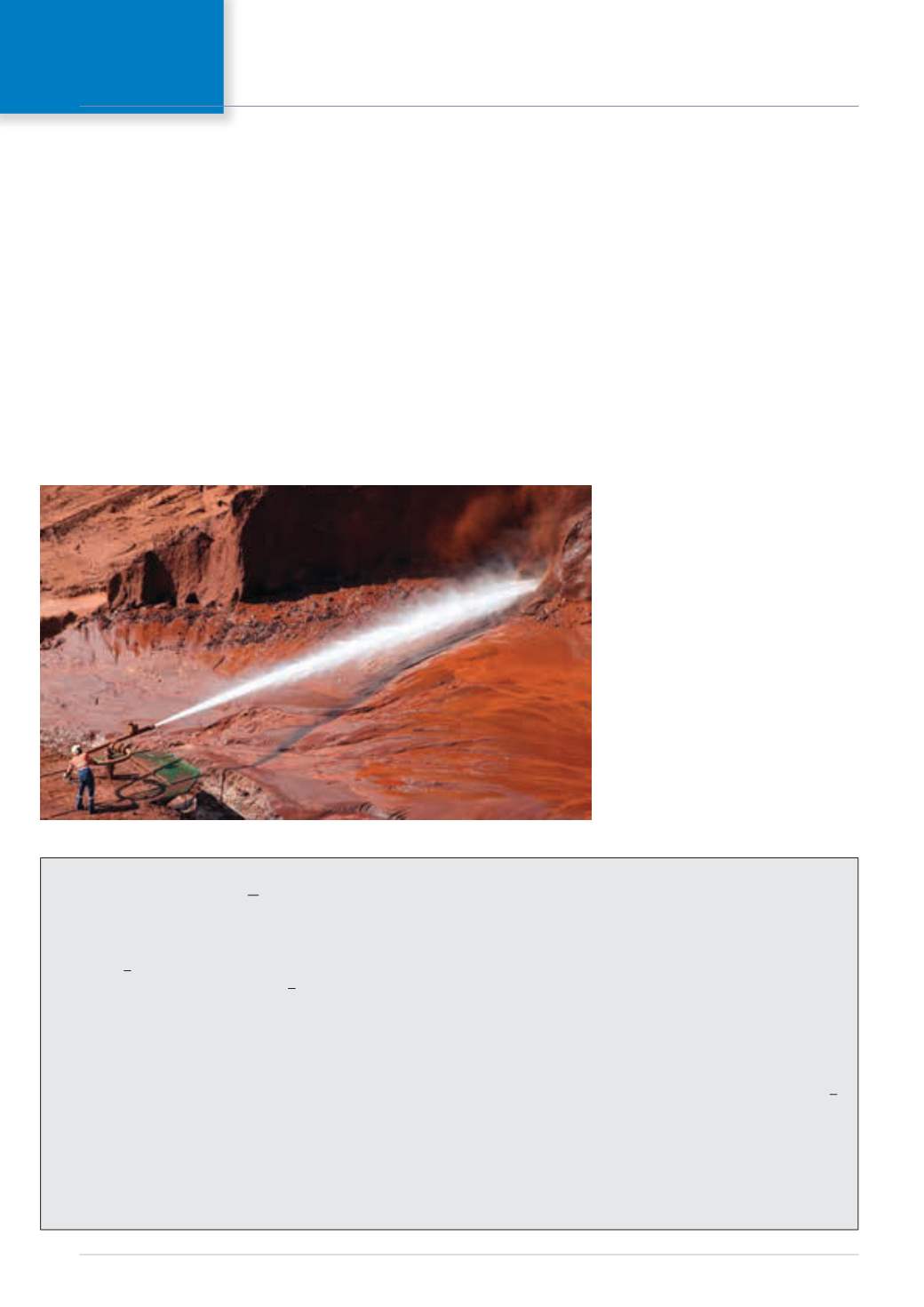

The hydraulic mining unit (HMU) in operation at Kwale Central Dune (photo: Base Resources).

Mining at the Kwale Operations was

originally based on a conventional dozer

trap mining unit (DMU), using Caterpillar

D11T dozers to feed the DMU. Historically,

when mining the high-grade areas of the

Kwale Central Dune, DMU mining rates

of up to 1 400 tonnes per hour (tph) have

been required to ensure the wet concen-

trator plant (WCP) is fully utilised. To offset

the declining ore grades expected from

mid-2018, the KP1 mine plan assumed an

increase in the mining rate to 1 800 tph. To

achieve this higher mining rate with the

DMU alone requires the addition of a third

D11T dozer.

The KP2 pre-feasibility study deter-

mined that the optimal mining rate to

maximise the economic returns of Kwale

Operations was 2 400 tph. The KP2 pre-fea-

sibility study identified hydraulic mining as

the preferred method to complement the

DMU to achieve the targeted 2 400 tph

mining rate. Operating dual mining units

has the additional benefit of allowing con-

current mining of both the high and low

grade ore, which assists in smoothing the

grade profile to create a more consistent

feed to the WCP.

In August 2016, as part of the DFS,

a 400 tph hydraulic mining unit (HMU)

was commissioned to trial the concept.

The HMU has proven to be extremely

well suited to mining Kwale ore, achiev-

ing higher availabilities and at lower unit

operating costs than the DMU. Following

NewMD for Khoemacau Copper Mining

Cupric Canyon Capital has announced the

appointment of Johan Ferreira as Head of

African Operations and Managing Director

of Khoemacau Copper Mining. Ferreira will

lead the development of the Khoemacau

copper/silver project in the Kalahari

Copperbelt of north-west Botswana with

construction beginning towards the end

of this year. Initial production from the new

mine will average 50 000 tonnes of copper

and 1,4 Moz of silver per year over a mine

life that exceeds 25 years. Future expan-

sions are expected to increase annual

production to over 100 000 tonnes of cop-

per and 3 Moz of silver.

Ferreira began his mining career with

Anglo American in 1986, and from 2005 to

2011 he was General Manager of the Moab

Khotsong and Great Noligwa gold mines.

Subsequently, he was appointed Senior

Vice President, South Africa Operations for

AngloGold Ashanti. In 2014, he accepted

an opportunity in Ghana with Newmont

Mining Corporation as Regional Group

Executive Operations and was soon pro-

moted to Regional Senior Vice President

– Africa Region, assuming executive

responsibility for that region. While in

Ghana, he was President of the Ghana

Chamber of Mines and a Director of the

American Chamber of Commerce. He holds

a Bachelor of Engineering (Mining) degree

from the University of Pretoria and sev-

eral other professional certifications and

diplomas.

Dennis Bartlett, Cupric’s Chief Executive

Officer, said, “We are excited to welcome

Johan to the Cupric team. He is a highly

experienced and accomplished mining

executive who brings the underground

mining expertise necessary to transition

the project from studies to mine develop-

ment and operations. Johan is assuming

the role previously held by Sam Rasmussen,

who completed his three-year contract in

December. Sam was instrumental in lead-

ing our efforts to complete not only the

resource drilling campaign and feasibility

study, but also to obtain the Khoemacau

mining licence. We wish Sam all the best in

his future endeavours.”

The new mine will be a mechanised

underground operation at the company’s

Zone 5 deposit. Ore will be treated at the

existing Boseto process plant, which is

located 35 km to the north-west.