ECONOMIC REPORT 2015

75

A) EU Emissions Trading Scheme

Although the UKCS is a major source of energy

production, it is also a significant industrial consumer

of energy and a source of GHG emissions. As such, the

offshore and onshore installations that form part of

the UK upstream are covered within the EU ETS, which

was intended at its inception in 2005 to be the principal

policy instrument for EU decarbonisation.

The scheme imposes a carbon cost on all participants,

requiring themto purchase EUAllowances (EUA) for their

GHG emissions unless they are granted free allowances.

The UK upstream sector receives free allowances in the

current ETS Phase III (from 2013 to 2020) for part of its

emissions since it is deemed to be vulnerable to ‘carbon

leakage’ and international competition from producing

areas that do not face a carbon price.

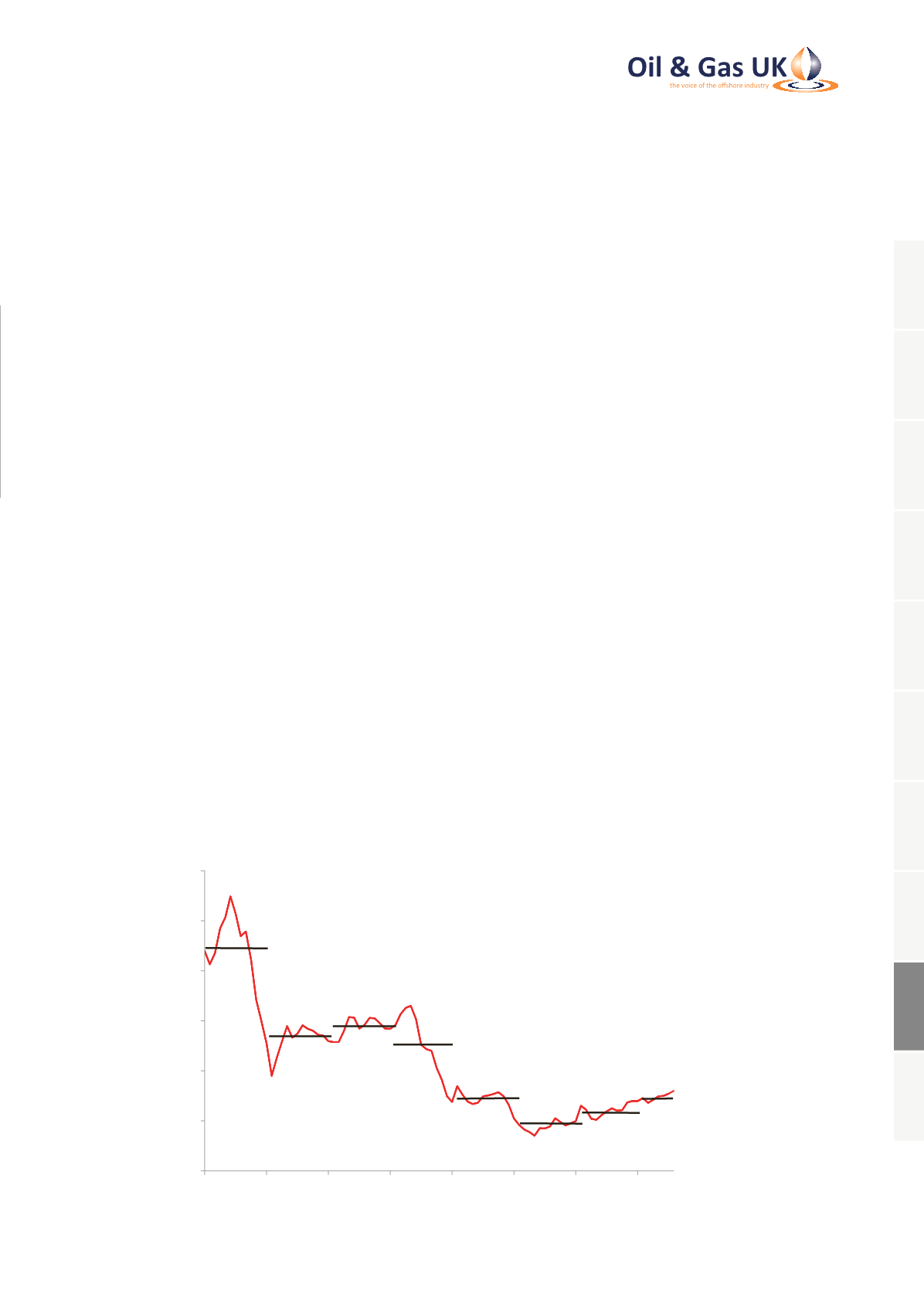

The demand for EUAs from industrial sectors collapsed

during the economic recession in 2008-09, causing the

carbon price to fall sharply as the supply of allowances

was unable to respond. The effect on the carbon

price was exacerbated by the effect of the 2009 EU

Renewables Directive, which mandated new investment

in renewables and thereby undermined further the

demand for allowances.

As the European economic recovery since 2010 has

been muted, EUA prices have remained depressed,

undermining confidence in the ETS as an effective

policy instrument. After reaching a low of €4/te CO

2

in 2013, EUA prices in the first half of 2015 have

averaged more than €7/te CO

2

and seem likely to rise

modestly over the remainder of Phase III. In an effort

to reduce the chronic surplus of allowances and to

restore the ETS’ credibility, the EU finally agreed in

2014 to defer the auction of 900 million allowances

within Phase III (so-called ‘backloading’) to reduce the

surplus in 2014-15. In April 2015, it intervened further

to create a new Market Stability Reserve (MSR) from

1 January 2019. The MSR will act as a reservoir,

absorbing the surplus and raising EUA prices by the

mid-2020s. Although there is no explicit carbon price

target, efforts tomodel the impact of these interventions

suggest that prices may be in the range €20-30/te CO

2

by 2025, but still below the €40-60/te CO

2

thought

to be decisive in shifting energy demand to

lower-carbon fuels.

0

5

10

15

20

25

30

2008

2009

2010

2011

2012

2013

2014

2015

EUA Spot Price (€/te CO

2

e)

Source: ICIS Heren, Intercontinental Exchange

*August 2015 predicted average

*

Figure 49: Monthly Average Spot EU Allowance Prices, January 2008 to August 2015

9. Appendices

1

2

3

4

5

6

7

8

9

10