CAPITAL EQUIPMENT NEWS

FEBRUARY 2017

6

T

he South African commercial

vehicle market totalled 27 010

unit sales in 2016, representing

a -11,4% decline compared

with 2015, according to official

figures from the National Association of

Automobile Manufacturers of South Africa

(Naamsa). The 2016 decline also means

that the SA truck market endured a second

successive year of negative growth, but

more worrying is that the total figure was

the lowest in five years, according to Rory

Schulz, marketing director at UD Trucks

Southern Africa, noting that domestic sales

exports also went down 1,9%. With 2016

GDP forecast revised to a low 0,1% growth,

Schulz says one should also consider that the

local truck market was around 8 000 units

in 1999 when the GDP was last at this low

level.

All market segments, except for the bus

segment, were in the red. The Light Duty

Truck (LDT) market led the losses with 8 645

total unit sales, a -18% decline compared

with 2015. The Medium Duty Truck (MDT)

and Heavy Duty Truck (HDT) segments

declined -4,2% and -10,1%, recording 5 589

and 12 583 unit sales, respectively. The Extra

Heavy Commercial Vehicle (EHCV) market

followed suit with a total of 11 850 units,

representing a -10,8% decline compared

with the year before. Buses opposed the

trend with an 8,2% growth, recording a total

of 1 327 unit sales for the year.

Schulz explains some of the reasons

behind the tough trading conditions for truck

makers in 2016. “This is the lowest local

sales total for commercial vehicles in five

years. The decline can be attributed to a slow

economy, a lack of business confidence and

struggling commodity prices,” he says.

2017 forecast

Looking ahead, Schulz expects the South

African commercial vehicle market to remain

flat in 2017, achieving an estimated 3%

growth to around 28 998 unit sales. With

fixed investment expected to grow to around

2,2%, up from -2,5% in 2016, Schulz believes

this is a good indicator that companies will

invest in new capital assets such as trucks.

Schulz also believes the projected 1,5%

GDP growth in 2017, up from 0,4% in 2016,

will further improve growth prospects for

the local truck industry. This will be further

buoyed by seemingly improving growth

prospects premised on easing drought

conditions in South Africa. “We also see

an improvement in commodity prices and

this will definitely help push up truck sales

this year,” says Schulz. “We also expect the

recent Rand strength to help ease inflationary

pressures.”

TRUCK MARKET

ROLLS INTO 2017

IN SLOW GEAR

Following an 11,4% decline of the South African truck market in 2016, UD

Trucks Southern Africa expects a marginal 3% growth in 2017 on the back

of stabilising commodity prices, slight increase in GDP and growth in fixed

investment rate, writes

Munesu Shoko

.

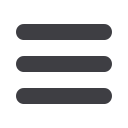

With its move to a brand-based organisation,

UD Trucks expects better growth in 2017.

Rory Schulz, marketing director at UD Trucks

Southern Africa, expects the South African

commercial vehicle market to remain flat in 2017.