page 15

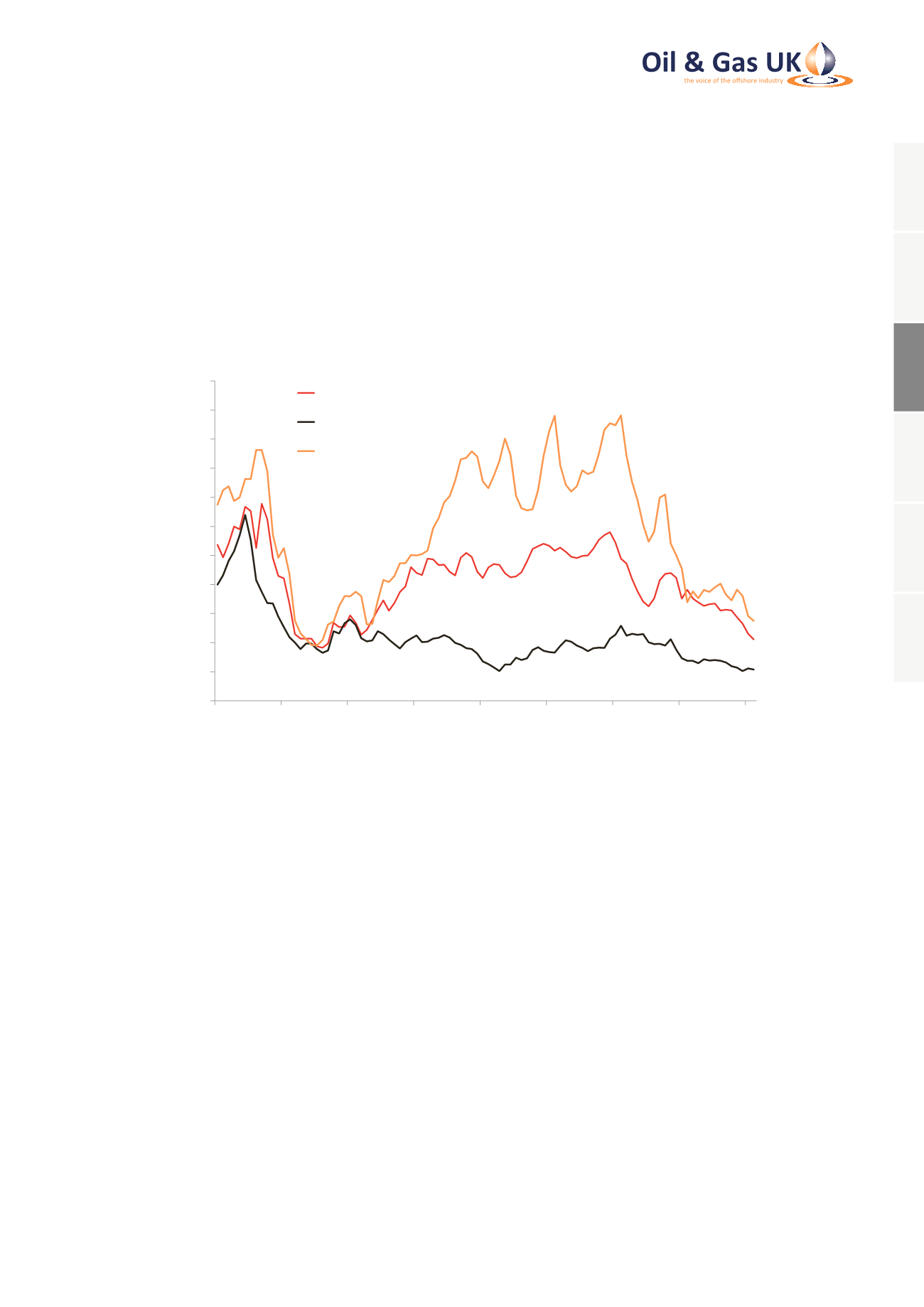

The first cargo of LNG to be exported from the US Gulf coast is due to be loaded inMarch 2016. Although investment

in US Gulf coast liquefaction capacity was contractually underpinned by demand for LNG in Asia, much of the LNG

will be capable of being delivered to Europe when Henry Hub-NBP price spreads are favourable. If US Henry Hub

prices remain in the range of $2-3/m BTU, US LNG may find itself competing in Europe with low-cost Russian

pipeline gas and Qatari LNG in Europe. Talk of a new ‘gas price war’ in Europe may be premature but there is little

doubt that any recovery in NBP and TTF gas prices may be capped by the growing supply-side competition in

European markets.

Figure 5: Regional Hub Gas and Spot LNG Prices

0

2

4

6

8

10

12

14

16

18

20

22

2008

2009

2010

2011

2012

2013

2014

2015

2016

Gas Price ($/Million BTU)

NBP Month Ahead

Henry Hub Front Month

Far East Spot LNG DES

Source: ICIS Heren, NYMEX

Carbon Prices

The EU Emissions Trading Scheme (EU ETS) remains the principal instrument of EU climate change policy and all

electricity generators and large industrial users of energy are required to participate in the cap-and-trade scheme.

Operators of most UKCS offshore installations and onshore terminals are included in the ETS and are consequently

obliged to buy allowances if they do not hold sufficient free allowances to cover their annual verified emissions

(14.8 million tonnes CO

2

in 2014).

Since the 2008-09 recession, which severely reduced EU energy demand, there has been a persistent

over-supply of allowances and prices have remained depressed. In 2015, prices of ETS allowances staged a

gradual recovery, reaching a three-year high of €8.50/te in November. However, they gave up most of these

gains in December 2015 and January 2016 as energy commodity prices collapsed, falling back below €6/te (see

Figure 6 overleaf).

1

2

3

4

5

6