UPM Annual Report 2016

UPM Annual Report 2016

78

79

In brief

Strategy

Businesses

Stakeholders

Accounts

Governance

COMMITTEE

MEMBERS

ATTENDANCE/

NO. OF MEETINGS ATTENDANCE-%

Audit

Committee

Piia-Noora Kauppi (Chairman)

7/7

100

Wendy E. Lane

7/7

100

Kim Wahl

7/7

100

Remuneration

Committee

Veli-Matti Reinikkala (Chairman)

4/4

100

Henrik Ehrnrooth

4/4

100

Suzanne Thoma

4/4

100

Nomination

and Governance

Committee

Björn Wahlroos (Chairman)

4/4

100

Berndt Brunow

4/4

100

Ari Puheloinen

4/4

100

Committee members and their attendance in committee meetings 2016

the Board. The committee’s results reviews

also included reviews of potential significant

and unusual transactions, and accounting

estimates and policies for the period in

question. On a quarterly basis, the committee

also reviewed reports on assurance and legal

matters, including status reports on

compliance, internal control, internal audit,

litigations, and other legal proceedings. Other

quarterly reports presented for the committee’s

review included treasury reports and energy

risk management report.

The lead audit partner attended all

committee meetings and provided the

committee with reports on the interim

procedures and findings as well as accounts of

the audit and non-audit fees incurred during

the quarter in question. The committee had

quarterly non-executive sessions with the

internal and statutory auditors and held

sessions with executive management, and

among the committee members at the end

of each meeting.

With regard to monitoring the effectiveness

of the company’s risk management systems,

the committee reviewed the company’s risk

management process and was informed of the

top 20 risks as well as group-level strategic

risks identified in this process including

macroeconomic, political, environmental,

compliance and business-specific risks. In 2016,

the committee also reviewed and acknowledged

the company’s adoption of ESMA (European

Securities and Markets Authority) guidelines

on alternative performance measures and

considered implications resulting from the

Market Abuse Regulation for the directors and

senior executives and for corporate procedures

and policies. In addition, the committee

reviewed and approved amendments to its

charter due to the changes in the regulatory

framework.

The Audit Committee also prepared the

Board’s proposal to the AGM for the election

and remuneration of the auditor. In this

respect, and together with corporate manage

Nomination and

Governance Committee

Duties and responsibilities of the

Nomination and Governance Committee

are related to the composition and

remuneration of the Board of Directors

and to corporate governance. When needed,

the committee also identifies individuals

qualified to serve as the President and CEO.

Following the committee’s review of the

Board composition and assessment of the

Board competences, diversity and

qualifications in relation to UPM strategy,

operations, and governance needs, no major

development needs were identified and

therefore, no changes in the Board

composition were proposed to the AGM in

2016. With regard to Board remuneration,

the committee emphasised the importance

of aligning the interests of directors with

those of shareholders and concluded that

shares continued to be the preferred form

of remuneration, but did not propose any

changes in the level of remuneration.

In 2016, the committee was especially

occupied with governance and compliance-

related matters and assisted the Board in

the revision of the UPMCode of Conduct,

amendment of the board and committee

charters and establishment of the Board

diversity principles. These principles and the

Board Diversity Policy are discussed earlier

on page 77 of this report.

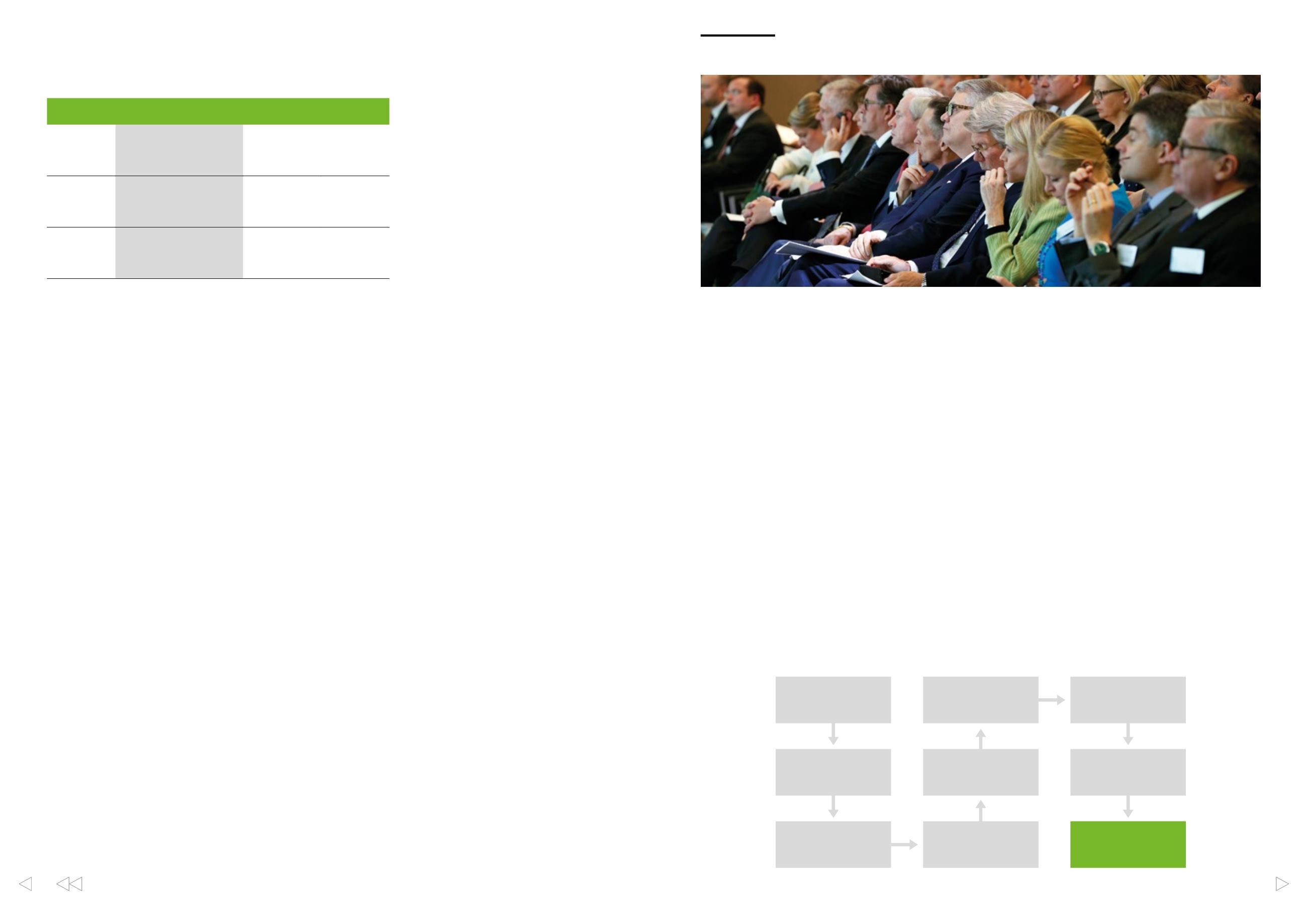

Director evaluation

and nomination process

The Board Diversity Policy also includes

a description of the various phases of the

Nomination and Governance Committee’s

well-established director nomination and

evaluation process. This process is presented

in the illustration below. When preparing

the Board’s proposal to the AGM regarding

the composition of the Board, the committee

follows this process.

Director independence criteria

The committee also assisted the Board in the

annual assessment of director independence.

To facilitate this assessment, the committee

adopted director independence criteria in

February, which complements the Finnish

Board committees

The committees assist the Board of Directors

by preparing matters to be decided by the

Board. In addition, the committees assist

the Board in its oversight and monitoring

responsibilities. The Board is responsible

for the performance of any duties assigned

to the committees.

The directors appointed to the Board

committees in the Board’s organisational

meeting on 7 April 2016 are presented in

the table above. The table also contains

information on the number of committee

meetings and committee members’ attendance

in the meetings.

The written committee charters approved

by the Board of Directors set forth the

purposes, composition, operations and duties

of each committee, as well as qualifications for

committee memberships. As mentioned earlier,

the charters were updated in 2016 and are

available on the corporate website. Each

committee is responsible for carrying out the

duties assigned to it in its charter.

The committees hold their meetings prior

to Board meetings in order to prepare matters

for the Board’s decision making. In the Board

meeting following the committee meetings,

the Committee Chairmen report to the Board

on matters discussed and actions taken by the

committees. In addition, minutes are kept for

the committee meetings and submitted to the

Board members for their information.

Audit Committee

Duties and responsibilities of the Audit

Committee are related to the oversight of the

company’s financial reporting processes and

financial reporting, internal control, internal

audit and risk management, and to monitoring

the audit and compliance procedures of the

company.

To perform its duties, the Audit Committee

monitored the company’s financial

performance and reviewed the key financial

figures and quarterly financial reports and

recommended the approval of the reports to

ment, the committee evaluated the qualifica

tions and independence of the auditor, and the

auditor’s provision of audit-related and non-

audit services. The evaluation included the

assessment of the effectiveness of the audit

process, quality of audit, performance of the lead

auditor and the audit team, and co-operation

with the auditor’s international audit network.

As a result of this evaluation, the committee

recommended the re-election of Pricewater

houseCoopers Oy as the company’s auditor.

Remuneration Committee

Duties and responsibilities of the Remuneration

Committee are related to the remuneration of

the President and CEO and senior executives

reporting directly to the President and CEO,

and to the review of the company’s talent and

succession planning procedures for senior

management.

To perform its duties, the committee reviews

the senior executives’ total remuneration

annually. The executive remuneration consists

of the base salary and fringe benefits, perform

ance-based short- and long-term incentives,

and pension benefits.

The committee’s review of the executives’

salaries and benefits included benchmarking

the salaries and benefits to market practices

in corresponding positions in peer companies.

Based on this review, the committee made

recommendations to the Board for the salaries

and benefits of the President and CEO and

other senior executives.

Related to the company’s short- and long-

term incentive schemes, the committee

reviewed and prepared the annually

commencing plans and made recommendations

to the Board for the structure, earning criteria,

targets and allocation of these plans. The com

mittee also evaluated the achievement of the

set targets and the overall performance of the

President and CEO and other senior executives,

and made recommendations to the Board for

the approval of short- and long-term incentive

pay-outs. These pay-outs are summarised in

the tables on page 81 of this report.

As to the succession plans for senior

management, the committee reviewed the

company’s talent and succession planning

procedures and reported to the Board on such

matters. The committee was also informed of

the results of the employee engagement survey,

which was conducted in August–September.

In addition, the committee reviewed and

approved amendments to its charter.

The Remuneration Committee follows

remuneration market trends at regular

intervals. In 2016, the committee was provided

with a comprehensive review of executive

remuneration, including comparison of the

company’s executive remuneration with that

of peers, regulatory framework of remuneration,

and remuneration market trends in Europe,

the US and APAC. According to that review,

the applied remuneration instruments and

metrics at UPMwidely reflect the common

market practices.

Corporate Governance Code’s independence

criteria. The criteria adopted by the committee

are available on the corporate website. The

incumbent directors’ independence evaluation

is discussed earlier on pages 76-77 of this report.

The committee also assessed directors’

independence on a continuous basis, and in

every meeting reviewed a report on any changes

in directors’ professional engagements and

positions of trust and assessed the potential

effects of such changes on directors’ indepen

dence and availability for Board work, and

reported to the Board on the outcome of

such assessments. According to the committee’s

assessment, the changes that took place in 2016

had no effect on the directors’ independence or

availability.

Furthermore, the committee reviewed the

composition, qualification criteria and duties

of the Board committees, and made a proposal

to the Board of Directors for the appointment of

committee members and chairmen. In addition,

the committee assisted the Board in the annual

evaluation of the Board performance and

working methods and in the review of the

survey results.

Director evaluation and nomination process

Search for potential

new director

candidates

Presenting

the proposal

at the AGM

Election of

directors by the

AGM

Evaluation of

director candidates

Evaluation of the

performance and

composition of the Board

Board proposal

for director nominees

to the AGM

Disclosure

of director

nominees

Evaluation of

director candidates’

independence

Recommending

director nominees

to the Board

CONTENTS