ECONOMIC REPORT 2015

36

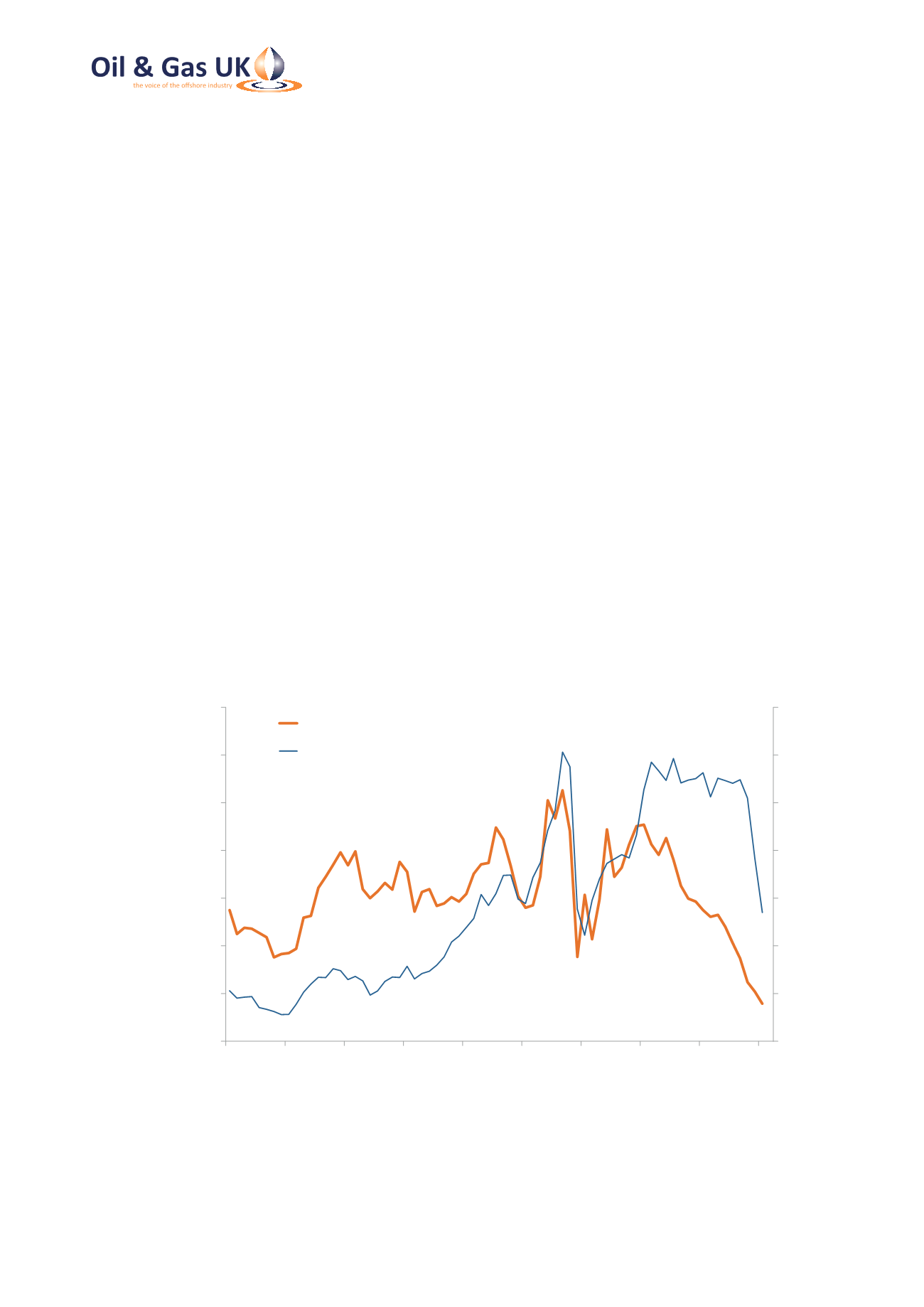

6.3 Profitability

The ONS has measured the UKCS’ pre-tax rate of return

for many years. While rate of return is a recognised

accounting metric, it does have limitations when applied

to the oil and gas sector, not least because returns

are reported pre-tax. This ignores the substantial

and additional layers of tax uniquely imposed on

the industry (see Appendix B) and the subsequent

ineffective valuation of the depreciated capital base.

Notwithstanding the limitations of the measure,

Figure 20 shows the steady decline of the UKCS’

profitability since 2011, despite strong oil prices over

most of the period. The rate of return reached 7.9 per

cent in the first quarter of 2015, the latest period for

which data are available and the lowest since at least

1997

8

. The industry’s rate of return is now half what

it was during the last major downturn in the fourth

quarter of 2008, reflecting the fall in oil price coupled

with rising costs and record capital investment.

6.4 The UK Supply Chain

The home-grown oil and gas supply chain is

acknowledged to be a major industrial enterprise,

servicing the demands of the UKCS and developing a

strong international business founded on its domestic

success. As shown by Figure 22 opposite, turnover has

grown rapidly over the last five years, rising by almost

65 per cent over the period 2008 to 2013, equivalent

to a CAGR

of ten per cent per annum. The strongest

growth has been in the wells and the marine and

subsea sectors.

Exports of high technology goods and services to the

global energy market supplement domestic business

and contributed over £16 billion, or 42 per cent, of the

supply chain’s £39 billion total turnover in 2013

9

. The

supply chain also provides highly skilled employment in

support of the indigenous offshore oil and gas industry

and increasingly to service the international market.

0

20

40

60

80

100

120

140

0

10

20

30

40

50

60

70

1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

Nominal Dated Brent ($/bbl)

Net Rate of Return (%)

Net Rate of Return (%)

Nominal Dated Brent ($/bbl)

Source: ONS, Argus Media

Figure 20: Office for National Statistics Published Net Rate of Return (Pre-Tax)

8

See

www.ons.gov.uk/ons/dcp171778_410201.pdf9

EY’s

Review of the UK Oilfield Services Industry

(March 2015) is available to download at

www.ey.com